Profits at the billionaire Issa brothers' retail and petrol station empire increased to almost $1.5bn during 2022, according to new figures.

EG Group, whose brands include Cooplands, Cumberland Farms, Leon and Euro Garages, has posted an EBITDA of $1.46bn on a constant currency basis, up by 1.9% compared to 2021.

The Blackburn-headquartered group's turnover also jumped by 25.1% to $33.04bn thanks to the contribution of acquisitions such as Cooplands.

READ MORE: Click here to sign up to the BusinessLive North West newsletter

The group, which is backed by TDR Capital, did not reveal how much it earnt in pre-tax profits during the year.

DON'T MISS:Typhoo Tea to close Merseyside factory with up to 90 jobs set to be lost

HS2 construction delay to save money 'potentially a real body blow for the UK's economic recovery'

Boohoo shareholders revolt over £175m bonus plan

The Issa brothers also own supermarket giant Asda, alongside their private equity backer, separately to EG Group.

They hit the headlines earlier this week after agreeing a sale and leaseback deal in the US for around $1.5bn.

EG Group has also agreed to sell 26 "non-core" sites under the Minit Mart banner in itscentral USA portfolio for $48m.

In a statement announcing the full-year results, the group said it had made "good strategic progress and delivered a resilient financial performance in 2022 – despite a challenging environment and elevated operating costs".

It added: "Management remains committed to putting in place a sustainable capital structure for the medium term and further reducing total net leverage with material debt repayment to investors, as well as through free cash flow generation.

"Given our well diversified business with a strong asset backing, we can access multiple pools of liquidity to help reduce the overall quantum of our debt, including further partial real estate monetisation and/or potential asset sales, which we will consider utilising as part of our plan."

The group’s site network increased to 6,612 sites by the end of the year, of which two thirds are company owned and company operated. The increase was mainly due to its completed acquisition from OMV of 285 forecourts in southern Germany in May 2022 in a €485m deal.

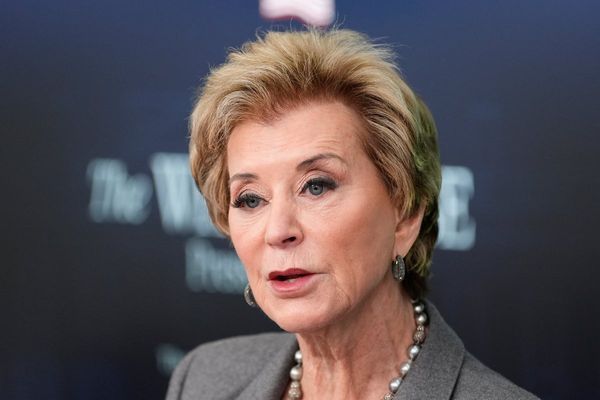

Co-founder and Co-CEO Zuber Issa said: "In 2022, we delivered a highly resilient performance, despite macro-economic headwinds.

"We continued to expand our successful foodservice business through disciplined investment in our unparalleled offering and ongoing innovation across proprietary and popular third-party brands.

"The grocery and merchandise business also performed well in 2022 and customers continue to respond positively to our converted Asda On the Move convenience stores.

"We again made good progress in Fuel against a highly competitive backdrop across our markets, and are encouraged by our ongoing trial of ultra-fast chargers and infrastructure, evpoint, in the UK, as part of our energy transition plans to lower-carbon fuels.

"As we previously stated, management is committed to further significant deleveraging and is actively exploring additional opportunities to put in place a sustainable capital structure for the Group to underpin our long-term strategy.

"We have made progress with our plans and taken the first steps in this process by agreeing a $1.5bn sale and lease back on a portfolio of sites on the east coast of the USA, and a $48m disposal of a number of non-core sites in our central US portfolio.

"Looking ahead, we remain confident that EG is well-positioned to continue to outperform the wider market and execute on our strategic objectives.

"I would also like to thank our colleagues for their dedication, hard work and resilience over the past year."

On its fourth quarter trading, EG Group's EBITDA of $303m was a 15% fall year on year "primarily due to currency movements" while it fell 9% on a constant current basis.

Its revenue increased by 14.2% to $7.99bn on a constant currency basis in the period compared to the same three months in 2021.

READ MORE:

JD Sports, In The Style and EG Group: The 10 latest North West deals

Online white goods retailer AO cuts Salford office space by 80%