With a market cap of $23.4 billion, PPG Industries, Inc. (PPG) is a prominent supplier of paints, coatings, and specialty materials. Founded in 1883, PPG is headquartered in Pennsylvania and operates in over 70 countries through three segments: Global Architectural Coatings; Performance Coatings; and Industrial Coatings. PPG is expected to release its fiscal Q3 2025 earnings results on Wednesday, Oct. 15.

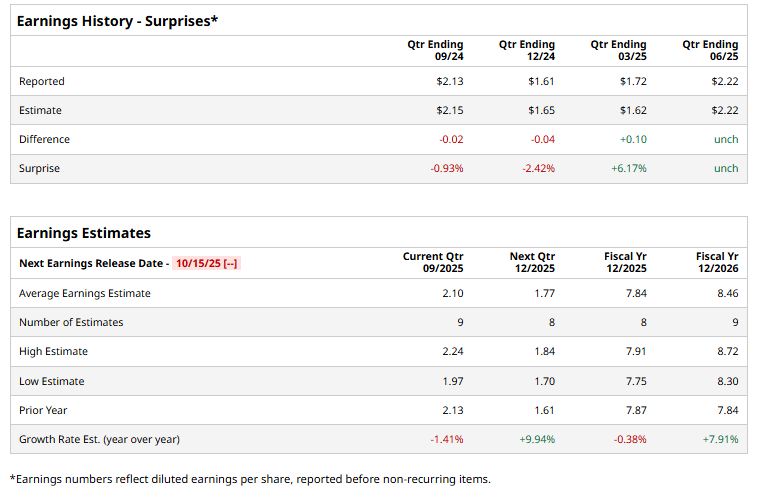

Ahead of this event, analysts project the company to report an adjusted EPS of $2.10, down 1.4% from $2.13 in the year-ago quarter. The company has met or surpassed Wall Street's bottom-line estimates in two of the last four quarterly reports while missing on two other occasions.

For fiscal 2025, analysts forecast the paints and coatings company to report an adjusted EPS of $7.84, a marginal decrease from $7.87 in fiscal 2024. But its adjusted EPS is expected to increase 7.9% year-over-year to $8.46 in fiscal 2026.

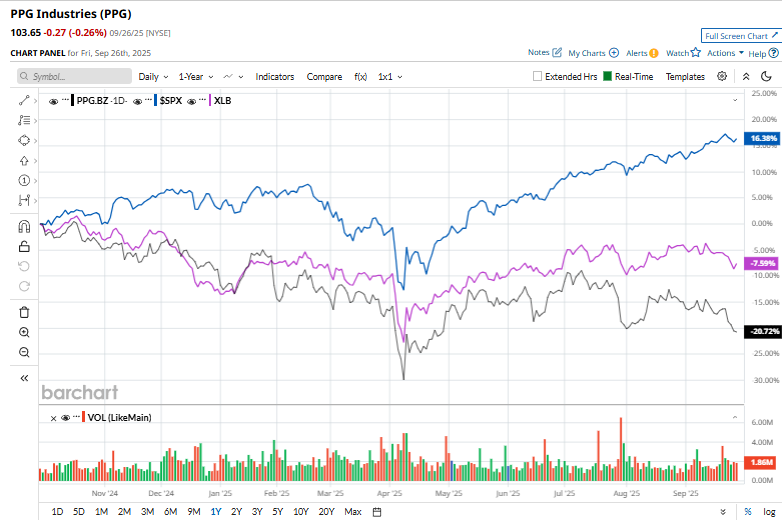

Over the past 52 weeks, shares of PPG Industries have slumped 23%, underperforming the broader S&P 500 Index's ($SPX) 15.6% gain and the Materials Select Sector SPDR Fund's (XLB) 8.5% drop over the same time frame.

On Sept. 16, the company unveiled its PPG HI-GARD® Non-Methanol hard coating for 1.5 standard index ophthalmic lenses. Designed as a direct replacement for traditional methanol-based coatings, the new formulation allows prescription lens manufacturers to comply with evolving methanol regulations while maintaining high durability and performance standards. However, PPG shares dropped 1% post announcement.

Analysts' consensus view on PPG Industries stock is cautiously optimistic, with an overall “Moderate Buy” rating. Among 25 analysts covering the stock, nine suggest a "Strong Buy" and 16 recommend a "Hold.” The average analyst price target of $128.40 represents a premium of 23.9% from the prevailing price level.