Headline inflation has risen for the third straight quarter in New Zealand, underlining the challenge for central bankers dealing with a "bogged down" economy.

Stats NZ confirmed on Monday the consumers price index (CPI) inflation rate lifted from 2.7 per cent to three per cent in the year to September 2025.

Quarterly CPI was measured at one per cent, the biggest three-month jump in two years.

At three per cent, Kiwi CPI matches Australia's headline inflation.

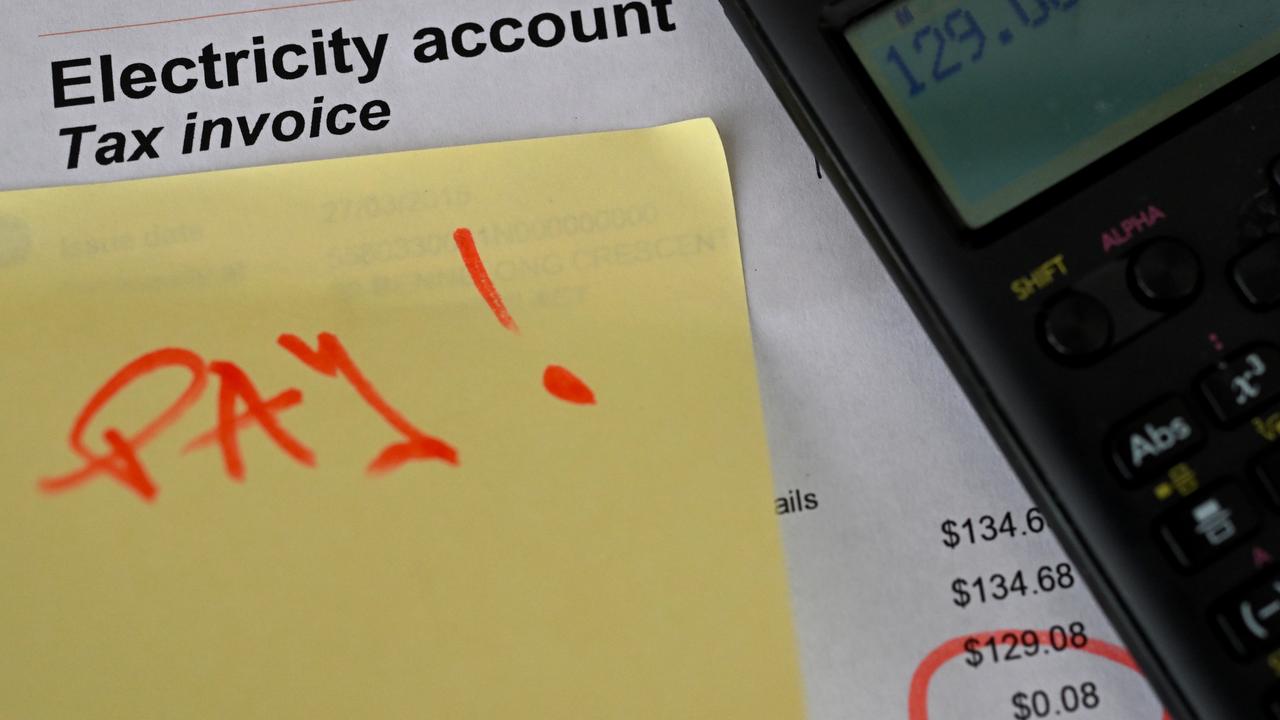

Deepening the cost-of-living woes facing Kiwis, the biggest contributors to the jump were unavoidable facts of life: power, rent, and rates.

Stats NZ spokeswoman Nicola Growden said at 11.3 per cent, annual electricity increases are "at their highest since the late 1980s".

The leap in rates - up 8.8 per cent - is due to Stats NZ's practise of adding in local government payments once a year, in this quarter.

Insurance was also up 4.1 per cent, as was dairy, by 10.9 per cent.

Falls were recorded in some areas: notably pharmaceutical products (down 10.6 per cent), telecommunication equipment (15.2 per cent) and petrol (1.6 per cent)

CPI now sits right at the top of the target band of the Reserve Bank of New Zealand (RBNZ), which has a mandate of keeping inflation between one and three per cent.

However, the Kiwi economy is in dire need of support, with gross domestic product dropping by 0.9 per cent in the last quarter.

That means the RBNZ, fresh from a 50 basis points cut earlier this month, is still seen as likely to cut again from 2.5 per cent at its year-ending November meeting.

"The RBNZ is likely to look through higher near-term inflation," ASB bank senior economist Mark Smith said.

"There are valid reasons suggesting that the period of thee per cent plus inflation will prove to be short-lived, including the softer domestic backdrop, cooling wage growth, the sluggish housing market and abundant spare capacity."

"The cost of living remains at the front of mind for consumers and is a key headwind facing NZ households ... we expect the OCR to be cut by 25bp in November."

The real risk of a "bogged down" economy may prompt further cuts in 2026, Mr Smith said.

"A more protracted activity slowdown and higher NZ unemployment rate could push medium-term inflation below two per cent," he said.

"There is the clear risk that the OCR troughs below 2.25 per cent this cycle."

The CPI rise was in line with market expectations, with three of the big four Kiwi banks tipping CPI to land where it did.