Jerome Powell, 65, received a harsh welcome from financial markets after becoming chair of the U.S. Federal Reserve Board and launching a new regime. What course will Powell chart as the Fed -- which serves as the U.S. central bank -- shifts to a normalized monetary policy after years of large-scale easing?

The Yomiuri Shimbun interviewed Totan Research Co. President Izuru Kato about Powell's strategy. Kato has for many years analyzed the monetary policies of Japan, the United States, European states, China and other countries. The following are excerpts from the interview.

The Yomiuri Shimbun: What do you think of the upheaval in financial markets following Powell's inauguration as chairman?

Kato: I was in the United States until the day before the plunge in stock prices began. The U.S. stock market has thus far reacted to the "globally synchronized economic conditions" in which simultaneously favorable economic conditions in the United States, Europe, Japan and China have created a synergistic effect as growth accelerates. This has given rise to a "Goldilocks economy" in which there is no proportional growth in inflation. However, just as investors had begun to worry that stock prices were reaching unjustifiably high levels, the market was dealt a blow by strong wage data announced on Feb. 2.

When wage growth suddenly quickens, inflation accelerates, bringing an end to the Goldilocks economy. Association of this development with an increased pace in interest rate hikes by the Fed caused market values to plunge.

Powell is viewed in U.S. financial circles as possessing extremely strong coordinating abilities. However, interactions with the market must proceed carefully, as tradings powered by artificial intelligence and other technologies have caused disruptions.

Q: What are the actual conditions in the current U.S. economy?

A: Former U.S. Treasury Secretary Lawrence Summers describes current U.S. economic conditions as a "sugar high." This refers to the rush of euphoria after eating lots of sweets. Right now, the United States enjoys a strong economy thanks to "sugary" benefits from overseas economies, the wealth effects of high stock prices and the weak dollar, but there is concern that a painful rebound is approaching.

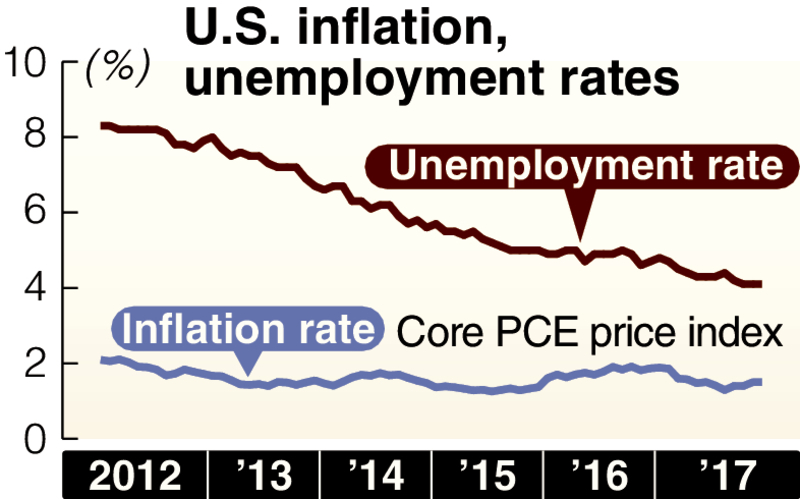

The unemployment rate reached 10 percent after the 2008 economic crisis caused by the collapse of Lehman Brothers, but lately has been in the neighborhood of 4 percent, less than during the 2006-07 housing bubble. Moreover, the administration of U.S. President Donald Trump decided to add more "sugar" in the form of a tax cut, with an eye toward this autumn's midterm elections and the 2020 presidential election.

Many people involved with U.S. markets have said tax cuts are unnecessary amid such favorable economic conditions. Even if economic conditions are good for the time being, the balance will collapse if long-term interest rates are heavily raised due to fears over the ballooning fiscal deficit, so it's necessary to be prudent.

Q: Will there be major price increases in the United States?

A: Last year, prices did not increase proportionally to the strong economy, which former Fed Chair Janet Yellen described as "a mystery" last autumn. The stagnation in wage growth was a significant factor. One of Powell's main tasks going forward will be to discern how this dynamic unfolds.

The impact of the large drop in mobile phone fees, which reduced the United States' [year-on-year] rate of inflation last year, will begin to appear in the spring. Crude oil prices have risen due to the favorable global economic trend, so the prices of gasoline and its related goods are also more likely to rise. Import prices will also begin increasing bit by bit because of the weak dollar.

Moreover, a growing number of companies, like retailing giant Wal-Mart, have announced wage hikes and bonuses due to the tax cut. As a result, while the rate of inflation may rise compared to last year, problems will emerge after the effects of these developments have taken root. With the globalization and automation of production bases and the collapse in prices due to the digital revolution, Powell will most likely focus on the extent of wage and price increases in the second half of the year.

Lacking confidence

Q: Will the Fed's stance on interest rates and the pace of hikes change?

A: Powell will likely maintain Yellen's course for the moment, and probably push for a gradual normalization of monetary policy [an exit strategy]. While January's wage growth was high, given the severe weather conditions and other factors, the data exceeded actual conditions in some aspects. The Fed still lacks confidence in the rise in wages.

Moreover, the rate of inflation continued to remain significantly below the 2 percent target last year. Many within the Fed say they wouldn't mind a future inflation rate a little over 2 percent to ensure that projected long-term inflation forecasts hold firm at around 2 percent.

If the financial markets stabilize somewhat, the Fed will probably decide to raise interest rates at the Federal Open Market Committee in March. This is due to concern that a delay in interest rate hikes could actually have an opposite effect, stoking predictions of inflation overheating. On the other hand, to indicate they are not considering accelerated monetary tightening, they will likely maintain their estimate of three rate hikes for the year at the March meeting.

Q: How will U.S. interest rate hikes affect global money trends?

A: Keeping with the theme of globally synchronized economic conditions, the influx of investment capital into emerging economies from the United States has picked up since last year. Furthermore, global capital has turned to real estate, natural resources, art, virtual currencies and other markets, creating intense booms. If the Fed suddenly increases the pace of interest rate hikes, it will trigger sharp reversals in those markets, risking a shock to the global economy. The Fed must account for all of the possibilities and move cautiously.

Q: How will the Fed's new regime influence the European Central Bank and the Bank of Japan?

A: Economic conditions are good in Europe as well, so the ECB has moved to normalize monetary policy since January by reducing securities purchases and other measures. At the same time, European governments are closely monitoring the rise in the euro's exchange rate.

For this reason, they are likely to emulate the Fed's approach to normalization and respond cautiously while increasing market predictability. I expect interest rate hikes to begin next year.

Conditions in Japan are also favorable as it responds to the global economic recovery, but the rate of price increases, excluding food and energy prices, remains low at 0.1 percent. Even if prices rise gradually due to wage increases by major companies, the Bank of Japan's 2 percent inflation target remains distant.

Should Bank of Japan Gov. Haruhiko Kuroda retain his post beyond April, he will likely continue his current policy. However, the central bank will be pressured to act to minimize the adverse side effects of monetary easing, such as reduced profits at financial institutions and operational difficulties with pensions and insurance caused by interest rate cuts.

(This interview was conducted by Yomiuri Shimbun Senior Research Fellow Hiroyuki Nakamura.)

(From The Yomiuri Shimbun, Feb. 13, 2018)

Izuru Kato

Totan Research Co. President

Kato graduated from Yokohama National University in 1988 before joining Tokyo Tanshi Co. After working as a call transactions broker and in other capacities, he became the president and chief economist of Totan Research Co. in 2013. He is well versed in the activities of different countries' central banks. He is 52.

Read more from The Japan News at https://japannews.yomiuri.co.jp/