The value of the pound and long-term Government bonds slumped sharply after Sir Keir Starmer failed to back Chancellor Rachel Reeves.

Ms Reeves was visibly tearful in the House of Commons over a “personal issue”, as her position and Government credibility faced scrutiny after a U-turn on welfare plans.

The U-turn on the Welfare Bill is now expected to stop the Labour Government from securing almost £5 billion worth of savings as it seeks to balance the books.

Financial markets were knocked as a result, with the value of the pound and gilts dropping noticeably as the Prime Minister spoke in Parliament.

The pound slid by 1.14% to 1.358 against the US dollar on Wednesday. Sterling had risen to a fresh three-year high against the dollar on Tuesday.

The currency also fell by 0.8% to 1.155 against the euro, striking its lowest level since April.

Meanwhile, the yield on Government bonds, called gilts, jumped in the face of concerns among investors.

The yield on 10-year gilts rose by 0.17 percentage points to 4.63%, while the 30-year gilt rose by 0.22 percentage points to 5.45%.

Both of these were the sharpest increases since US President Donald Trump’s tariff plans shook up financial markets in April.

Gilt yields move counter to the value of the bonds, meaning that their prices were lower on Wednesday because of the change.

The rise in yields also means it will be more expensive for the Government to pay off debts, putting further pressure on its finances.

Kathleen Brooks, research director at XTB, said: “UK bond yields have taken a step higher as we progress through Wednesday, and Prime Minister’s Questions has not eased concern that the bond vigilantes are circling. UK bonds are tanking today.

“If yields continue to rise at this pace for the next few days, the PM and Chancellor will have to decide if they want to have a sensible fiscal policy whereby public sector debt is reined in, or whether they want to please the Labour backbenches, who don’t seem worried by rising debt levels and forget that we are in a new era, where bond investors can shun sovereign debt in favour of less risky, less indebted corporate debt.

“Overall, this could be the start of another fiscal crisis for the UK.”

How Starmer went from defiant to defeated as he scrambled to get his bill through

Angela Rayner reveals why she’d never want to be prime minister

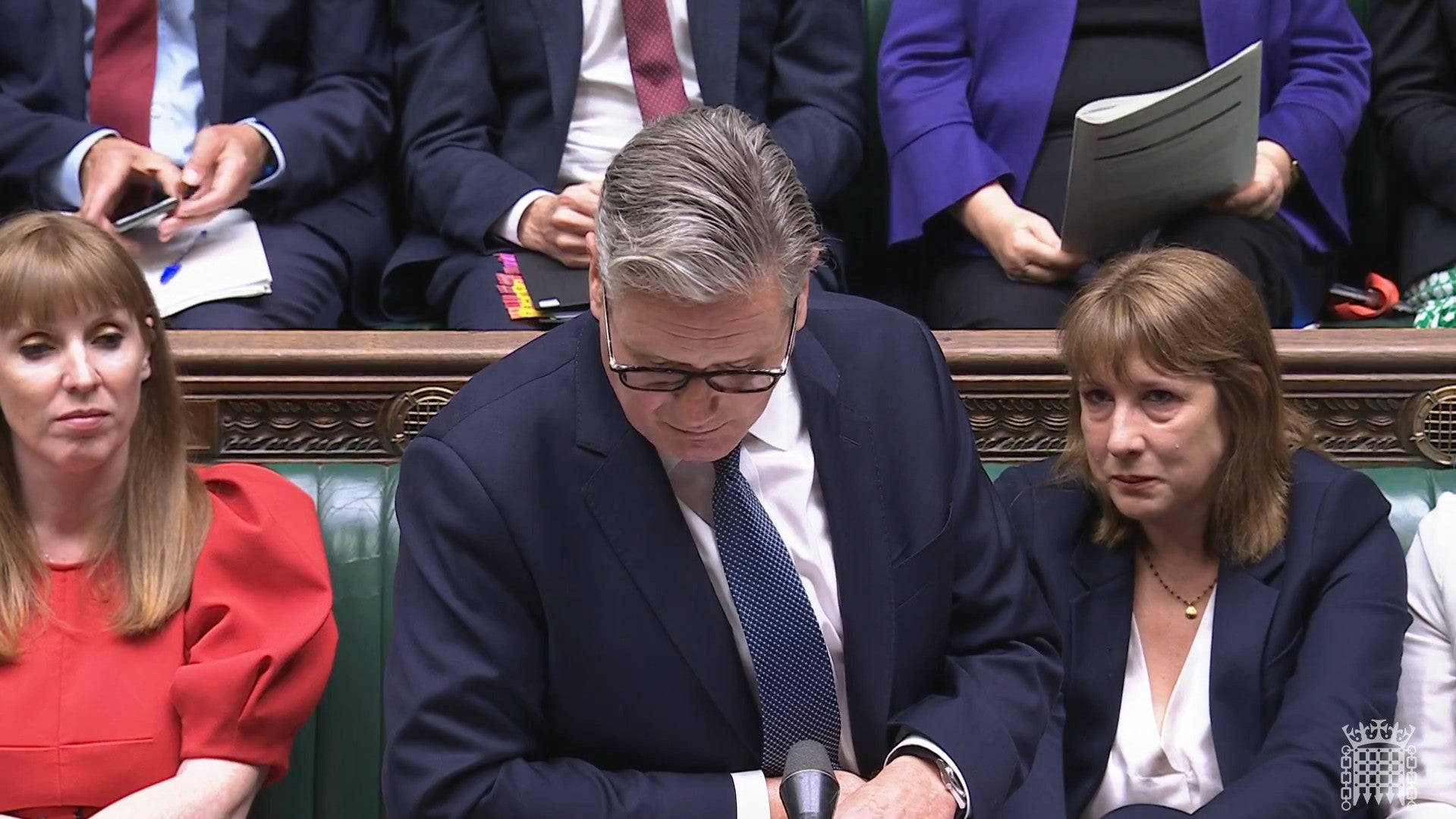

Reeves battles tears as Starmer declines to back her staying in post

Rachel Reeves appears emotional at PMQs after Starmer refuses to guarantee position

Kate Middleton reveals ‘life-changing’ cancer journey is a ‘rollercoaster’

McGregor could use Lawrence appeal as ‘avatar’ to reduce legal bill, court told