/Pool%20Corporation%20site%20magnified-by%20Casimiro%20PT%20via%20Shutterstock.jpg)

Covington, Louisiana-based Pool Corporation (POOL) is the world’s largest wholesale distributor of swimming pool supplies, equipment, and outdoor living products. With a market cap of $11.9 billion, it serves service professionals, builders, remodelers, retailers, and commercial operators through an extensive distribution network.

Companies worth $10 billion or more are typically referred to as "large-cap stocks." POOL fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the industrial distribution industry. Its business is anchored by recurring revenue from pool maintenance and repair, complemented by remodelling and new construction sales. The company also benefits from scale, product variety, and strong vendor relationships.

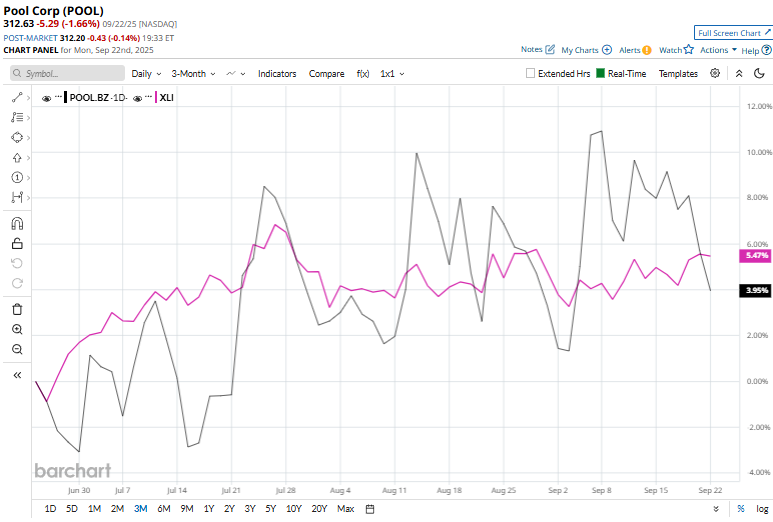

However, the pool giant is currently trading 21% below its 52-week high of $395.60 met on Nov. 25 last year. POOL shares have increased 8.4% over the past three months, surpassing the Industrial Select Sector SPDR Fund (XLI), which has gained 7.5% over the same time frame.

POOL shares have declined 8.3% year-to-date, underperforming the XLI’s 16.1% rise during the same period. Moreover, over the past 12 months, POOL has plunged 14.2%, lagging behind the XLI’s 14.9% gain.

POOL has been trading below its 200-day moving average since mid-March and has recently dipped below its 50-day moving average.

On July 24, Pool Corp released its second-quarter earnings and its shares climbed 3%. While growth in maintenance products and a modest pickup in discretionary spending supported performance, net sales edged up marginally year-over-year to $1.8 billion, slightly below consensus estimates. On the earnings side, net income increased nearly 1% to $194.3 million, with EPS of $5.17 topping expectations by about 1%.

Its peer, Core & Main, Inc. (CNM), dropped marginally in 2025 and has gained 16.8% over the past year, outperforming the stock.

Among the 14 analysts covering the POOL stock, the consensus rating is a “Moderate Buy.” Its mean price target of $331.45 suggests a 6% upside potential from current price levels.