/Pool%20Corporation%20logo%20with%20green%20background-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Headquartered in Covington, Louisiana, Pool Corporation (POOL) is a prominent global distributor in the swimming pool and outdoor-living sector. Its business involves supplying equipment, parts, and services to pool service professionals, builders, and retailers. Its market capitalization stands at $11.5 billion. This leading distributor of pool supplies is expected to announce its fiscal third-quarter earnings for 2025 soon.

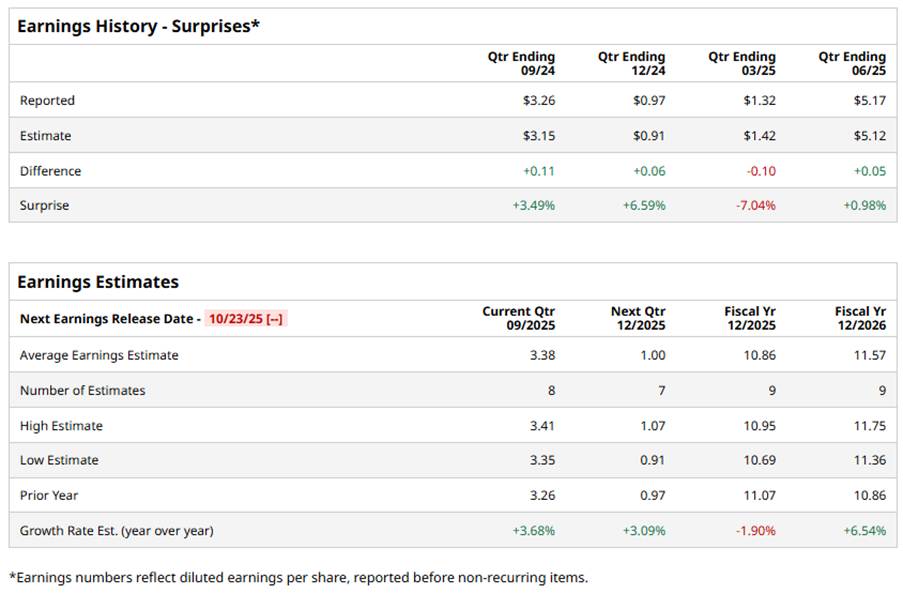

Ahead of the event, analysts expect Pool Corporation to report a profit of $3.38 per share on a diluted basis, up 3.7% from $3.26 per share in the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on one other occasion.

For the full year, analysts expect the company’s EPS to be $10.86, down 1.9% from $11.07 in fiscal 2024. However, its EPS is expected to rise 6.5% (YoY) to $11.57 in fiscal 2026.

POOL stock has underperformed the S&P 500 Index’s ($SPX) 17.2% gains, with shares down 15.6% over the past 52 weeks. Also, it underperformed the Industrial Select Sector SPDR Fund’s (XLI) 14.5% rise over the same time frame.

Pool’s share price has been falling largely because of weaker demand in the face of a tougher macroeconomic environment. Macro uncertainties and cooling consumer discretionary spending are making homeowners less inclined to invest in high-ticket outdoor or home improvement projects, including pools.

Analysts are moderately bullish on POOL, with a “Moderate Buy” rating overall. Out of 15 analysts covering the stock, five advise a “Strong Buy” rating, nine give a “Hold,” and one indicates a “Moderate Sell.” POOL’s average analyst price target is $333.27, indicating a potential upside of 8.5% from the current levels.