Bitcoin (CRYPTO: BTC) will "never stop going up" because "they will never stop printing money," said Anthony Pompliano, founder and CEO of Professional Capital Management, during a Tuesday interview on CNBC.

Pompliano Calls Bitcoin The "Hurdle Rate"

Pompliano said Bitcoin's appeal lies in its simplicity as "savings technology."

He explained that investors can "work hard, spend less than they make, and put their savings into Bitcoin" to preserve value against monetary debasement.

He added that the trend of investors moving capital into Bitcoin represents the "story of finance of this decade," noting that "Bitcoin is becoming the hurdle rate."

According to Pompliano, since 2020 the S&P 500 (NYSE:SPY) has doubled in dollar terms but is down 90% when priced in Bitcoin — showing that most traditional market returns "are negative because no one can beat Bitcoin."

Read Also: Ethereum, BitMine Just Broke Out — And $5,000 ETH, $130 BMNR Could Be Next

Bitcoin Price Prediction: Bulls Eye $124,000 Breakout After Third Attempt

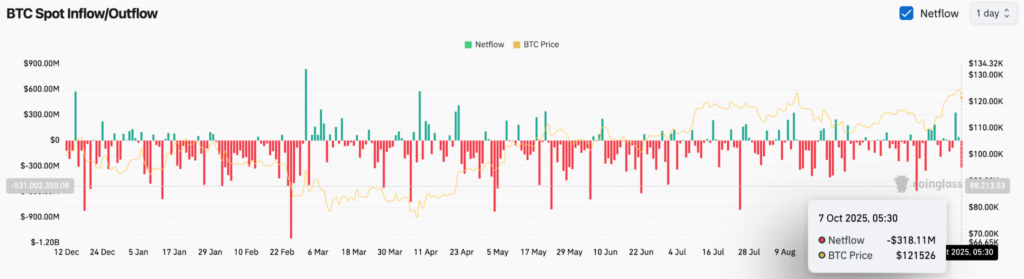

BTC On-Chain Netflows (Source: Coinglass)

Bitcoin's third breakout attempt above $124,000 has faltered, with Coinglass data showing $318 million in net inflows to exchanges on October 7, signaling selling pressure near the highs.

The rejection at this level triggered long liquidations, suggesting short-term distribution despite the broader uptrend remaining intact.

BTC Price Action (Source: TradingView)

The Parabolic SAR indicator still prints below price action, keeping the medium-term bullish structure in place.

Support lies between $117,500–$116,200, where the 20-, 50-, and 100-day EMAs are clustered.

A decisive close above $124,000 remains key for the next leg higher.

Why It Matters

What Pompliano highlights is not just a bullish soundbite but a reframing of how global finance measures value.

If Bitcoin becomes the "hurdle rate," then every traditional asset such as equities, bonds, or real estate is judged against its performance.

That changes portfolio theory at its core because it implies risk-free returns may no longer be defined by Treasuries but by a decentralized asset.

For institutions, this poses a fundamental question: are they underperforming simply by not holding Bitcoin?

Read Next:

Image: Shutterstock