Bitcoin (CRYPTO: BTC) is stuck near $111,000 as prediction markets see a slide toward $95,000 as possible, even while technical charts still flash room for a rebound toward $130,000.

Polymarket Traders Bet on Bitcoin's $95,000 Fall Over $130,000 Breakout

Data from Polymarket shows that traders now give Bitcoin a 13% chance of reaching $95,000 this month, compared with only 10% odds of hitting $130,000.

The shift reflects a cooling outlook after several weeks of volatility that tested investor conviction.

The change in sentiment follows a series of failed attempts to hold above $115,000.

Market participants appear to be hedging for lower levels even as the broader uptrend remains intact.

BTC Price Tests Key Support as Bulls Fight for $122,000 Target

BTC Price Prediction for October 16th (Source: TradingView)

Bitcoin is trading above its 200-day exponential moving average at $108,125 while defending the ascending trendline that has guided the market since April.

The daily chart shows resistance between $113,400 and $116,300, where the 50- and 100-day EMAs overlap with the Supertrend indicator.

A sustained move above that cluster could confirm renewed momentum and open the way toward $122,800.

A close below $108,000 would expose the next demand zone near $105,000 to $106,000, which matches the base formed earlier this year.

Bitcoin Outflows Cooling After $1B Exodus

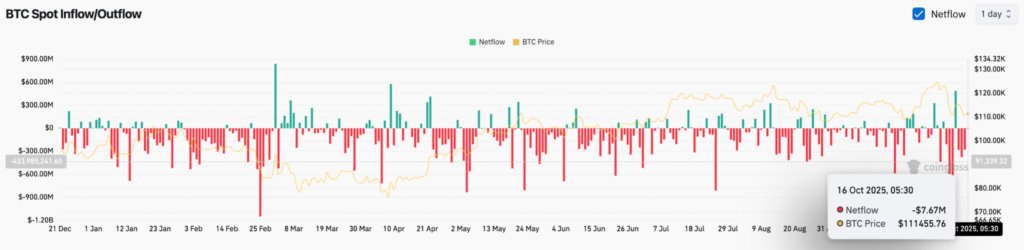

BTC Netflows (Source: Coinglass)

After nearly $1 billion in outflows over the previous three sessions, spot netflows have eased to about negative $7.6 million, suggesting that heavy exchange withdrawals may be slowing.

Historically, easing outflows after large redemptions have signaled periods of consolidation before the next directional move.

Why It Matters

Bitcoin sitting at $111,000 is not just another price pause — it is happening at the exact intersection where prediction markets, on-chain data, and technical structures collide.

Polymarket odds show traders bracing for $95,000, yet the charts still defend the $108,000–$111,000 base that has fueled every rally since April.

When conviction in derivatives and prediction markets diverges from price structure, it often precedes explosive resolution.

This moment could tell us whether Bitcoin will end "Uptober" as just another consolidation month or as the launchpad toward a historic push beyond $130,000.

Read Next:

Image: Shutterstock