A viral Reddit post on the r/Finanzen subreddit is questioning whether even the ‘Oracle of Omaha’ Warren Buffett needs to re-evaluate his strategy, as data from Card Ladder shows that Pokémon trading cards have become a surprisingly lucrative investment, significantly outpacing the S&P 500.

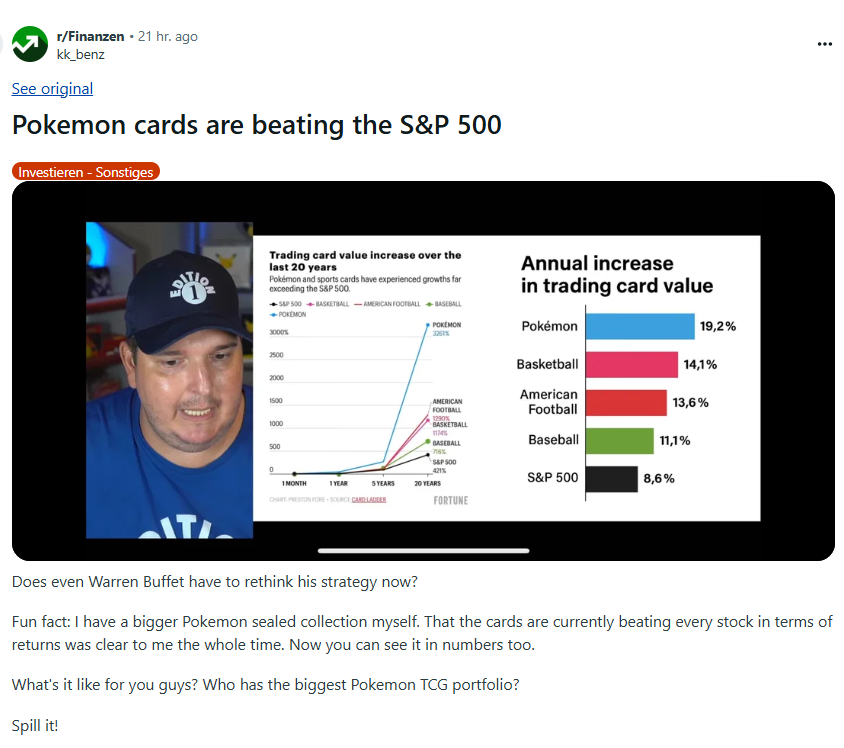

What Happened: According to a report by Fortune, the average Pokémon card has appreciated by a staggering 3,261% over the past 20 years.

The average one-year increase for a Pokémon card is nearly 46%, a pace that dwarfs the S&P 500's average annual return rate of 12%.

The Card Ladder chart shared by the user highlights, American Football, Basketball, and Baseball cards also outpace the S&P 500’s returns over the 20 years, which stands at 421%.

This trend is fueling a “Pokémania” among Gen Z and Millennial collectors, many of whom, like the Reddit user, believe these cards are a superior alternative to traditional stock market investments.

The user asks, “Does even Warren Buffett have to rethink his strategy now?”

The Reddit user, in fact, claims to have a large, sealed collection of cards themselves.

“I have a bigger Pokemon sealed collection myself. That the cards are currently beating every stock in terms of returns was clear to me the whole time. Now you can see it in numbers too.”

At the time of this report, Card Ladder has not yet responded to Benzinga‘s request for comment.

See Also: Trump Tariffs Challenge SMCI’s AI Business, But Global Supply Chain Eases Blow After Weak Q4

Why It Matters: Despite the amazing returns, collecting cards presents its own challenges. Unlike stocks or NFTs, which are digital collectibles, cards are a physical and often illiquid asset.

Finding them has become increasingly difficult as high demand has left shelves bare at major retailers like Walmart Inc. (NYSE:WMT) and Target Corp. (NYSE:TGT).

This rush for physical collectibles may be a reaction to the digital world, as Ryan Hoge, president of card grader PSA, told Fortune: “I think sometimes people want to break from the digital, and this is a good outlet for it.”

Price Action: Here’s how major U.S. equities have performed in the long and short term along with the S&P 500 and Nasdaq 100 indices.

| Stocks/Indices/ETFs | YTD Performance | One-Year Performance | Five-Year Performance |

| Nvidia Corporation (NASDAQ:NVDA) | 28.88% | 70.99% | 1491.61% |

| Apple Inc. (NASDAQ:AAPL) | -16.78% | -16.78% | 82.63% |

| Microsoft Corp. (NASDAQ:MSFT) | 26.08% | 32.07% | 148.38% |

| Amazon.com Inc. (NASDAQ:AMZN) | -2.94% | 32.00% | 34.97% |

| Alphabet Inc. (NASDAQ:GOOG) | 2.46% | 21.66% | 161.40% |

| Meta Platforms Inc. (NASDAQ:META) | 27.40% | 54.52% | 184.41% |

| Tesla Inc. (NASDAQ:TSLA) | -18.60% | 53.87% | 218.76% |

| Berkshire Hathaway Inc. (NYSE:BRK) | 2.90% | 9.96% | 121.59% |

| S&P 500 | 7.34% | 20.21% | 87.96% |

| Nasdaq 100 | 9.74% | 27.33% | 106.64% |

| Roundhill Magnificent Seven ETF (BATS:MAGS) | 6.33% | 39.11% | 129.72% |

Price Action: The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Wednesday. The SPY was up 0.27% at $629.66, while the QQQ advanced 0.046% to $560.53, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image Via Shutterstock