Starting each Friday and continuing on through the weekend, Next TV writers Daniel Frankel and David Bloom engage in a lively, spirited, semi-respectful discussion, via SMS, on the pressing issues of the week in TMT. One of us is righter than the other … You know who it is.

DANIEL FRANKEL: So a lot to get into this week. But I’ll start with the FCC ordering cable and satellite TV companies to list the “all-in” price for their services. As I ponder the 1990 Soul Asylum classic And the Horse They Rode in On, I'm not so sure this is such a consumer-friendly idea in the end. Folks got tired of the bullshit fees a while ago, and there are now plenty of alternatives to linear pay TV. To me, this rule feels like it's two decades too late. Will this do anything but push cable operators out of linear video even faster … and simply reduce consumer choice?

DAVID BLOOM: Your solicitude for the poor, put-upon cable providers is truly heart-warming, particularly after decades of rent extractions that finally became so excessive that the convenience of the bundle was outweighed by the rapacious appetites of the extractors. This FCC move is part of a broader Biden administration strategy to end what are charmingly known as “junk fees,” while increasing clarity about what we’re actually paying.

You should see what they’re doing to the banks, acknowledged past masters at the junk-fee biz. I seriously doubt the FCC requirement will perceptibly hasten the already rapid decline of the MVPDs. That’s been proceeding apace for years. And maybe the industry can do a little marketing jiujitsu and use its all-in price (and convenience) in comparison with the rapidly increasing costs of all those different streaming services, especially if last September’s Charter-Disney deal becomes the industry norm in terms of access to all of a media company’s best content.

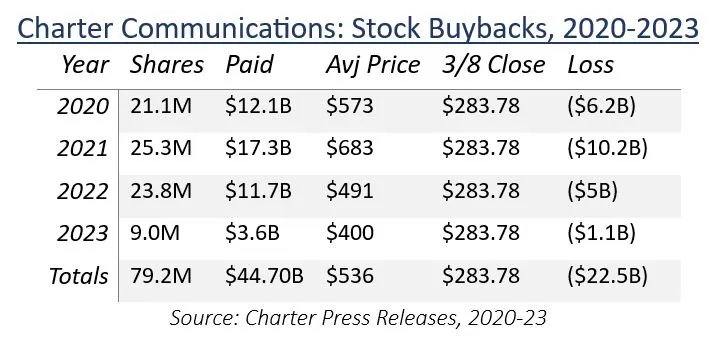

FRANKEL: I find it hard not to root for the, er, poor cable guys. They're losing ground to the wireless internet, and their stock prices are all down. There was an interesting note in Ted Hearn's Policyband Substack this week about Charter's precipitous fall — it’s now trading at a five-year low — and how management has run up a paper debt of over $2 billion chasing stock buybacks.

Hearn noted that $2 billion sure would come in handy for buying Altice USA. You know, on second thought, it’s hard to feel sorry for them!

BLOOM: Right, share buybacks that prop up stock prices, upon which an executive team might depend for their bonuses, are a bad idea if they foreclose smart long-term investment. Just look at the value destruction that Phillipe Dauman visited upon Viacom as he poured billions into propping up share prices rather than, say, creating a significant Nickelodeon streaming service while kids still cared about the brand. That said, buying more of what’s already collapsing seems bad, too. Yes, an Altice acquisition would extend Charter’s reach by a couple of million households, perhaps modestly delaying decline in its MVPD.

But Hollywood executives and their financial enablers are slowly understanding that yet another merger/acquisition/leveraged buyout won't fix the mess they’re in. Returning to what’s now Paramount Global, look at the lack of deals getting done (bring on Apollo!). Rich Greenfield of LightShed Partners even suggested that controlling shareholder Shari Redstone “must" fire CEO Bob Bakish if she wants to save her patrimony. He argues continuing to operate undersized, over-expensive Paramount Plus is a giant strategic and financial blunder. As revenue keeps bleeding out, and share prices wilt, it’s hard to disagree. No one buying Par would keep Par+ running. Why not pretty up the books now, save billions, and get on with licensing premium content to everywhere else, while you still can?

FRANKEL: So you have a distribution platform that has nearly 70 million subscribers … and that you've already plunged billions of dollars into, dating back to CBS All Access and Showtime … and you're just going to kill it? Sounds like dumb advice. I think we need to play Public Enemy's 17-year-old 20-year anniversary classic, Harder Than You Think, just so I can process this moment

BLOOM: “Nearly 70 million subscribers” sounds meaningful, until you realize that Paramount Plus is still hemorrhaging money, is about dead last in priority among the big SVOD services and has no foreseeable path toward profitability or primacy. Also, it’s not Alphabet, Amazon, or Apple, with bottomless revenues flowing in from other sources. What’s your advice? Keep losing billions you don’t have? Remember that Shari’s ownership vehicle, National Amusements, depends on Paramount dividends to finance its own substantial debt, and those dividends have been cut and aren’t paying for everything. So, again, just because you have a lot of subscribers doesn’t mean you have a lot of revenue, never mind profits. Being more like arms-dealer Sony might be smart. Or Paramount can go broke and let private equity pick through the bones of the fallen Redstone empire in bankruptcy court. Look, I’m hardly alone here in envisioning a private-equity carve-up.

Also Read: Imagining the Apollo-Paramount Arranged Marriage

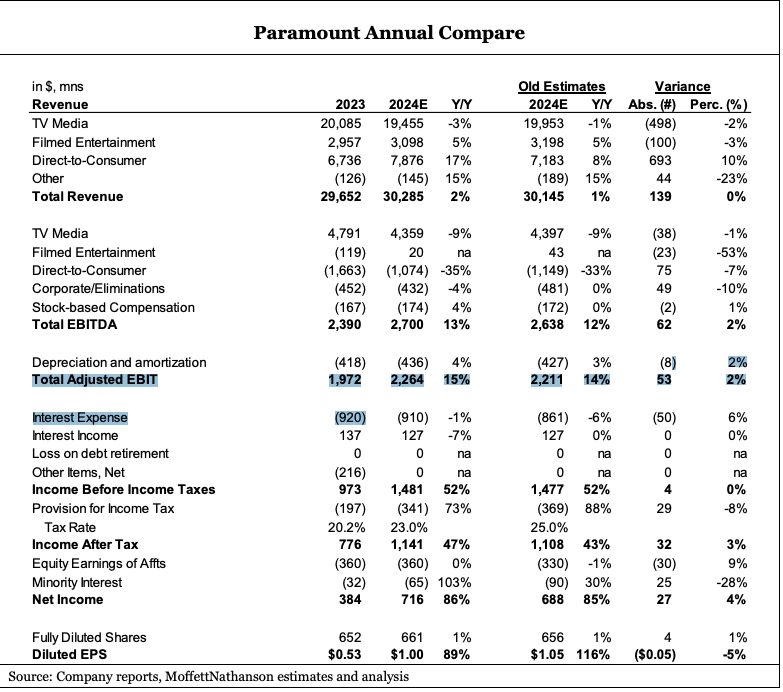

FRANKEL: Sorry, I still don't get it. In the fourth quarter, Paramount's direct-to-consumer business narrowed its losses on the basis of adjusted operating income before depreciation and amortization (OIBDA) to $490 million versus $575 million in the fourth quarter of 2022. DTC losses peaked in 2022, with adjusted OIBDA in 2023 ($4.8 billion) down from $5.5 billion the year before. Meanwhile, Par’s DTC revenue rose 34% to $1.9 billion, with advertising revenue up 14% to $526 million and subscription revenue increasing by 43% to $1.3 billion. So Paramount is through the hardest part of making its distribution platform of the future. Why oh why would they want to bail on that now? What does the company do if it doesn’t have a streaming platform? Like, why are they even here? A fellow sports dad friend of mine paid over $30K several years ago for a 2010 Forest River Georgetown RV, so he could travel around rural Montana and the upper Midwest for his son’s college football games. After setting some respectable Division II passing records, the boy is now in business management school and has hung up his cleats. Dad doesn't know what the heck to do with the RV, which costs a ton each month to store and maintain, not to mention fuel if he still goes anywhere with it. It’s kind of hard to sell in this market, but he’s not going to just give the thing away. Like Paramount Plus, it has a lot of value … to someone.

BLOOM: Okay, Professor Pangloss, here’s the problem: Even by your rosy-tinted take, Paramount is still losing almost $2 billion a year (four times the last quarter’s level and only a modest 15% improvement year-over-year) from its incredible shrinking streaming services four years after Par+ launch. Paramount literally can’t afford to keep losing $2 billion a year, given the accelerating decline of its money-making linear networks. While you may believe things are only going to get better from here, how? How long will it take to break even, never mind make a profit? Given the debt deadlines hanging over Redstone and NAI, can she wait for that magic moment of redemption, whenever it may arrive from heaven? And beyond that, what could make this magic moment happen, and soon?

You can’t cut your way to growth. Even worse, MVPD renewals are looming, and Paramount Global has been one of the big “cheaters” leaking broadcast premium content onto its streaming service. The “bill” for that cheating is about to come due. New cable deals likely will exile several Par cable channels to the ice floe, while limiting or even reducing carriage and retransmission fees for the survivors. And Paramount doesn’t really even have the leverage of withholding the NFL games on CBS to force a better deal, thanks to its cheating. Why, as an NFL fan, would you pay for a whole cable bundle featuring increasingly crappy and formulaic broadcast network programming, when you could just buy the base tier of Paramount Plus for six months of the year, then cancel? And why, if you’re Comcast or Charter, do you give Paramount a sweetheart deal when they’ve been screwing you over for years now with the cheating? What’s going to make all this magically better?

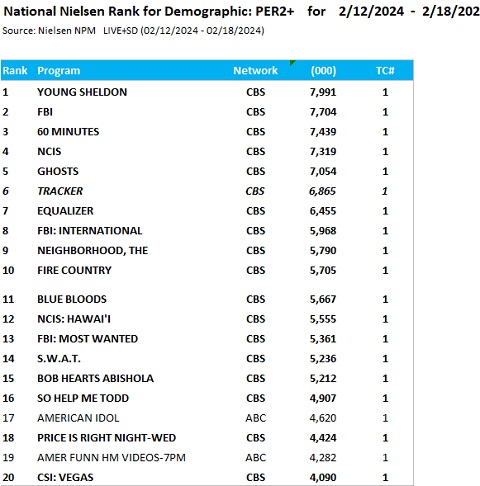

FRANKEL: Listen, just like your Super Bowl and Oscar picks, you are supported by expert consensus here. MoffettNathanson's Robert Fishman recently wrote, “DTC losses are abating, but even if one squints real hard, it is difficult to see a path towards long-term streaming success for Paramount Plus.” That said, what are they even doing in the media business if they're not streaming? Things are (relatively) rosy on the CBS Television Network right now. As the Futon Critic noted, CBS hosted the top 16 shows on broadcast TV for “premiere week” last month (even if the strike delay from fall made premiere week like having breakfast for dinner). But in a couple of years, there might not be a CBS Television Network, despite this relative prosperity. What I wanna know is, why doesn't everyone just track down and hire the decision-makers behind USA Networks‘ “Characters Welcome” campaign back in the aughts? According to Nielsen’s latest domestic weekly streaming report, three of the top 10 shows (Suits, Monk and Royal Pains) were USA Network shows from that era that are now streaming on Netflix.

BLOOM: Mad props to CBS for continuing to super-serve its aging, declining, still No. 1 broadcast audience. The makers of prescription medicine for obscure maladies, no-hands-needed walking shoes and laxative suppositories are grateful for an easy way to reach their senescent target audience where it sits on the living-room Barcalounger. Other advertisers, meanwhile, increasingly are turning to platforms that actually reach younger, growing, and highly engaged demographics, from TikTok to Temu, YouTube to connected TV, Roblox to Fortnite. Paramount Global was built on assets finely tuned for older eras of media consumption. Film, broadcast and cable were all fabulously lucrative in those older eras. They aren’t now. And Par's streaming operations, the supposed answer to its woes, continue to hemorrhage cash at a time when the company is already overloaded with debt and otherwise declining. The market realizes the sum of the parts isn’t worth much, which is why, for all the conversations about Redstone selling Paramount or just National Amusements, the response has mostly been … crickets, not deals. That says pretty much everything.