Shares of Plug Power Inc (NASDAQ:PLUG) are trading higher Monday, rebounding from last week's slide which was driven by financing and dilution concerns. Here’s what investors need to know.

What To Know: The hydrogen company's stock received a boost on Monday after Susquehanna analyst Biju Perincheril maintained a Neutral rating, but nearly doubled the price target to $3.50 from a previous $1.80.

The price target increase comes after Plug announced a warrant inducement agreement last week. An institutional investor exercised existing warrants at $2.00 per share, providing Plug with approximately $370 million in gross proceeds.

In exchange, the investor received new warrants to purchase shares at an exercise price of $7.75. While this deal could raise an additional $1.4 billion if fully exercised, the near-term dilution weighed on shares.

The financing news was coupled with the announcement of a leadership transition, with Jose Luis Crespo set to eventually take over as CEO. Monday's price target increase suggests a more positive outlook on the company's ability to navigate its capital needs.

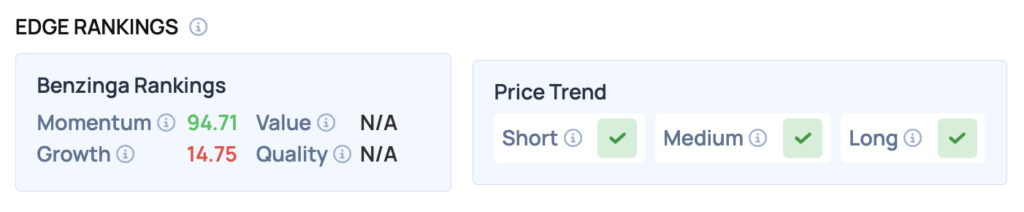

Benzinga Edge Rankings: Underscoring its recent price action, Plug Power boasts a very high Momentum score of 94.71, according to Benzinga Edge rankings.

PLUG Price Action: Plug Power shares were up 14.04% at $3.90 at the time of publication Monday, according to Benzinga Pro. The stock is trading within its 52-week range of 69 cents to $4.58.

Plug Power stock is well above its 50-day moving average of $2.02, indicating strong bullish momentum. The price is approaching the upper end of its 52-week range, suggesting potential resistance near $4.58.

Read Also: Retail Investors’ Top Stocks With Earnings This Week: Fastenal, ASML, TSMC And More

How To Buy PLUG Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Plug Power’s case, it is in the Industrials sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock

.png?w=600)