Plug Power Inc (NASDAQ:PLUG) shares are pulling back Tuesday afternoon, following the momentum from Monday’s rally, which was spurred by the growing need for alternative energy solutions to power the artificial intelligence boom. The recent interest rate cut by the Federal Reserve has also bolstered investor confidence in capital-intensive companies like Plug over the past week.

What To Know: The company’s hydrogen fuel cells are seen as a potential green power solution for AI data centers, which require vast, uninterrupted power. This has led to a combination of shifting industry demand and new partnerships in the AI-driven data center market.

Plug Power also disclosed updates to its regulatory filings, including a prospectus supplement related to its May 2025 registration statement, which covers the resale of common stock related to warrants issued in March 2025.

These warrants, representing over 185 million shares at a $2.00 exercise price, will remain valid until March 2028. The company continues to court institutional stakeholders and analysts as part of a broader transparency push.

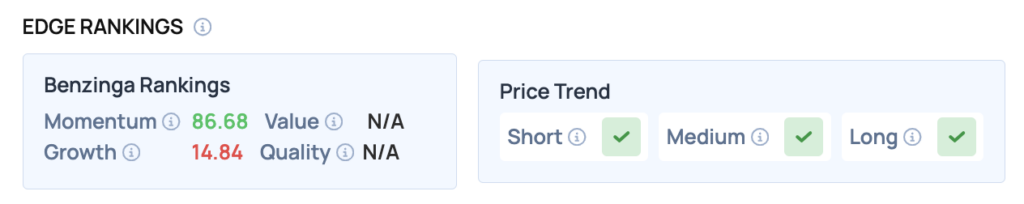

Benzinga Edge Rankings: According to Benzinga Edge stock rankings, Plug Power boasts a strong Momentum score of 86.68, reflecting its recent positive price movement.

Price Action: According to data from Benzinga Pro, PLUG shares are trading lower by 4.15% to $2.54 Tuesday afternoon. The stock has a 52-week high of $3.32 and a 52-week low of $0.69.

Read Also: Wall Street Pauses For A Breather, Small Caps Soar: What’s Moving Markets Tuesday?

How To Buy PLUG Stock

By now you're likely curious about how to participate in the market for Plug Power – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

In the case of Plug Power, which is trading at $2.56 as of publishing time, $100 would buy you 39.37 shares of stock.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock