Shares of Plug Power Inc (NASDAQ:PLUG) are surging Monday morning, continuing a powerful rally that has seen the hydrogen fuel-cell company's stock climb 160% over the past month. Here’s what investors need to know.

What To Know: Fueling the investor optimism is a bullish analyst note from H.C. Wainwright last week, which reiterated a "Buy" rating and more than doubled its price target on Plug to $7 from $3. The firm highlighted that significant year-over-year increases in electricity prices are making green hydrogen more cost-competitive against grey hydrogen.

Additionally, H.C. Wainwright analysts see a symbiotic relationship developing with nuclear power. They believe the push for nuclear, especially small modular reactors, will provide the stable, carbon-free baseload power required for predictable and cost-effective electrolysis, bolstering the entire hydrogen adoption case.

The positive sentiment in shares also follows a key operational announcement. Plug recently said it delivered its first 10-megawatt electrolyzer to Galp's Sines refinery in Portugal, a critical step in one of Europe's largest green hydrogen projects.

This European expansion, coupled with growing investor excitement over the technology's potential to power energy-intensive AI data centers, has provided a significant boost to the stock's recent performance.

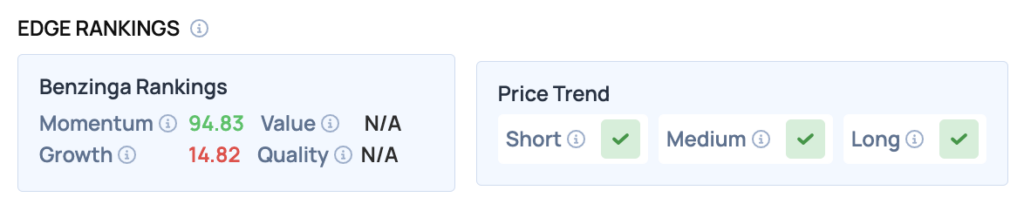

Benzinga Edge Rankings: Reflecting this powerful rally, Benzinga Edge stock rankings give Plug Power a Momentum score of 94.83, indicating strong recent price performance.

PLUG Price Action: Plug Power shares were up 6.69% at $4.06 at the time of publication Monday, according to Benzinga Pro. The stock hit a 52-week high of $4.58 in early trading Monday.

The current price is well above its 50-day moving average of $1.81, suggesting a robust upward trend. Key support levels may be established near the 50-day and 100-day moving averages, while resistance could be tested at previous highs.

Read Also: Stock Market Today: Nasdaq, S&P 500 Futures Rise As Government Enters 2nd Week Of Shutdown

How To Buy PLUG Stock

By now you're likely curious about how to participate in the market for Plug Power – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock