/Green%20hydrogen%20by%20Scharfsinn%20via%20Shutterstock.jpg)

Hydrogen might not make daily headlines, but it’s quietly powering the clean energy revolution. From fueling futuristic vehicles to driving heavy industry, global demand hit 97 million metric tons in 2023, and it is racing toward 150 million by 2030. Sitting right in the middle of this shift is Plug Power (PLUG), the U.S. hydrogen solution provider that has been chasing one big dream — to build an end-to-end hydrogen ecosystem, from production to delivery to real-world use.

But that dream has not come easy. After years of red ink and a brutal start to 2025, Plug Power’s story just took a dramatic turn. PLUG stock, once left for dead, has suddenly shown signs of life, surging sharply in recent weeks after upbeat analyst calls and bullish price targets reignited investor optimism. For a brief moment, it felt like Plug Power might finally be turning the corner.

Then came the big news yesterday. Plug Power announced that Jose Luis Crespo — a Plug veteran credited with building an $8 billion sales pipeline — will be the company's new President and incoming CEO, replacing long-time chief Andy Marsh. The market, however, didn’t exactly cheer this news, with PLUG shares slipping 6% in response on Oct. 7.

Now, with new leadership steering a company still struggling for profitability, is this shake-up the jolt that Plug Power needs to finally reignite its momentum? Or should investors watch the first sparks before leaning in?

About Plug Power Stock

Founded in 1997 and headquartered in New York, Plug Power is a pioneer in the hydrogen economy, developing and supplying fuel-cell systems, electrolyzers, and complete hydrogen infrastructure solutions. With a market capitalization of $4.5 billion, the company’s technology powers everything from material handling and electric vehicles (EVs) to stationary energy systems.

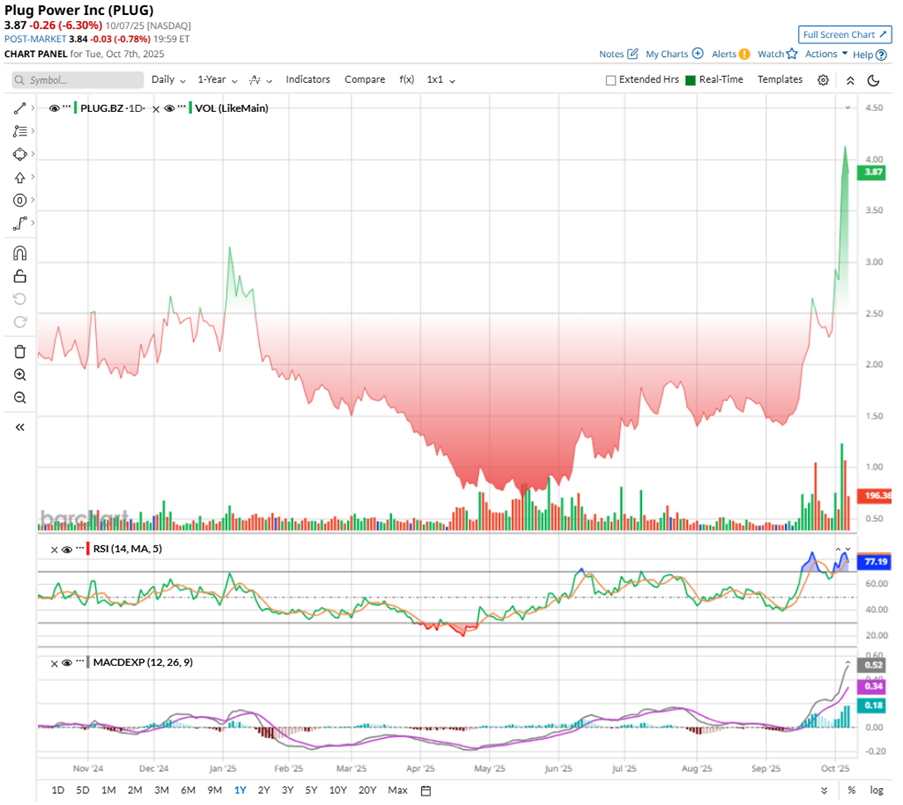

After months of pain and pessimism, Plug Power seems to be scripting a comeback story that few saw coming. PLUG stock, once languishing below $1 earlier this year, has staged a stunning rebound, soaring 95% over the past 52 weeks and 90% year-to-date (YTD). Over the past six months, PLUG has rocketed 282%, and climbed 166% over the past month. Shares even hit a 52-week high of $4.58 on Oct. 6 before cooling slightly.

Under the hood, the technicals tell an equally intriguing tale. The surge in trading volume reflects renewed investor excitement, and the MACD oscillator’s bullish crossover signals strengthening momentum.

But not everything is glowing green. The RSI has shot above 70, suggesting that the stock may be entering overbought territory — a hint that the rally could be overheating. While this penny stock’s sharp rebound is hard to ignore, it comes after years of wealth erosion and volatile swings.

Plug Power’s Mixed Q2 Earnings Report

Plug Power’s second-quarter report for fiscal 2025 was a mixed bag — a slight spark with a lot of smoke. Revenue climbed 21% year-over-year (YOY) to $174 million, powered by strong demand across its hydrogen platforms. Electrolyzer sales were the star of the show, tripling to $45 million.

Yet the company still can’t shake its profitability problem. Loss per share came in at $0.20, better than last year’s $0.36 per-share loss but worse than analysts had hoped. Gross margins, though, improved to -31% from a brutal -92% last year, still showing a business struggling to turn efficiency into profit.

Cash remains a sore spot. Operating outflows totaled $297.4 million for the first half of 2025, easing from last year’s outflow $422.5 million. But with only $140.7 million left in cash — less than half its short-term debt — liquidity risk looms large.

The real concern was demand, which is not holding up. Electrolyzer backlog plunged 38% YOY, while total backlog dropped 29% to $782.4 million. Plug’s book-to-bill ratio has languished below one for seven-straight quarters, a warning sign that outgoing shipments still outpace fresh orders.

Still, there is some sunlight breaking through the clouds. The U.S. government’s extended 48E and 45V tax credits for hydrogen and fuel-cell production offer a vital policy tailwind. Marsh called the credits a game changer, bringing long-term visibility that the industry has desperately needed.

Meanwhile, Plug’s “Project Quantum Leap” restructuring is underway — trimming fat, consolidating sites, and aiming for gross-margin neutrality by the end of 2025. Management has set a revenue target of $700 million for the year. The firm's Georgia and Louisiana hydrogen facilities are humming along, and a pipeline of European projects could help turn the tide by 2026.

Analysts tracking Plug Power project its losses to narrow impressively this year and next. For fiscal 2025, losses are expected to shrink 79% YOY to $0.57 per share, before narrowing another 40% annually to a $0.34 per-share loss in fiscal 2026.

What Do Analysts Expect for Plug Power Stock?

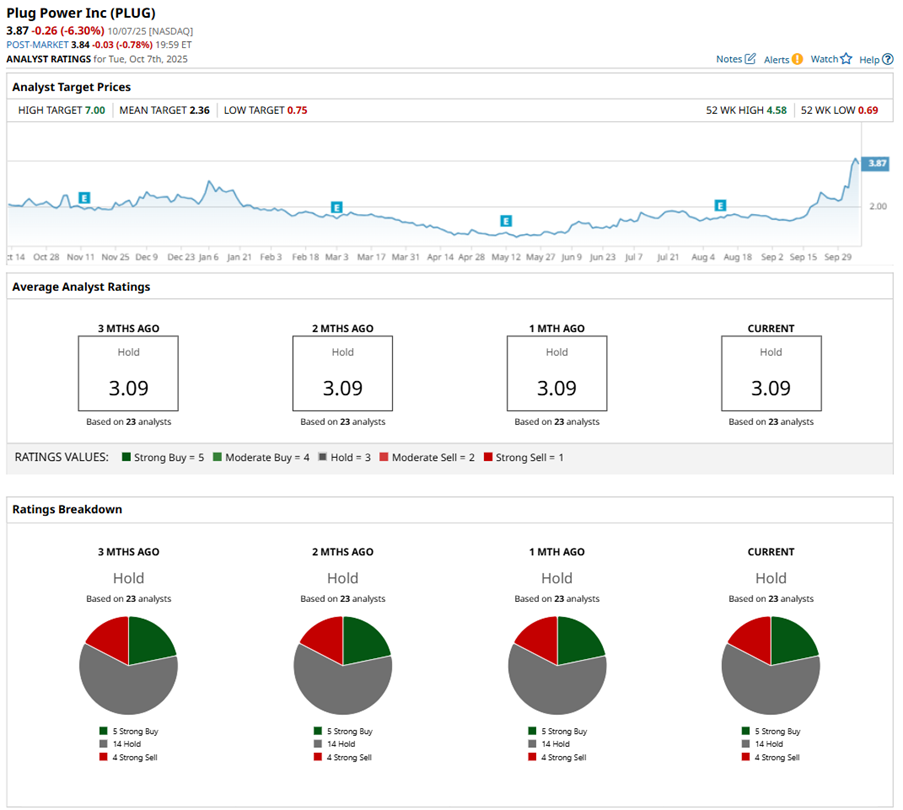

PLUG stock rallied impressively last week, riding a wave of upbeat analyst sentiment. For one, H.C. Wainwright seems to think Plug Power's moment in the sun might finally be here. The firm doubled down on its bullish stance, lifting its target to $7 from $3 and keeping a “Buy” rating.

H.C. Wainwright anticipates that rising U.S. electricity prices are reshaping the energy landscape, making green hydrogen look far more attractive, and perfeclty positioning Plug Power’s tech. With nuclear energy back in political favor, the analyst sees a cleaner, electrified future playing right into the company's hands.

Wall Street’s verdict on PLUG stock lands somewhere in the middle, with a cautious “Hold” rating overall. Of the 23 analysts tracking PLUG, five recommend a “Strong Buy,” 14 analysts sit tight with a “Hold,” and four wave the “Strong Sell” flag.

PLUG stock has surpassed the mean target price of $2.48. However, H.C. Wainwright’s Street-high target price of $7 represents 73% potential upside from current levels — if Plug can keep the current spark alive.