Hydrogen fuel cell company Plug Power (PLUG) has seen significant traction recently due to a series of positive news that has ignited a robust stock rally. The positive view of PLUG stock was initiated by analysts from H.C. Wainwright, who raised their price target on PLUG from $3 to a Street-high of $7 and reaffirmed a “Buy” rating. The stock gained nearly 35% intraday on Oct. 3 on the news.

PLUG stock continued its rally, driven by multiple key milestones, including the delivery of the first 10-megawatt electrolyzer system to a major energy company in Portugal. Should you consider buying Plug Power stock now?

About Plug Power Stock

Based in New York, Plug Power is a pioneering company in the field of hydrogen fuel cell technology. It specializes in designing, manufacturing, and commercializing fuel cell systems that replace traditional batteries in electric vehicles (EVs) and industrial equipment. The company is developing a comprehensive green hydrogen ecosystem that encompasses hydrogen production, storage, distribution, and energy generation.

Serving sectors such as material handling, e-mobility, stationary power, and industrial applications, Plug Power offers integrated solutions including fuel cells, electrolyzers, and hydrogen fueling infrastructure. Through strategic partnerships and advanced technology, it aims to accelerate the adoption of clean hydrogen energy and facilitate a global transition to a zero-emission economy. The company has a market capitalization of $3.9 billion.

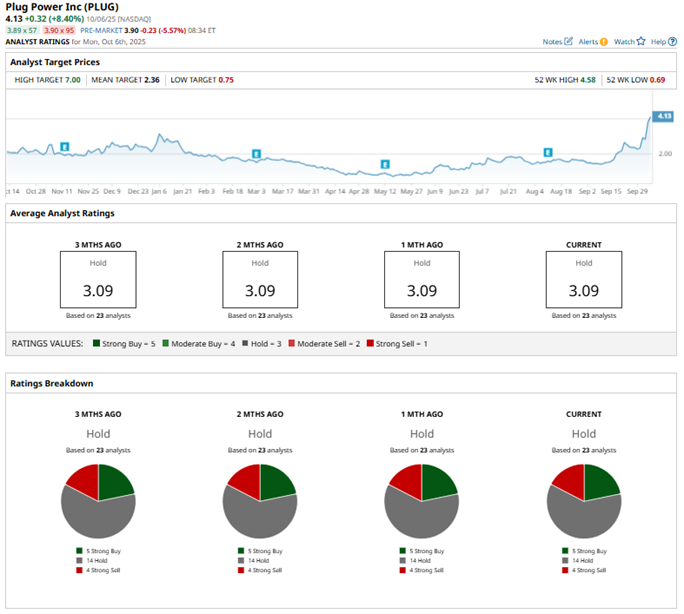

Over the past 52 weeks, Plug Power stock has gained 74%, while it is up 61% year-to-date (YTD). The stock has also been on a tear this past month, up 137%, although it is down 10% over the past five days. Based on this recent rally, PLUG reached a 52-week high of $4.58 on Oct. 6. Shares are currently down 25% from this high.

Plug Power’s valuation is significantly stretched compared to the industry. Its price-to-sales ratio of 6.94 times is higher than the industry average.

Plug Power Reported Mixed Q2 Results

On Aug. 11, Plug Power reported its second-quarter results for fiscal 2025. The company’s quarterly net revenue climbed by 21% year-over-year (YOY) to $174 million, which was higher than the $151.2 million that Wall Street analysts had expected.

Plug Power's gross loss dropped from $131.26 million in Q2 2024 to $53.47 million in Q2 2025. Net loss also reduced from $0.36 per share to $0.20 per share over the same period. However, this bottom-line figure fell short of the $0.15 loss per share that Wall Street analysts had expected.

The company reported that its Project Quantum Leap — an intiative aimed at reducing costs and optimizing operations — is delivering cost benefits through workforce optimization, facility consolidation, and renegotiated supply contracts. Plug Power also stands to benefit from the passage of the “One Big Beautiful Bill" in July, which solidified the Section 45V Clean Hydrogen Production Tax Credit and the Section 48E Investment Tax Credit. Through cost discipline and scale benefits from its GenEco deployments, the firm expects to achieve breakeven status on its gross margin on a run-rate basis by Q4 2025.

Wall Street analysts are still optimistic about Plug Power’s ability to recover its losses. They expect the company’s loss per share to narrow by 48% YOY to $0.13 for the third quarter of fiscal 2025. They also foresee a 79% improvement to a loss per share of $0.57 for the current fiscal year as well as a 39% improvement to a loss per share of $0.35 in fiscal 2026.

What Do Analysts Think About Plug Power Stock?

Apart from the bullish view that analysts at H.C. Wainwright have, Wall Street analysts have been mainly cautious about Plug Power’s prospects. In August, Wells Fargo maintained an “Equal Weight” rating on PLUG stock, while raising the price target of $1 to $1.50. Wells Fargo analysts lack visibility into the company's ability to record positive profit margins.

On the other hand, in the same month, analysts at BMO Capital lowered their price target from $1.10 to $1, maintaining an “Underperform” rating. BMO Capital analysts, while acknowledging the company’s improvement in the Q2 results, remain concerned about Plug Power's prospects.

Jefferies raised the price target on Plug Power from $0.90 to $1.60, but kept a “Hold” rating on the stock. Despite the resolution of the “One Big Beautiful Bill” analysts still find it hard to see robust prospects for renewable names like Plug Power.

Susquehanna analyst Charles Minervino raised the price target from $1 to $1.80, but maintained a “Neutral” rating on the stock. Analysts are cautious about the entire renewable sector due to potential changes in tariff policy and subsidies under the Inflation Reduction Act.

Wall Street analysts are taking a cautious stance on Plug Power with a consensus “Hold” rating overall. Of the 23 analysts rating the stock, five give it a “Strong Buy” rating, 14 analysts opt for a “Hold” rating, and four analysts provide a “Strong Sell” rating. The consensus price target of $2.36 represents significant downside from current levels. However, H.C. Wainwright's Street-high price target of $7 indicates 105% potential upside from current levels.

Key Takeaways

While H.C. Wainwright analysts see significant upside in Plug Power, the consensus opinion of Wall Street analysts on PLUG stock remains cautious. Therefore, it might be wise to wait for a better entry point in the stock.