Despite a sharp sell-off that has seen Palantir Technologies Inc. (NYSE:PLTR) shares plummet nearly 15% in the last five sessions, Wedbush Securities analyst Dan Ives is urging investors to see the dip as a buying opportunity.

Check out PLTR’s stock price here.

Palantir ‘The Poster Child Of The AI Revolution’

The prominent tech bull remains steadfast in his conviction, viewing the recent pullback as a healthy consolidation for a long-term winner in the artificial intelligence sector.

Speaking on CNBC Thursday, Ives dismissed the market nervousness surrounding the stock, which has been a high-flyer in the AI space. “I think these pullbacks are healthy,” Ives stated, emphasizing his long-term outlook.

He described Palantir as “the poster child of the AI revolution” and boldly predicted it would grow into a “$1 trillion market” capitalization over the next three to four years, a significant jump from its current valuation of roughly $330 billion. “The nervousness I get, but it doesn’t in any way change our view,” he added.

PLTR Revenue Could Reach $20 Billion, Says Ives

To justify such a lofty target, Ives projected a future where Palantir’s revenue could reach “$12, $15, $20 billion” with impressive free cash flow margins of 40% to 50%.

He believes the broader AI boom is still in its early phases, using a vivid analogy to describe the opportunity. “It was 9:00 p.m., it’s now 10:15 p.m. at the AI party. That party goes to 4:00 a.m.,” Ives remarked, suggesting the bull cycle for top tech names has years left to run.

“To me, it’s not the time to run for the hills. It’s actually, I view these as opportunities to own it.”

Andrew Left’s Citron Research Shorts PLTR

Ives's bullish commentary provides a strong counter-narrative to recent headwinds that have intensified selling pressure on the stock.

Notably, short-seller Citron Research recently initiated a short position on Palantir, valuing the company at $40 per share.

Citron's report drew unfavorable comparisons to private AI giants like OpenAI and Databricks, fueling investor concerns about Palantir's competitive standing and valuation and contributing to the recent decline. However, for Ives, the fundamental growth story remains firmly intact.

Price Action

Shares of Palantir fell 1.10% on Wednesday and were up 2.07% in after-hours. They have declined by 14.53% in the last five sessions, but the stock is up 107.49% year-to-date and 379.44% over the past year.

According to Benzinga Pro, PLTR's forward price-to-earnings or forward P/E ratio stood at 243.902x.

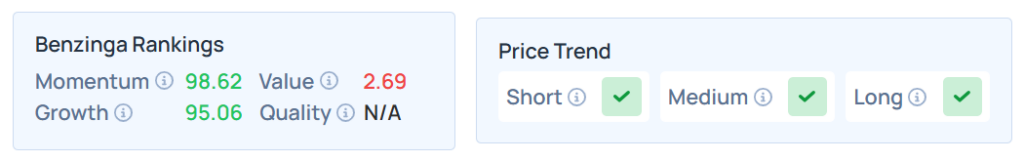

Benzinga’s Edge Stock Rankings indicate that PLTR maintains a stronger price trend in the short, medium, and long terms. However, the stock scores poorly on value rankings. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, fell on Wednesday. The SPY was down 0.27% at $638.11, while the QQQ declined 0.59% to $565.90, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo: Michael Vi / Shutterstock