MUMBAI: Shares worth between Rs 30,000 crore and Rs 40,000 crore are lying with the government since their original owners or their heirs are, for some reason or the other, have not claimed the same.

Last week, in response to a public interest litigation (PIL), the Supreme Court ordered the government and the markets regulator Sebi to respond to a notice about making the data public.

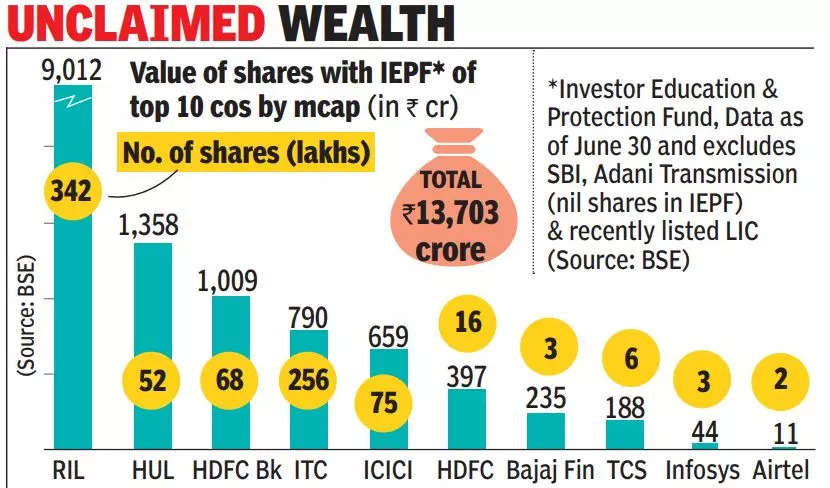

Data collated by TOIfrom the BSE showed that, as of June 2022, shares worth a little over Rs 13,700 crore of just 10 of the most valued companies in India are lying with the government’s Investor Education and Protection Fund (IEPF).

According to government rules, if investors do not claim dividend paid by the company in which they are shareholders for seven consecutive years, those scrips are transferred to the IEPF, whichis administered by the IEPF Authority (IEPFA).

An estimate made three years ago by Jeevantika Consultancy Services, which works to retrieve shares of investors from IEPF, showed that the total value of stocks of the BSE’s top 200 most valued companies that the fund had at that time was about Rs 30,000 crore.

There were around 15 lakh shareholders whose stocks were with IEPF, Jeevantika Consultancy co-founder Vijai Mantri said. The consultancy has collated data and made it available on its website and searchable free of cost. It tries to reach out to these shareholders to inform them about their unclaimed wealth and be a force multiplier in the ongoing efforts of IEPFA, Registrars & Transfer Agents (RTA) and listed companies to help these shareholders reclaim their wealth, Mantri said. Other estimates put the total value of shares with IEPF — of all listed companies taken together —at about Rs 40,000 crore.

Claim settlements have been slow and there are several reasons for the same. “Shareholders face issues like KYC updates, signature mismatch, name correction, duplicate issue of shares, succession & transmission, and filing of IEPF Form 5 to reclaim their shares,” said Jeevantika Consultancy co-founder Khagesh Chitlangiya. “Despite best intentions and efforts by Sebi, RTA, companies and IEPFA to simplify the process to reclaim shares entrusted with the IEPF, it is still cumbersome for a shareholder to complete it within the stipulated time. ”

In addition, shareholders have to coordinate with the RTA, the company and IEPF for reclaiming the shares, which takes time. With the case now in the apex court, people working in this field believe the pace will improve and more cases would be resolved.