Phreesia, Inc. (NYSE:PHR) posted mixed results for the second quarter on Thursday.

The company posted quarterly earnings of 1 cent per share, compared to market estimates of a loss of 6 cents per share. The company's quarterly sales came in at $117.255 million versus expectations of $116.526 million.

Phreesia affirmed FY2026 sales guidance of $472.000 million-$482.000 million, versus market estimates of $477.148 million.

“I am proud to share that Phreesia has had many noteworthy developments over the past quarter. In addition to delivering another solid set of financial results, including achieving our first-ever net income positive quarter, we have expanded our reach and capabilities, positioning us well for the future. I am also excited to share that we entered into a definitive agreement to acquire AccessOne, a market leader in providing financing solutions for healthcare receivables. Please refer to the AccessOne press release published earlier today for additional details,” said CEO and Co-Founder Chaim Indig.

Phreesia shares fell 8.5% to trade at $28.59 on Friday.

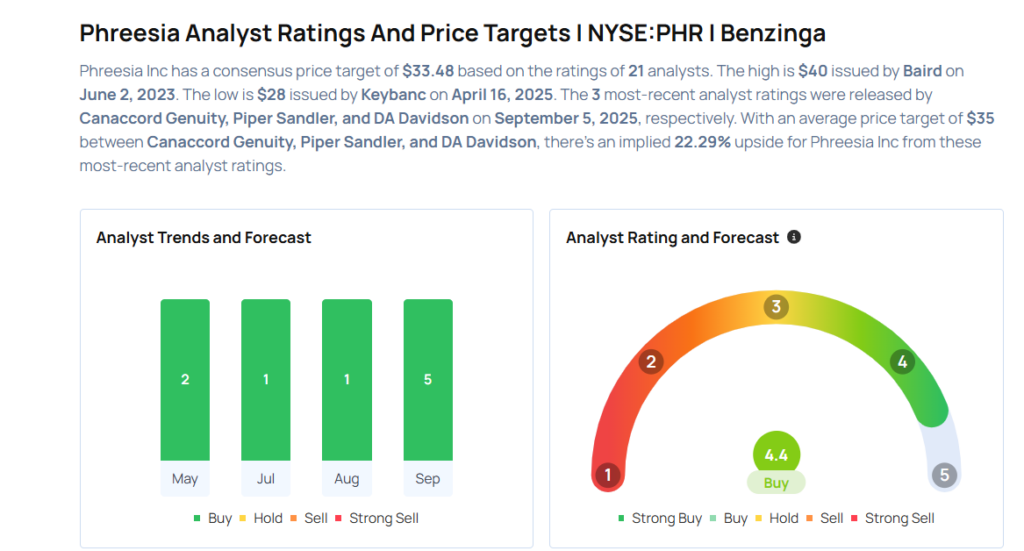

These analysts made changes to their price targets on Phreesia following earnings announcement.

- Needham analyst Ryan MacDonald maintained Phreesia with a Buy and raised the price target from $29 to $35.

- Piper Sandler analyst Jessica Tassan maintained the stock with an Overweight rating and raised the price target from $33 to $34.

- Canaccord Genuity analyst Richard Close maintained Phreesia with a Buy and raised the price target from $34 to $38.

Considering buying PHR stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock