Valued at a market cap of $250.4 billion, Philip Morris International Inc. (PM) is a leading multinational tobacco company headquartered in Stamford, Connecticut, with operations spanning over 180 countries. The company is best known for owning and marketing some of the world’s most recognized cigarette and smoke-free product brands, including Marlboro, the world’s top-selling international cigarette brand.

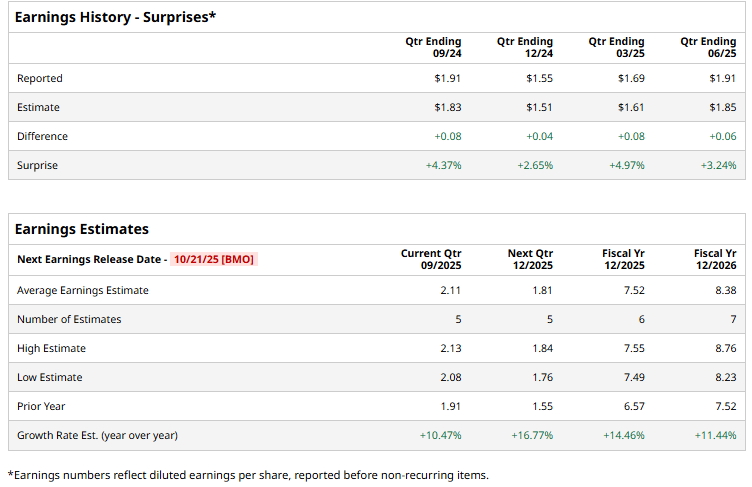

The company is expected to announce its fiscal Q3 2025 earnings results before the market opens on Tuesday, Oct. 21. Ahead of this event, analysts expect Philip Morris to report an adjusted EPS of $2.11, up 10.5% from $1.91 in the year-ago quarter. The company has consistently surpassed Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts expect the Marlboro maker to report an adjusted EPS of $7.52, up 14.5% from $6.57 in fiscal 2024.

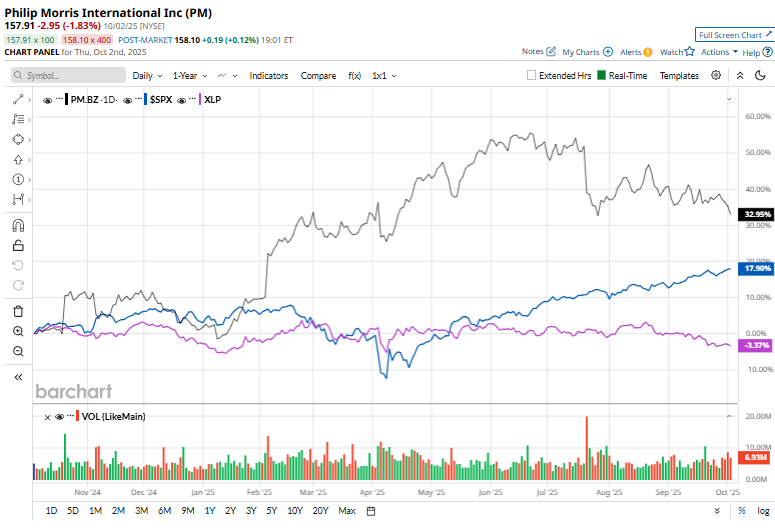

Shares of Philip Morris have jumped 32% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 17.6% rise and the Consumer Staples Select Sector SPDR Fund’s (XLP) 5% decline over the same period.

Contrasting its robust momentum, shares of PM plunged 8.4% after its Q2 earnings release on Jul. 22. The company’s net revenue of $10.1 billion grew 7.1% from the prior-year quarter, with total shipment volumes up 1.2%. However, the top-line figure fell short of the consensus estimates, which might have lowered investor confidence. Nonetheless, on the brighter side, its adjusted EPS of $1.91 managed to surpass the analyst estimates of $1.85 and surged by an impressive 20.1% year-over-year.

Analysts' consensus view on Philip Morris’ stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 15 analysts covering the stock, nine recommend "Strong Buy," two suggest "Moderate Buy," and four advise "Hold." Its average analyst price target of $193.77 indicates an upswing potential of 22.7% from the current market prices,