Investor Martin Shkreli, popularly known as “Pharma Bro,” pushed back against criticism on this recent short position on iBuying platform Opendoor Technologies Inc. (NASDAQ:OPEN), which is rallying amid the Federal Reserve’s rate cuts on Wednesday.

OPEN shares are climbing with conviction. Check the market position here.

Opendoor Surges Amid Rate Cuts

“DO NOT make fun of me if one of the investment positions I am in is not going in my favor. That is inappropriate,” Shrekli said on X, as Opendoor’s shares rallied 14.46% on Wednesday, and 34.61% so far this week. This comes amid the Federal Reserve’s 25 bps rate cut to 4.00%-4.25%, ending a nine-month pause to the current easing cycle.

See Also: Opendoor Is A ‘Stock That Could Be The Amazon Of Housing’: Eric Jackson

On Tuesday, Shkreli confirmed that he had shorted Opendoor shares at $9.36 per share, marking his first trade in the iBuying company.

Shkreli declared his intention to launch a due diligence campaign against the firm early this week, saying, “I will be doing diligence calls with former employees, customers, competitors, and hopefully, management too! I will send invites to the calls or anonymous transcripts as appropriate.”

An ‘Obvious Short’ And ‘Fundamentally Broken’

Shkreli has been a vocal critic of Opendoor in recent weeks, having called it “an obvious short,” while saying that anyone long on the stock “should never invest again.”

Last week, Shkreli acknowledged the appointment of Kaz Nejatian as the company’s new CEO as a “big win,” while reiterating his stance that the business was “fundamentally broken,” and that he was unsure about how it could be turned around.

Short Interest Remains High, But Technicals Indicate A ‘Buy’

Opendoor’s short interest currently stands at 26.6% of total outstanding shares, according to data from Benzinga Pro. This is relatively high relative to 2.3% of float for a median S&P 500 stock.

The stock’s relative strength index or RSI indicator stands at 59.124, which indicates a “Buy,” meaning that the stock has moderate upward momentum.

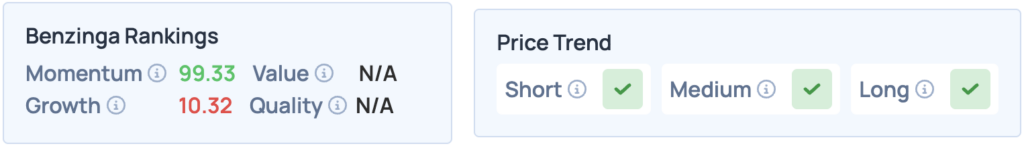

Shares of Opendoor were up 14.46% on Wednesday, closing at $10.21, and are up another 1.18% after hours. The stock scores high on Momentum in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Photo: PJ McDonnell from Shutterstock

Read More: