Valued at a market cap of $44 billion, PG&E Corporation (PCG) sells and delivers electricity and natural gas to customers in northern and central California. The Oakland, California-based company generates electricity using nuclear, hydroelectric, fossil fuel-fired, fuel cell, and photovoltaic sources. It is expected to announce its fiscal Q1 earnings for 2025 before the market opens on Thursday, Apr. 24.

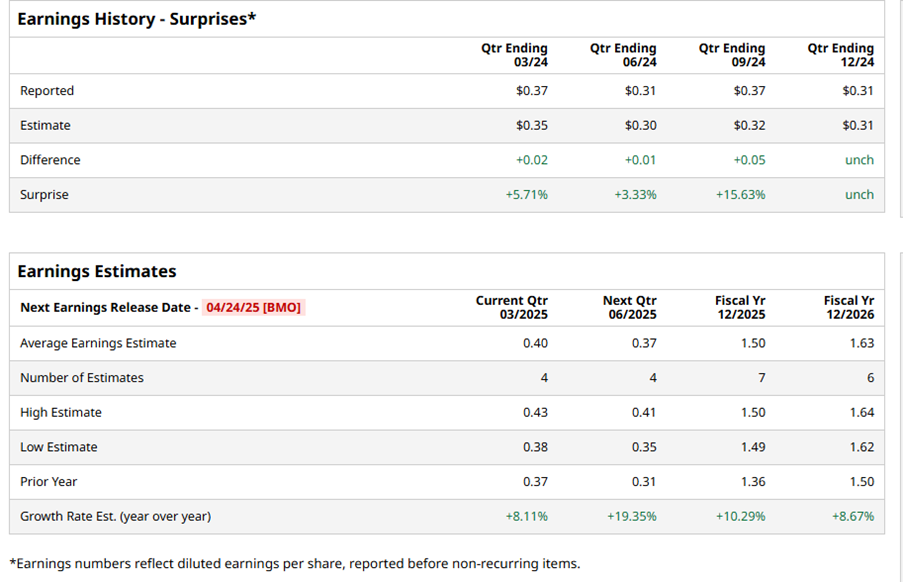

Ahead of this event, analysts expect this utility company to report a profit of $0.40 per share, up 8.1% from $0.37 per share in the year-ago quarter. The company has met or surpassed Wall Street's earnings estimates in each of the last four quarters. In Q4 2024, PCG’s EPS of $0.31 met the consensus estimates.

For fiscal 2025, analysts expect PCG to report a profit of $1.50 per share, up 10.3% from $1.36 in fiscal 2024. Furthermore, its EPS is expected to grow 8.7% year over year to $1.63 in fiscal 2026.

Shares of PCG have declined 1.5% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 2.1% rise, and the Utilities Select Sector SPDR Fund’s (XLU) 16.3% uptick over the same time frame.

PCG’s shares closed down 1.1% after its Q4 earnings release on Feb. 13. Its core earnings of $0.31 per share came in-line with the consensus estimates. Adding to the positives, the company raised its fiscal 2025 core EPS guidance in the range of $1.47 to $1.51. However, its Q4 core EPS fell 34% from the year-ago quarter and its full-year 2024 revenue of $24.4 billion marginally declined year-over-year due to lower natural gas sales. These factors might have dampened investor confidence.

Wall Street analysts are moderately optimistic about PCG’s stock, with a "Moderate Buy" rating overall. Among 16 analysts covering the stock, 11 recommend "Strong Buy," four suggest “Hold,” and one advises a “Strong Sell” rating. The mean price target for PCG is $20.67, which indicates a 25.5% potential upside from the current levels.