/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)

With a market cap of $138.2 billion, Pfizer Inc. (PFE) is a leading global biopharmaceutical company headquartered in New York City. Founded in 1849, Pfizer discovers, develops and manufactures medicines and vaccines across a broad range of therapeutic areas, including oncology, immunology, rare diseases, cardiology, endocrinology and vaccines.

Shares of this pharmaceutical giant have underperformed the broader market over the past year. PFE has declined 21% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 17.1%. In 2025, PFE stock is down 8.4%, compared to SPX’s 8.6% rise on a YTD basis.

Zooming in, PFE has also trailed the Invesco Pharmaceuticals ETF (PJP), which has fallen 2.7% over the past year and has surged 1.3% in 2025

On July 24, Pfizer announced a global (excluding China) licensing agreement with 3SBio for exclusive rights to develop, manufacture, and commercialize SSGJ-707, a bispecific antibody targeting PD-1 and VEGF. The deal strengthens Pfizer’s oncology pipeline and reinforces its position in innovative cancer research. However, its shares dropped 2.2% in the next trading session amid macroeconomic headwinds.

For the current fiscal year, ending in December, analysts expect PFE’s EPS to decline 1.3% year over year to $3.07 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

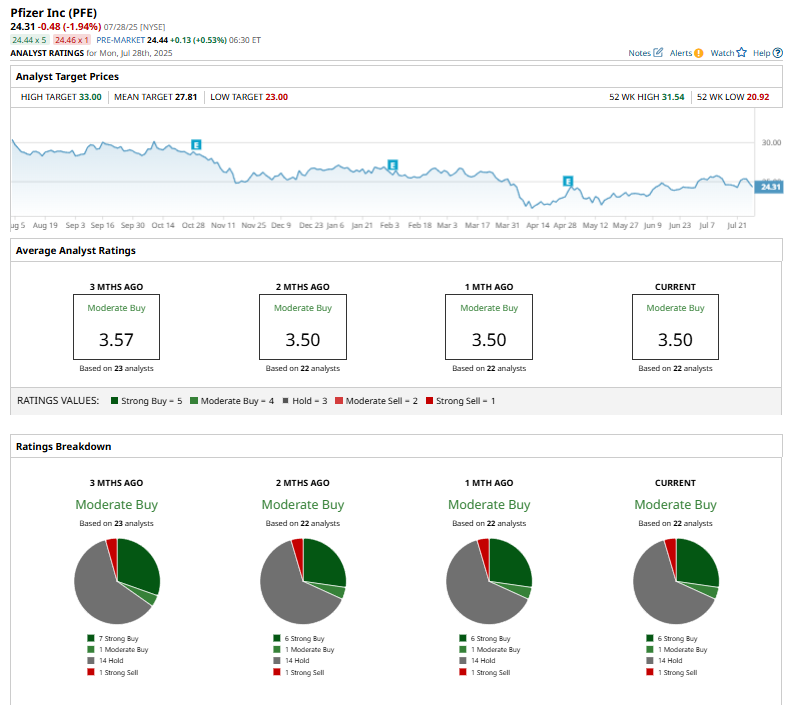

Among the 22 analysts covering PFE stock, the consensus is a “Moderate Buy.” That’s based on six “Strong Buy” ratings, one “Moderate Buy,” 14 “Holds,” and one “Strong Sell.”

This configuration is less bullish than three months ago, when seven analysts suggested a “Strong Buy.”

On April 30, UBS Group AG (UBS) analyst Trung Huynh raised Pfizer’s price target from $24 to $25 while maintaining a “Neutral” rating. Despite mixed revenue performance, the analyst highlighted Pfizer’s significant cost savings as a positive factor.

The mean price target of $27.81 represents a 14.4% premium to PFE’s current price levels. The Street-high price target of $33 suggests an ambitious upside potential of 35.7%.