/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)

With a market cap of $139.4 billion, Pfizer Inc. (PFE) is a global biopharmaceutical company headquartered in New York, known for developing and manufacturing medicines and vaccines across areas such as oncology, immunology, and infectious diseases. Its key products include Comirnaty, Paxlovid, Eliquis, and Ibrance.

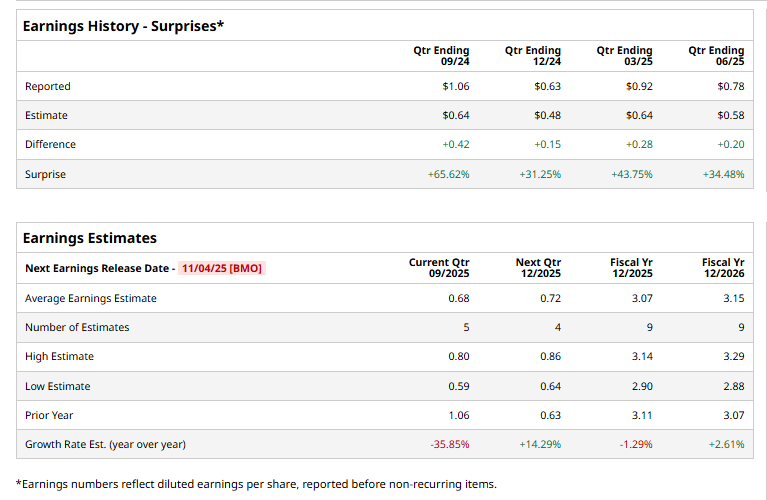

The pharma titan is slated to announce its fiscal Q3 2025 results before the market opens on Tuesday, Nov. 4. Ahead of the event, analysts predict Pfizer to report an adjusted EPS of $0.68, down 35.9% from $1.06 in the year-ago quarter. However, the company has surpassed Wall Street's bottom-line estimates in the past four quarterly reports.

For fiscal 2025, analysts expect the drugmaker to report adjusted EPS of $3.07, down 1.3% from $3.11 in fiscal 2024. Nevertheless, adjusted EPS is anticipated to grow 2.6% year-over-year to $3.15 in fiscal 2026.

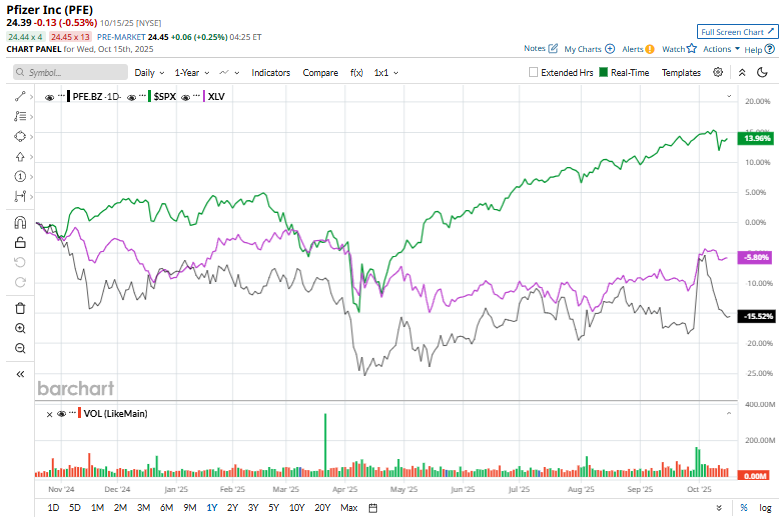

Shares of Pfizer have dropped 8.2% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 11.9% rise and the Health Care Select Sector SPDR Fund's (XLV) 7.1% decrease over the same period.

On Oct. 6, Pfizer shares surged 7.2% after the company announced a landmark agreement with the U.S. government to lower prescription drug prices. The deal includes ‘most-favored-nation’ pricing for Medicaid, 50% average discounts through a government website, and a $70 billion investment in U.S. research and manufacturing, providing a three-year tariff grace period and easing policy uncertainty for the pharmaceutical sector.

Analysts' consensus rating on Pfizer stock is moderately optimistic, with a "Moderate Buy" rating overall. Among 24 analysts covering the stock, six recommend a "Strong Buy,” one has a "Moderate Buy" rating, 16 give a "Hold" rating, and one suggests a "Strong Sell.” The stock’s mean price target of $28.48 implies an upswing of 16.8% from the prevailing price levels.