Pfizer Inc. (NYSE:PFE) stock climbed 1.54% in Monday pre-market amid reports that the company on the verge of acquiring Metsera Inc. (NASDAQ:MTSR), a developer of anti-obesity drugs.

Pfizer Nears $7.3Billion Deal to Acquire Metsera's Weight-Loss Drug

Pfizer is in the final stages of a deal to purchase Metsera, offering $47.50 in cash per share and an additional $22.50 if specific performance targets are achieved, as reported by Financial Times. This would value Metsera at up to $7.3 billion, making it the largest acquisition of an experimental weight-loss treatment by a major pharmaceutical company.

The acquisition could be announced as early as Monday, pending any last-minute complications. The deal would provide Pfizer with an experimental drug, MET-097i, which could potentially compete in the development of the next generation of anti-obesity drugs. This would be a significant opportunity for Pfizer after its in-house obesity treatment, danuglipron, failed in clinical trials earlier this year.

Metsera, a newly public company, is developing next-generation weight-loss treatments to compete with Eli Lilly‘s (NYSE:LLY) Zepbound and Novo Nordisk‘s (NYSE:NVO) Wegovy, which have been associated with side effects like muscle loss.

Metsera Deal Aims to Boost Growth Amid Vaccine Woes

This acquisition comes at a critical time for Pfizer, which has recently faced challenges in the vaccine market. Earlier this month, Pfizer’s shares fell following a report that linked COVID-19 vaccines to child deaths, causing alarm among scientists.

However, Pfizer also reported positive results for its LP.8.1-adapted monovalent COMIRNATY (2025-2026 Formula) in high-risk adults in the same month. The vaccine generated a ≥4-fold increase in neutralizing antibodies against the LP.8.1 sublineage within 14 days.

Pfizer's acquisition of Metsera, including potential milestone payments, would be the largest by a major drugmaker for an experimental weight-loss drug, with analysts estimating the obesity drug market could reach $95 billion annually at peak sales, as per Financial Times.

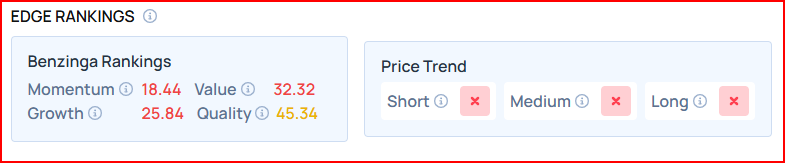

According to Benzinga Edge Stock Rankings, Pfizer has a growth score of 25.84% and a momentum rating of 18.44%. Click here to see how it compares to other leading healthcare companies.

READ NEXT:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.