/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)

Pfizer, Inc. (PFE) stock is incredibly cheap following management's raise of its 2025 adjusted earnings per share guidance. It's at just over 8x this year's estimates and 7.8x next year. That's too cheap. Shorting out-of-the-money (OTM) put options works here.

PFE is at $24.59 today, up slightly from before its Aug. 5 earnings release. I discussed how statistically cheap PFE was in my July 29 Barchart article ("Pfizer Stock Is a Value Play Ahead of Earnings - Investors Can Short PFE Puts for Income").

I set the price target at $34.41, +42% at the time, based on an average of its historical P/E multiples, dividend yield averages, and analysts' price targets. The updated price target is $33.58, providing at least a +36% potential upside in PFE stock.

Pfizer Raises Its Guidance and Analysts Up Their Targets

Pfizer's Q2 revenue came in +8.3% stronger than expected, according to Seeking Alpha, and adjusted earnings per share (EPS) were 21 cents higher than expected at $0.78.

Those surprises help push up PFE stock after earnings. It could have further to go based on management's earnings guidance.

Pfizer said it now expects adj. EPS to be 10 cents higher in 2025, between $2.90 and $3.10. As a result, analysts have now raised their 2025 estimates to $3.05 per share, up from $3.30 from prior (see my Barchart article last week). That means its 2025 forward price/earnings (P/E) multiple is just 8.06x.

And for 2026, they have raised their EPS estimates to $3.13 per share (up from $3.08 beforehand), putting PFE stock on a forward multiple of just 7.86x.

Target Prices

P/E Target Prices. But the average multiple for the past 5 years has been 10.75x, according to Seeking Alpha, and 10.12x, according to Morningstar, for an average of 10.435x:

$3.09 (average 2025 and 2025 EPS estimates) x 10.435 = $32.24 target price

Dividend Yield Target Prices. Moreover, using its historical dividend yield average of 4.68%, Pfizer's annual $1.72 dividend per share (SPS) makes PFE stock worth:

$1.72 DPS / 0.0468 = $36.75 target price

However, over the next 12 months, Pfizer will likely raise its DPS, as it has done over the past 14 years. Assuming the DPS rises 5% to $1.81, the target price over the next 12 months is:

$1.81 NTM DPS / 0.0468 = $38.68

Analyst Target Prices. Lastly, analysts have raised their prices. Yahoo! Finance now reports that the average of 24 analysts is $28.86, up from $28.67. Other surveys show $28.00 (Barchart), $29.75 (Stock Analysis), and $32.66 (AnaChart.com).

The average of these analyst surveys is $29.82, up from $29.65 last week.

As a result, the average of these three methods is $33.58. That represents a potential upside of +36.6% from today's price.

One way to play this, as I showed in the July 29 Barchart article, is to sell short out-of-the-money puts. That way, an investor can set a lower potential buy-in price and also get paid.

Shorting OTM PFE Puts for Income

I previously suggested selling short the $23.00 put strike price put option that expires on Aug. 29, i.e., 31 days to expiry (DTE). At the time, this strike price was just about 5% below the trading price and had a midpoint premium of 26 cents.

That provided the short seller a one-month DTE yield of 1.13% (i.e., $0.26/$23.00). Today, those puts are trading for just 6 cents at the midpoint, so most of the yield has been made, even though there are still 17 days left to expiry. In other words, the trade has been successful.

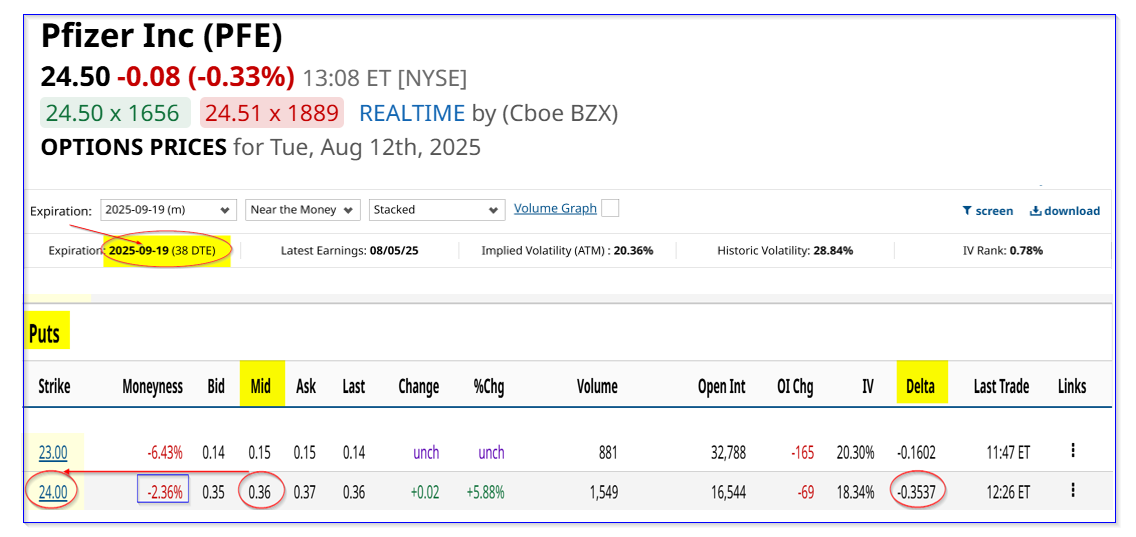

So, it makes sense to roll this play over to a later date. For example, the Sept. 19 PFE put option at the $24.00 strike price has a midpoint price of 36 cents.

That provides a new short-seller of these puts an immediate yield of 1.50% (i.e., $0.36/$24.00). That, however, has a very high chance of being assigned as the strike price is only 2.35% below the trading price (note the delta ratio is high at 35%).

Combining this trade with a $23.00 strike price short-put play provides an average yield of 1.085% with an average $23.50 strike price:

$51/$4,700 collateral = 0.0185 = 1.085% or, $0.51/2 = $.255 per contract/ $23.50 = 0.01085 = 1.085%

That also provides a lower break-even point of $23.50-$0.255, or $23.245, which is 5.1% below today's trading price.

The point is that this is a way to set a lower buy-in point for new investors in PFE and to get paid while waiting. For existing PFE shareholders, it also provides a way to make extra income and a potential lower dollar-average cost opportunity.

The bottom line is that PFE stock is very cheap here. Shorting OTM puts is a conservative way to play the stock.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.