Pfizer (PFE Get Pfizer Inc. Report shares hit an all-time high of $51.86 on Aug. 18, and it’s been downhill since.

Quite literally, actually.

The day Pfizer hit that high, the shares reversed and closed lower by 2.2% in the session. That was the start of three straight declines.

On the fourth day, Pfizer stock pushed higher, but again reversed. In the process, it set a lower high, topping out at $51.36.

Since then the stock has fallen in 11 of the past 14 sessions. With the shares flat on Tuesday so far, it might become 12 of the past 15 sessions.

That’s even as Moderna (MRNA Get Moderna, Inc. Report continues to burst to the upside, threatening to run to $500 or higher.

It’s also as the vaccines could get approved for children in the next few weeks. That’s along with the possibility that Pfizer gets its vaccine approved for a booster shot.

Is the recent rut an opportunity?

Trading Pfizer Stock

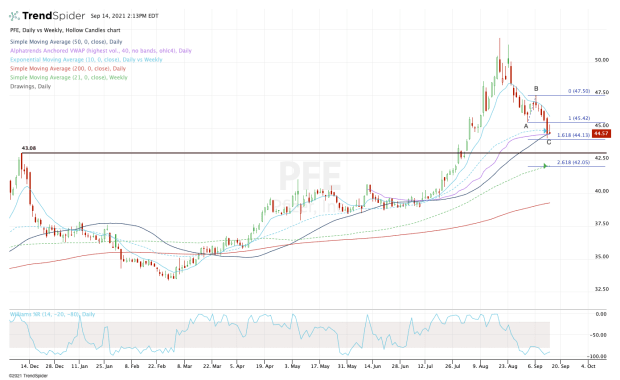

Chart courtesy of TrendSpider.com

Pfizer has not been trading like Moderna. Is it because Moderna’s vaccine creates more antibodies? Or is it because Pfizer is a much bigger company and the vaccine moves the needle less (and thus more for Moderna)?

Likely the latter, but when it comes to the chart, the technicals matter more. Right now, Moderna is in a bullish trend and Pfizer is pulling back.

If Pfizer closes lower today, it will mark the stock’s seventh straight decline. But we’re also at a key area on the charts.

Following an “ABC” correction, Pfizer stock is dipping into the 10-week and 50-day moving averages, as well as the daily VWAP measure.

Further, this week’s low is very close to the 161.8% downside extension of the current correction.

Should the shares bounce, I want to see Pfizer clear $45.42, then the 10-day moving average. That could put $47.50-plus in play, provided Pfizer can also clear the 21-day moving average.

If support doesn’t come into play or Pfizer can muster only a small relief rally, we could see further downside to the $42 to $43 area.

The $43 level was an important breakout zone for Pfizer, while the 21-week moving average and the 261.8% downside extension both come into play near $42.