Bitcoin’s (CRYPTO: BTC) ongoing struggles have brought renewed attention to comments made last year by Palantir Technologies co-founder Peter Thiel, who predicted that the leading cryptocurrency was unlikely to see a dramatic surge.

Bitcoin Failed To Meet Thiel’s Expectations

During a CNBC interview in June last year, Thiel said he was fascinated by the idea of a “decentralized future of computing” and that Bitcoin remained the “perfect vehicle” for that for a long time.

“I am much less convinced now,” he added. “I'm not sure it's going to go up that dramatically from here.”

Thiel Predicted A Volatile, Bumpy Ride For BTC

Thiel, who also co-founded payments giant PayPal and the Founders Fund, felt that the apex cryptocurrency has been “co-opted” by organizations such as BlackRock.

He argued that Bitcoin hasn't fulfilled its vision as a cypherpunk, crypto-anarchist and anti-establishment freedom tool, instead integrating more with traditional finance with the launch of spot exchange-traded funds.

“We got the ETF edition, and I don't know who else buys it," he said. “It probably can go up some, but it’s going to be a volatile, bumpy ride.”

Founders Fund, a venture capital firm founded by Thiel, has had a significant history with Bitcoin. The fund made $1.8 billion through Bitcoin investments just before the market collapsed in 2022. It then purchased another $100 million in Bitcoin in 2023, when it was trading below $30,000.

See Also: Bitcoin Bear Market Bottom Could Arrive In October 2026, Analyst Warns

Was Thiel’s Prediction Prescient?

Nearly seventeen months later, the forecast turns out to be relevant. Bitcoin crashed below $100,000, a sharp reversal from its all-time highs of $126,198.07 only a month ago. Several financial analysts declared that the apex cryptocurrency has officially entered a bear market.

BlackRock's iShares Bitcoin Trust ETF (NASDAQ:IBIT) saw outflows exceeding $400 million last week and around $560 million so far this week, as of Nov. 5, according to So So Value.

Price Action: At the time of writing, BTC was exchanging hands at $103,047.65, up 6.02% in the last 24 hours, according to data from Benzinga Pro.

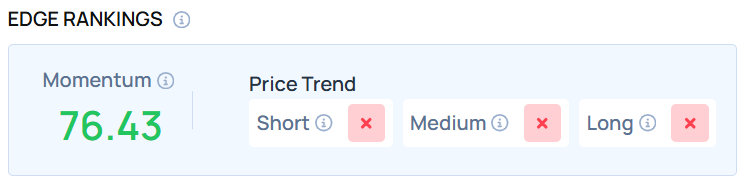

As of this writing, the IBIT ETF maintains a weaker price trend over the short, medium and long term, with a decent Momentum ranking. Visit Benzinga Edge Stock Rankings to find out more about the stock.

Photo: Mark Reinstein On Shutterstock.com

Read Next: