Economist Peter Schiff is calling out President Donald Trump’s newly announced trade deal with Vietnam, warning that American consumers are likely to bear the brunt of the agreement.

What Happened: On Thursday, in a post on X, Schiff criticized the deal, saying that it gives Vietnamese consumers an upper hand while leaving American shoppers worse off.

Schiff didn't hold back when declaring “Americans are losers and Vietnamese are winners” under the new trade deal, saying that U.S. consumers will end up paying more for Vietnamese imports, while buyers in Vietnam gain cheaper access to American goods.

He says this about consumers in both nations, “relative to their positions under Biden,” which essentially means to say that Americans are worse off, while the Vietnamese are better off than they were last year, as a result of this deal.

Here, Schiff is referring to the terms of the new agreement, according to which the U.S. will charge 20% on all imports from Vietnam, while the latter will not charge anything on American imports.

The U.S. will also be imposing a steeper 40% tariff on goods that pass through Vietnam, a process known as trans-shipment. This move is aimed at tackling Chinese goods that flow through Vietnam, while sporting the label “Made In Vietnam,” according to a report by Reuters.

Why It Matters: Schiff has been a vocal critic of Trump’s tariff regime over the past couple of months, referring to them as a “self-inflicted wound,” especially the ones that were imposed on steel and aluminum imports.

Nearly two months ago, footwear giants Adidas AG (OTC:ADDYY) and Nike Inc. (NYSE:NKE), among several others, had called the tariffs an “existential threat,” given their reliance on countries such as China, Vietnam, and Cambodia for sourcing.

On Wednesday, following the announcement of the trade deal with Vietnam, shares of Nike surged 4.06%, alongside other apparel stocks such as Under Armour Inc. (NYSE:UAA) and RH (NYSE:RH), up by 1.83% and 3.43%, respectively.

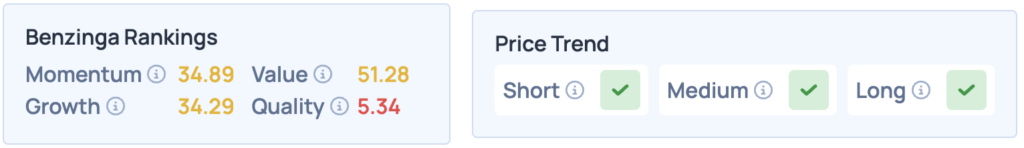

While Nike shares score poorly on Benzinga’s Edge Stock Rankings, they have a favorable price trend in the short, medium and long terms. Click here for more insights on how it compares with peers and competitors such as Adidas, Under Armour and Lululemon Athletic Inc. (NASDAQ:LULU).

Read More:

Photo courtesy: Maxim Elramsisy / Shutterstock.com