Shares of Petco Health and Wellness Company Inc (NASDAQ:WOOF) are trading higher Friday morning after the company posted a surprise second-quarter profit that overshadowed a slight miss on revenue. The strong bottom-line results prompted the company to raise its full-year earnings outlook.

What To Know: After the market closed on Thursday, the pet wellness retailer reported earnings of 5 cents per share for the second quarter. This result beat the consensus analyst estimate, of a loss of 1 cent per share.

While the earnings beat fueled investor optimism, Petco’s top-line figures showed a modest decline. The company announced quarterly revenue of $1.48 billion, a 2.3% decrease year-over-year and just shy of the $1.49 billion expected by Wall Street. Comparable sales also decreased by 1.4% over the same period.

Despite the lower sales, Petco demonstrated improved profitability. Gross profit margin expanded by 120 basis points to 39.3%, and adjusted EBITDA increased to $113.9 million. Based on this performance, Petco maintained its full-year sales forecast while raising its earnings guidance.

In reaction to the report, analysts at Baird maintained a Neutral rating on Petco stock but increased their price target to $4.

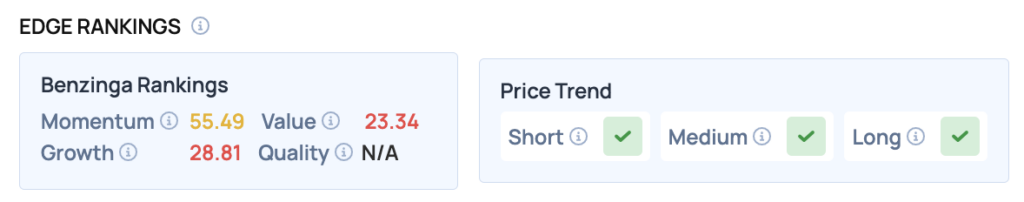

Benzinga Edge Rankings: According to Benzinga Edge stock rankings, WOOF has a moderate Momentum score of 55.49 but scores low for both Value and Growth.

Price Action: According to data from Benzinga Pro, WOOF shares are trading higher by 22.1% to $3.94 Friday morning. The stock has a 52-week high of $6.29 and a 52-week low of $2.28.

Read Also: Fed’s Preferred Inflation Gauge Hits Highest Since February, Threatens Powell’s Rate Cut Bet

How To Buy WOOF Stock

By now you're likely curious about how to participate in the market for Petco Health and Wellness – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

In the case of Petco Health and Wellness, which is trading at $3.83 as of publishing time, $100 would buy you 26.11 shares of stock.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock