PepsiCo (PEP) shares opened comfortably in the green on Sept. 2 after activist investor Elliott Investment Management announced a $4 billion stake in the beverage giant.

According to the hedge fund manager, there’s tremendous value embedded in the iconic soft drink company waiting for an “appropriately ambitious turnaround plan” to unlock.

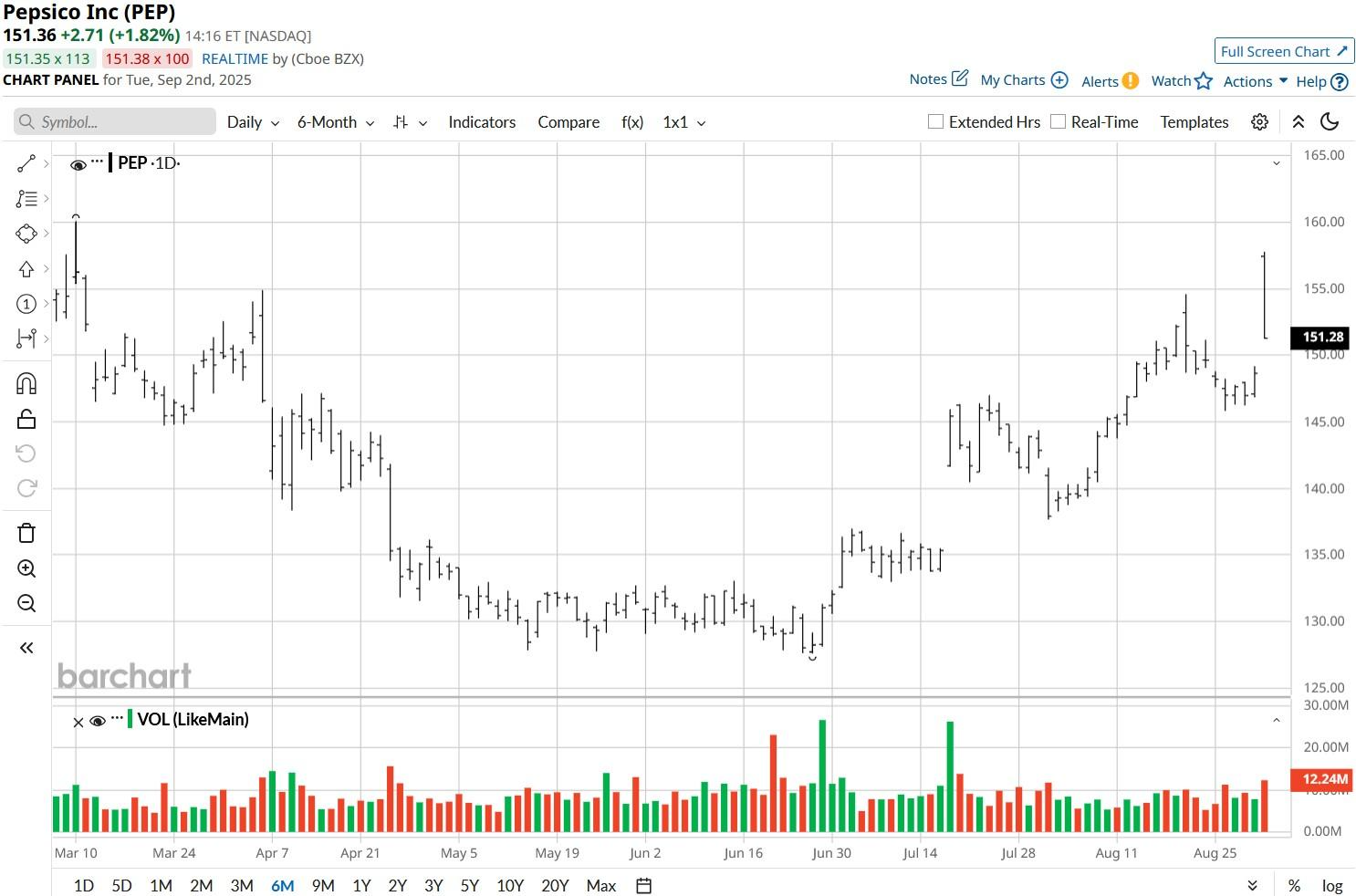

PepsiCo stock has rallied more than 15% over the past three months. Still, it is roughly flat in the year to date.

Is Elliott’s Stake a Positive for PepsiCo Stock?

Elliott Management brings a proven playbook of operational streamlining, strategic refranchising, and asset divestitures to PepsiCo.

Over time, its activist agenda focused on sharpening execution and unlocking brand value could unlock significant upside in PEP shares. In fact, the hedge fund manager itself projects up to a 50% gain.

Additionally, the firm’s involvement may boost investor confidence, attract institutional interest, and pressure management to accelerate reforms as well.

If executed well, the plan could reposition this Nasdaq-listed firm for strong growth and long-term shareholder returns. Note that PepsiCo stock also currently pays a healthy dividend yield of 3.76%.

Piper Sandler Remains Bullish on PEP Shares

Piper Sandler analyst Michael Lavery also sees potential for significant upside in PepsiCo shares.

The multinational is managing to keep its gross margin over 54% despite a cautious U.S. consumer, which warrants buying its shares in the second half of 2025, he told clients in a research note last week.

According to Lavery, the Nasdaq-listed firm’s renewed focus on “Muscle Milk” and commitment to innovation will yield results over time.

PEP’s recently increased stake in fitness and energy drinks specialist, Celsius Holdings (CELH), could also serve as a material catalyst. Note that Piper Sandler currently sees PEP stock hitting $160 over the next 12 months.

Wall Street Agrees with Piper Sandler on PepsiCo

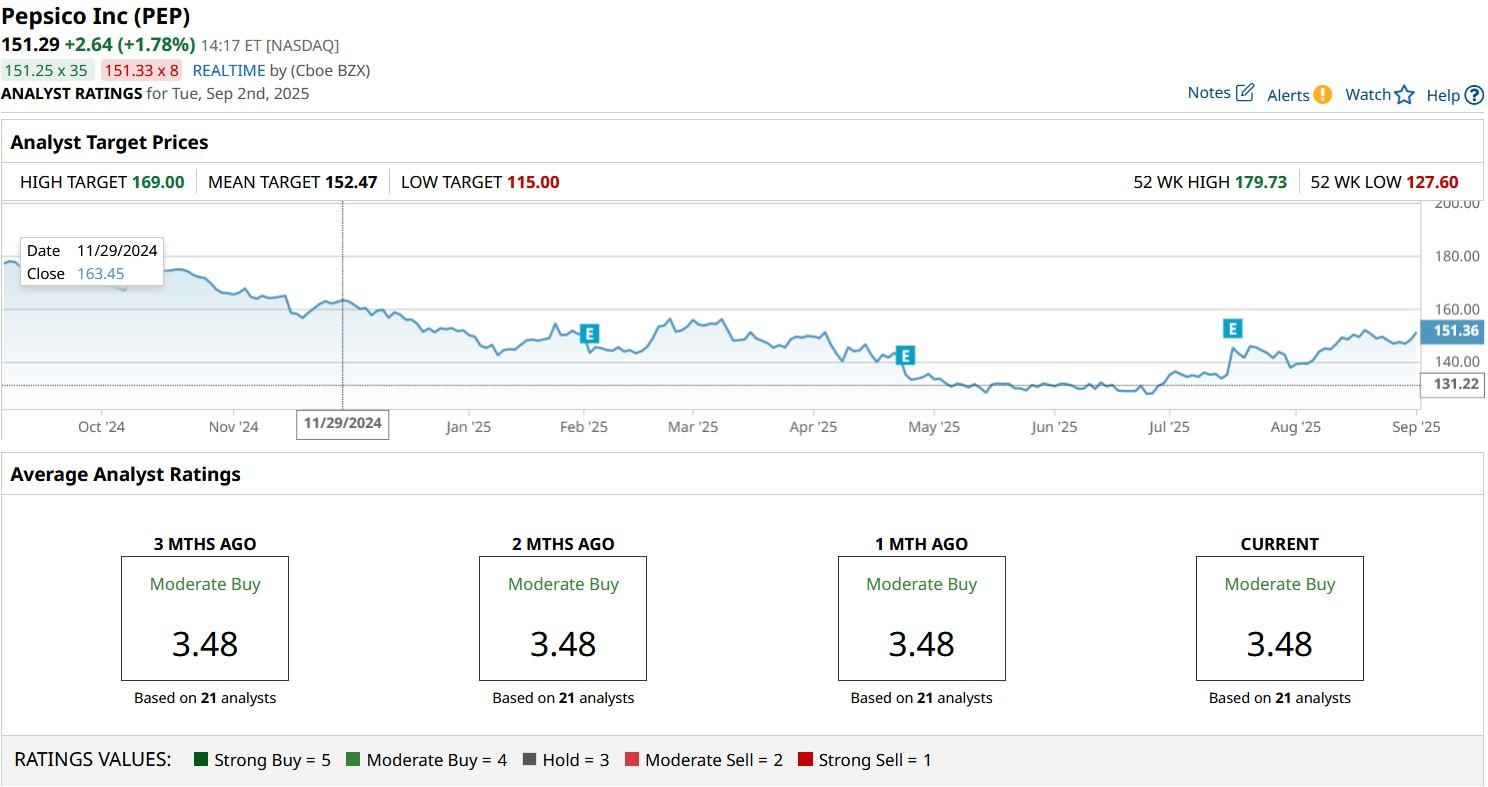

Other Wall Street analysts are keeping constructive on PepsiCo shares as well despite their recent underperformance.

The consensus rating on PEP stock currently sits at “Moderate Buy” with price objectives going as high $169, indicating potential upside of more than 10% from here.