A premium wine maker whose portfolio includes the prestigious Penfolds brand has plunged into the red after it was forced to swallow a one-off hit to its bottom line.

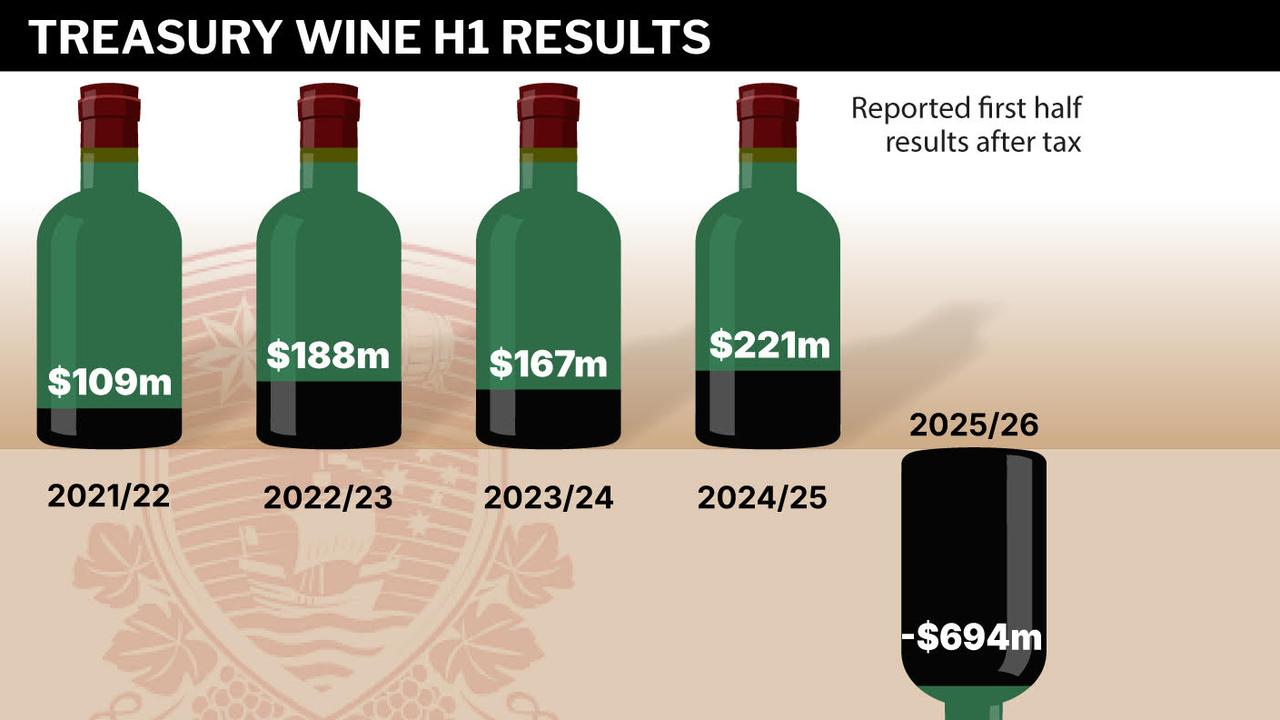

Treasury Wine Estates on Monday reported a first-half bottom-line net loss of $649.4 million, against a net profit of $220.9 million in the previous corresponding period.

The result reflected a post-tax loss of $751 million, due to a previously flagged impairment related to its US assets.

Stripping out that impact, its interim net profit was $128.5 million, down 46.3 per cent, generally reflecting tough market conditions and after it restricted shipments due to parallel import activity in China.

The listed company also scrapped its interim dividend and while it stressed the decision was temporary, it cautioned that the resumption was subject to financial performance. Last year, it paid 20 cents a share.

CEO Sam Fischer said the overall results reflected the actions it had to take to shore up its brands and sales channels as it targets cost savings of around $100 million a year.

"I'm full of optimism and energy around the progress we're making and the future we are shaping," he told analysts during a briefing.

"While we have work ahead of us to address some key specific areas, it is the underlying strength of our brands and wealth of opportunities in our markets that continues to excite me."

Treasury Wine's underlying result - earnings before interest, tax and the valuation of non-cash items such as its vineyards in Australia and the US - was at was $236.4 million just above its guidance, albeit a fall of almost 40 per cent.

Underlying earnings for its flagship Penfolds division were down by almost 20 per cent to $201 million while its Treasury Americas (California) and Collective (Australia, UK and US) arms posted relatively small profits of $44 million and $28 million respectively.

"Demand for the Penfolds brand remains strong and depletions continue to growth in China (up 17.2 per cent and Australia (up 3.5 per cent)," the group said.

Depletions refer to the volume of wine sold by distributors directly to the end-consumer, and is a measure of actual demand, as opposed to shipments.

Soft depletions mean consumers are purchasing less wine than anticipated, while growing depletions mean the opposite.

"Demand for the Penfolds brand remains strong across key markets ... Bin389 and 407 continue to perform well," Mr Fischer said.

Mr Fischer noted that with Chinese New Year celebrations getting underway, he expected to see good year-on-year growth for Penfolds products.

Treasury Wine booked sales of $1.3 billion for the first half, down 16 per cent on the prior corresponding period.

The group expects its second half underlying earnings for 20205/26 to be higher than the first half, supported by the Penfolds division and momentum in its California business.

The group's other high-profile wine brands include Wolf Blass, Wynns, Pepperjack, Squealing Pig, 19 Crimes and Matua.

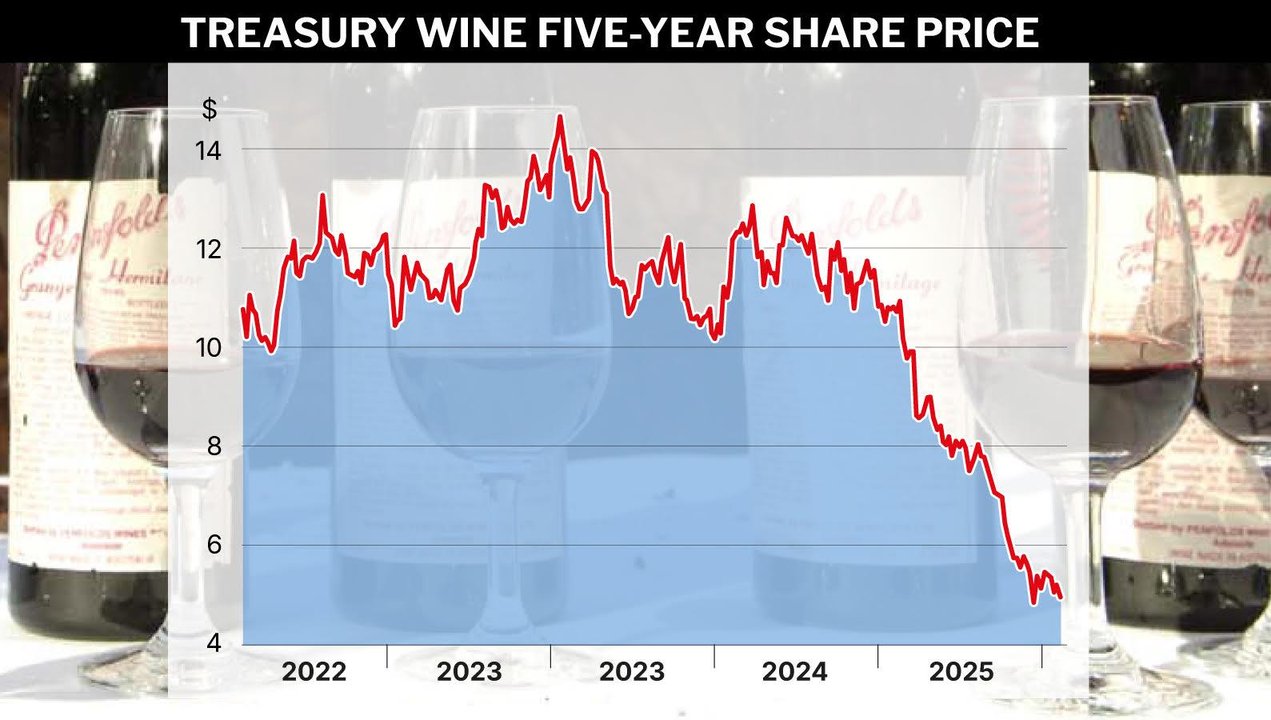

Treasury Wine shares on Monday closed down 5.2 per cent to a two-month low of $4.97.