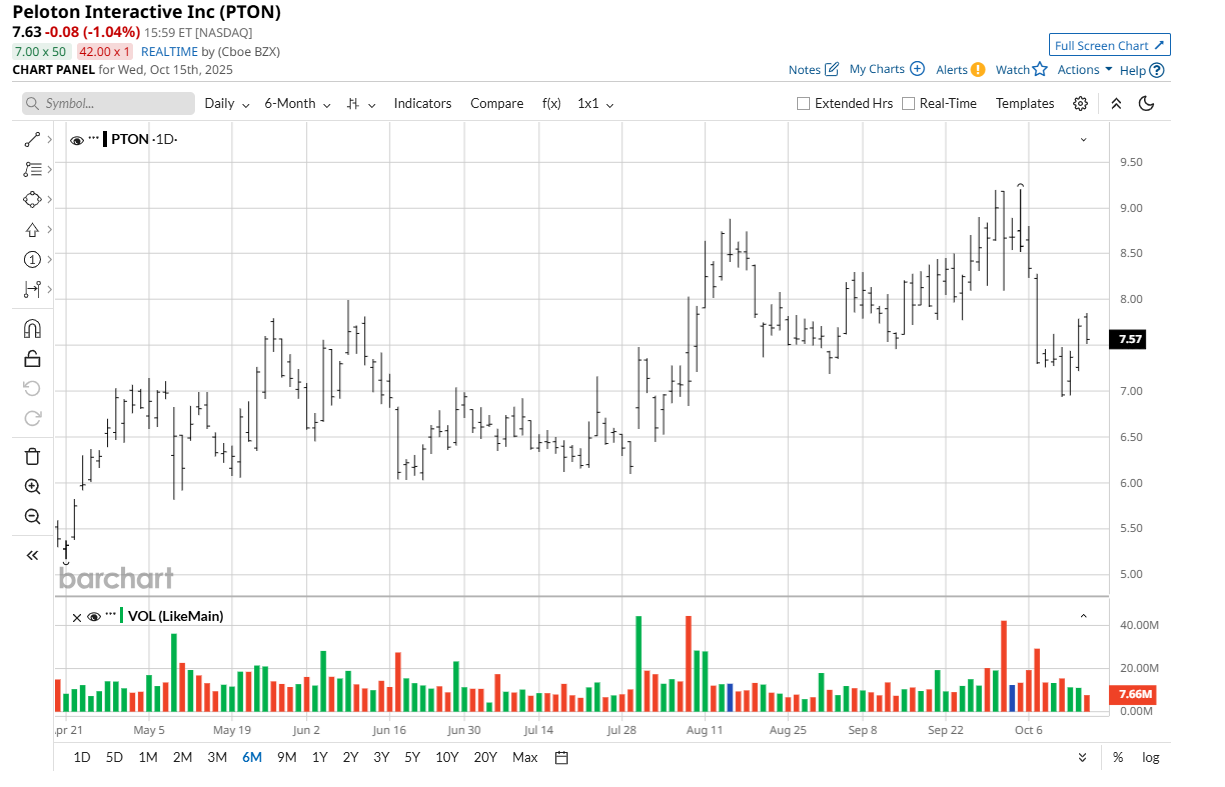

Down but not out, shares of Peloton (PTON) are attractive at current prices.

Granted, Peloton stock is down 95% from its peak in 2020, but it’s up about 66% from its April low of about $4.63. So, investors clearly like what they see with Peloton’s turnaround plan. Plus, the company managed to gain a bull at Goldman Sachs, which views PTON stock as a buy opportunity.

Now, in an effort to reignite sales growth, the connected exercise equipment company is revamping equipment, adding a new commercial unit, and raising subscription prices ahead of the 2025 holidays. In fact, Morgan Stanley believes that by raising prices, the company could rake in an additional $180 million in EBITDA.

It’s also introducing new bikes and AI-integrated software to help fuel sales growth and attract new customers with equipment designed to create personalized workouts.

Peloton’s Balance Sheet Is Showing Big Signs of Improvement

While we’ll have to wait and see how impactful those above changes will be, we’re also starting to see positive changes in PTON’s balance sheet.

For example, it just produced significant free cash flow of $324 million, which the company hasn’t seen for years. Plus, PTON just cut its net debt by 43%, showing that there are some signs of a turnaround here.

In its most recent quarter, the company posted EPS of $0.05, which beat by $0.12. Revenue of $606.9 million, down 5.7% year over year, still beat by $26.99 million.

It’s mostly positive news until you scroll down to its declining membership numbers.

Member numbers are down 6% year over year. Paid connected subscription numbers were also down 6%. However, I am encouraged by the jump in its gross margins, up 5% year over year.

Those declining numbers beg the question: Why is the company, which is desperately trying to expand its customer base, raising prices?

I’m not so sure. But let’s give the turnaround plan some time to play out – and we’ll come back to that question.

Moving forward, the company does expect to see revenue growth after a seasonally weak first quarter. It also expects to see further improvements in profits, gross margins, and in its free cash flow numbers. If PTON can slow the loss of memberships, and right the ship with newer offerings, PTON could see an impressive turnaround.

In fiscal 2026, the company also plans to cut its run-rate expenses by another $100 million. That’s on top of the $200 million it cut in FY2025. Some of the cuts will come from indirect costs, such as supplier contracts. Some will come from cutting its staff by 6%.

“Our operating expenses remain too high, which hinders our ability to invest in our future,” CEO Peter Stern said, as quoted by CNBC. “We are launching a cost restructuring plan intended to achieve at least $100 million of run-rate savings by the end of FY26 by reducing the size of our global team, paring back indirect spend, and relocating some of our work.

Right now, PTON is a speculative bet based on whether management can right the ship.

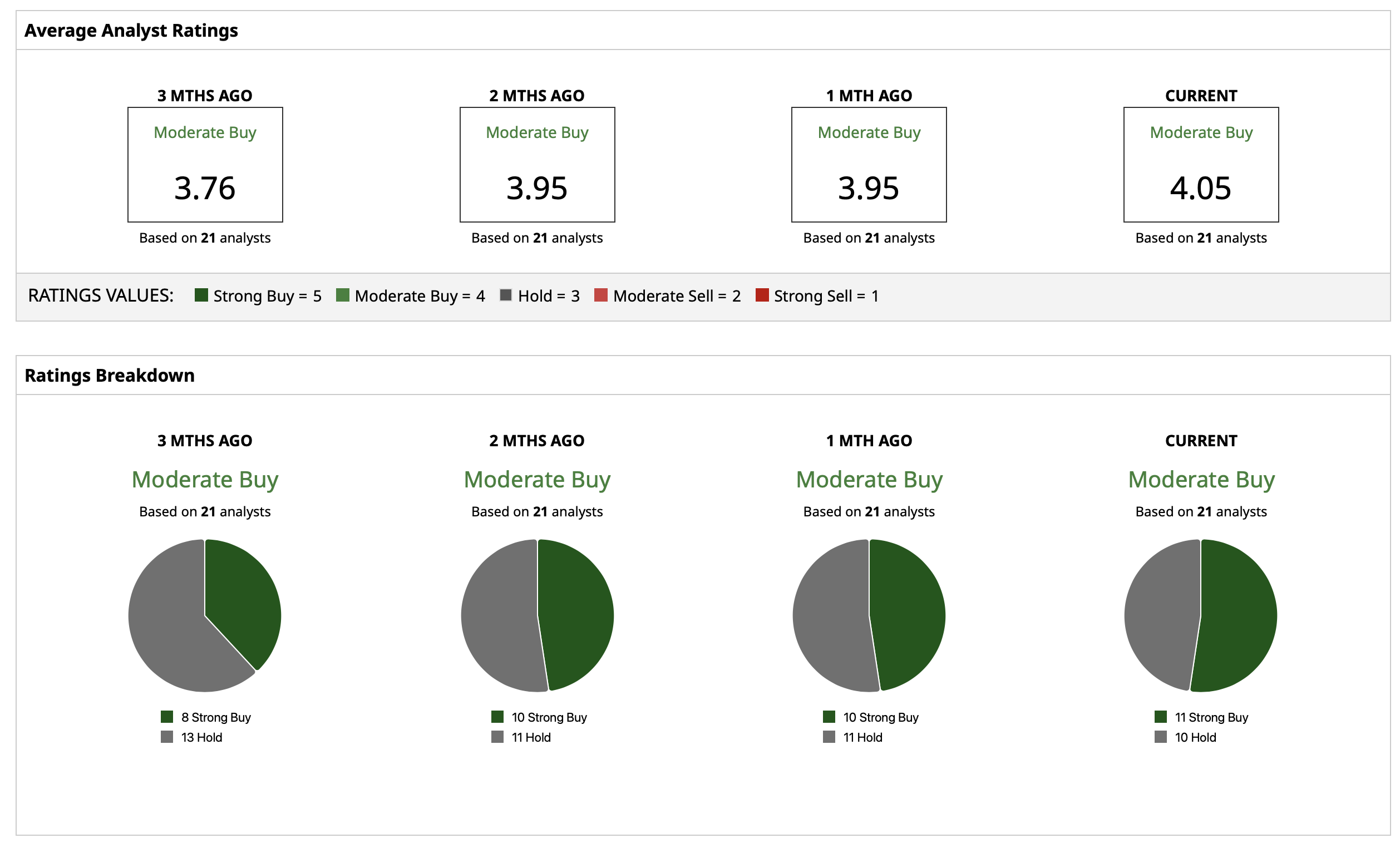

What Analysts Say About PTON Stock

PTON has a “Moderate Buy” rating and an average price target of $10.55, up 38% from its current share price. Price targets on PTON range from a low of $6 to a high of $20.