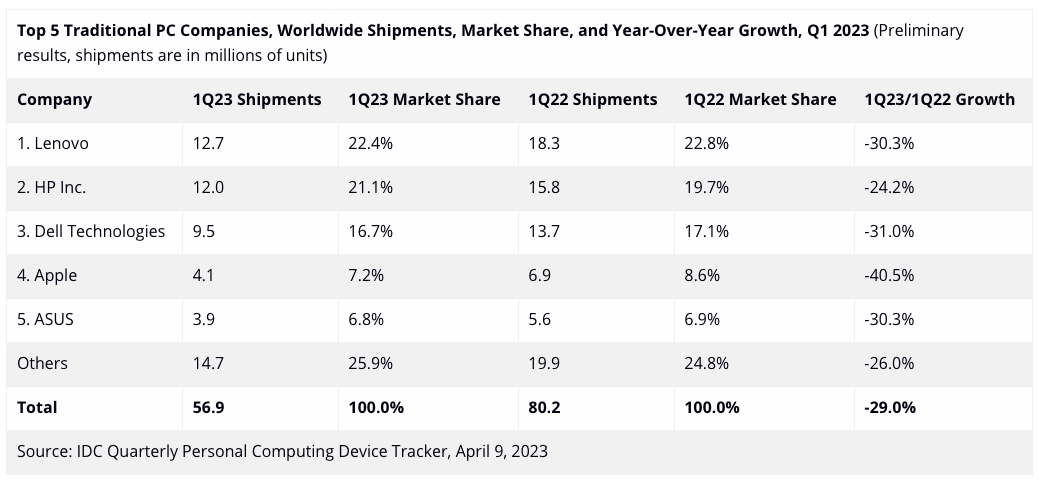

IDC reports that diminished demand, surplus stock, and a declining macroeconomic environment all played a role in the significant decline in traditional PC shipments in the first quarter of 2023. Shipments of PCs declined by 29% year-over-year, hurting all PC makers. Yet surprisingly, Apple was hurt the most.

Global PC shipments totaled 56.9 million, a 29% decrease compared to the same period in 2022, based on initial data from IDC. Analysts believe these results signify an end to the COVID-induced demand period and a temporary revert to pre-COVID trends. Shipments in Q1 2023 were substantially lower than the 59.2 million and 60.6 million units in Q1 2019 and Q1 2018, respectively.

While all PC makers lost sales in the first quarter, Apple was perhaps the biggest loser, with a 40.5% year-over-year decline. Apple's primary focus in recent years has been on its iPhones and services businesses, which could have diverted resources and attention away from its traditional PC lineup. Indeed, the company launched its M2 Pro and M2 Max-based laptops in early Q1 (a slow season typically) and never updated its desktop lineup that still features its M1-series system-on-chips from 2020.

Even though Apple's M1 may still offer great performance-per-watt and single-thread performance (given its eight-wide decoding architecture), it is now three years old, and those customers who wanted to get an M1-based PC have already obtained one.

As far as the whole PC market is concerned, the rankings did not change. The top five PC manufacturers by market share were Lenovo (23.9%), HP (21.5%), Dell (16.0%), Apple (7.5%), and Acer (6.4%).

"Though channel inventory has depleted in the last few months, it's still well above the healthy four to six week range," said Jitesh Ubrani, research manager for IDC's Mobility and Consumer Device Trackers. "Even with heavy discounting, channels and PC makers can expect elevated inventory to persist into the middle of the year and potentially into the third quarter."

IDC says that the stagnation in growth and demand allows supply chains to adapt as PC OEMs investigate manufacturing alternatives outside of China. Concurrently, PC manufacturers are adjusting their strategies for the rest of the year and placing orders for Chromebooks in anticipation of increased licensing fees later in the year. Nevertheless, short-term PC shipments will probably struggle, with a resurgence expected by year-end due to global economic improvements and users considering upgrading to Windows 11.

IDC notes other factors in the PC market's stagnation. Analysts believe that the stall allows supply chains to adapt as factories investigate manufacturing alternatives outside of China and adjust their strategies for the rest of the year.

Nevertheless, short-term PC shipments will probably struggle, with a resurgence expected by year-end due to global economic improvements and users considering upgrading to Windows 11, according to IDC.

"By 2024, the aging installed base will be due for a refresh," stated Linn Huang, research vice president, Devices and Displays at IDC. "If the economy is on an upward trajectory by then, we anticipate a significant market boost as consumers upgrade, schools replace worn Chromebooks, and businesses transition to Windows 11. However, if economic stagnation persists in key markets into next year, recovery may be a slow process."