/PayPal%20Holdings%20Inc%20logo%20and%20money-by%20Sergio%20Photone%20via%20Shutterstock.jpg)

Valued at $67.8 billion, PayPal Holdings (PYPL) is a fintech company that offers digital payment services to both individuals and businesses. PayPal connects buyers and sellers via a secure digital platform, allowing for quick, simple, and secure financial transactions, including cross-border transactions in over 200 countries and more than 25 currencies.

PayPal’s growth had slowed due to tight competition in the digital payment industry from Visa (V), Mastercard (MA), and Block (XYZ). However, under the leadership of CEO Alex Chriss, who took charge in 2023, the company is aggressively pursuing a diverse growth strategy that is already paying off.

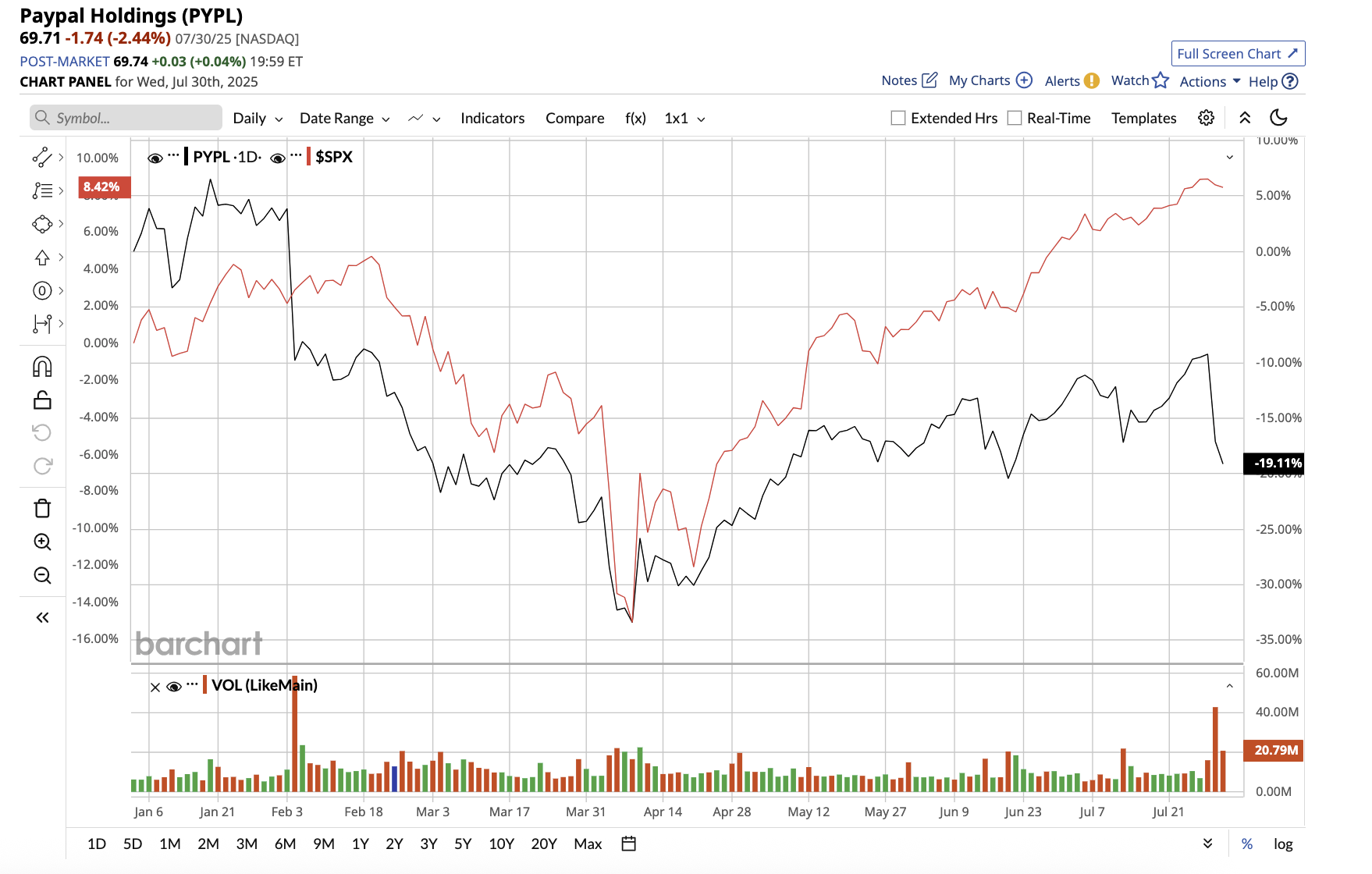

PayPal reported a strong second quarter last week, beating both revenue and earnings estimates. The stock is down 18.8% year-to-date, underperforming the broader market. Nonetheless, Wall Street’s high price estimate predicts the stock can soar as much as 79% to reach $125. Let’s find out if that is a possibility.

PayPal’s Bold Reinvention Is Finally Paying Off

Despite macroeconomic headwinds, PayPal’s second-quarter results showed resilience and momentum. Net revenue increased by 5% year over year to $8.3 billion. Adjusted earnings per share (EPS) rose an impressive 18% to $1.40 per share. Total and monthly active accounts increased 2%. Total payment volume (TPV) reached $443.5 billion, up 6% year-over-year, driven by strong performance in checkout, Venmo, Buy Now, Pay Later (BNPL), and omnichannel offerings. BNPL’s business is emerging as a significant differentiator, with a 20% increase in TPV. Additionally, monthly active BNPL users grew by 18%. What distinguishes PayPal's BNPL is its seamless integration with merchants' systems, which is not only frictionless for customers but also cost-effective for businesses.

Additionally, Venmo is transforming into a legitimate commerce platform, with TPV rising 12%, reaching a three-year high with revenue growth of 20% in Q2. Venmo is becoming increasingly common in everyday commerce. Top brands such as Sephora, KFC, and Pizza Hut are incorporating Pay with Venmo into their apps, extending the service’s reach into mainstream retail.

In Q2, the company also revealed PayPal World, a cross-border wallet interoperability platform that connects five major wallets: PayPal, Venmo, Mercado Pago, Tenpay Global, and UPI (India). Management believes that this game-changing interoperability will enable merchants to reach over 2 billion customers worldwide using a single PayPal integration.

PayPal is also preparing for the future of digital commerce, which will be driven by artificial intelligence (AI) innovation. It is already embedded in early stage integrations with Perplexity, Anthropic, and Salesforce (CRM), among others, allowing for direct checkout within AI-driven interfaces. One of the most strategic changes in the last few quarters has been its increased role in the stablecoin ecosystem. PayPal is doubling down on stablecoins to combat high fees and long settlement times in cross-border payments. Furthermore, the newly launched Pay with Crypto feature enables instant conversion of over 100 cryptocurrencies into fiat or PYUSD.

The company generated adjusted free cash flow of $656 million and returned $1.5 billion in share repurchases. The company ended the quarter with $13.7 billion in cash, cash equivalents, and investments, as well as $11.5 billion in debt. The company expects to generate $6 billion to $7 billion in adjusted free cash flow in 2025. A strong financial position will enable PayPal to continue investing in AI, infrastructure modernization, and global expansion.

A Raised Bar for 2025

Given the strength of its Q2 results, PayPal raised its full-year guidance for both transaction margin (TM) dollars and adjusted EPS. TM dollars are expected to grow 6% to 7% for the full year, with adjusted EPS ranging from $5.15 to $5.30, representing 11% to 14% year-on-year growth. Management emphasized that the updated guidance also included the ability to absorb potential weakness in e-commerce or global consumer spending if trade tensions and tariffs weigh on demand in the second half of the year.

Analysts predict PayPal’s earnings to increase by 12.7% in 2025, followed by another 9.7% in 2026. Currently, PayPal is trading at 15x forward earnings, which is lower than its five-year historical average of 40x and peer Block’s forward P/E ratio of 29x.

During the earnings call, CEO Alex Chriss made a bold statement: “Fintech is in its infancy, and we believe the next five years are likely to see more change in how people shop than the last two decades combined.” And to meet this change, PayPal is transforming from a payment utility into a global e-commerce platform.

PayPal’s transformation is well underway. With multiple growth engines firing, a strong balance sheet, and a trusted global brand, PayPal is poised to become the backbone of digital commerce worldwide. If fintech truly is in its infancy, then PayPal is growing up fast and could be a great addition to a long-term diversified portfolio at this reasonable valuation.

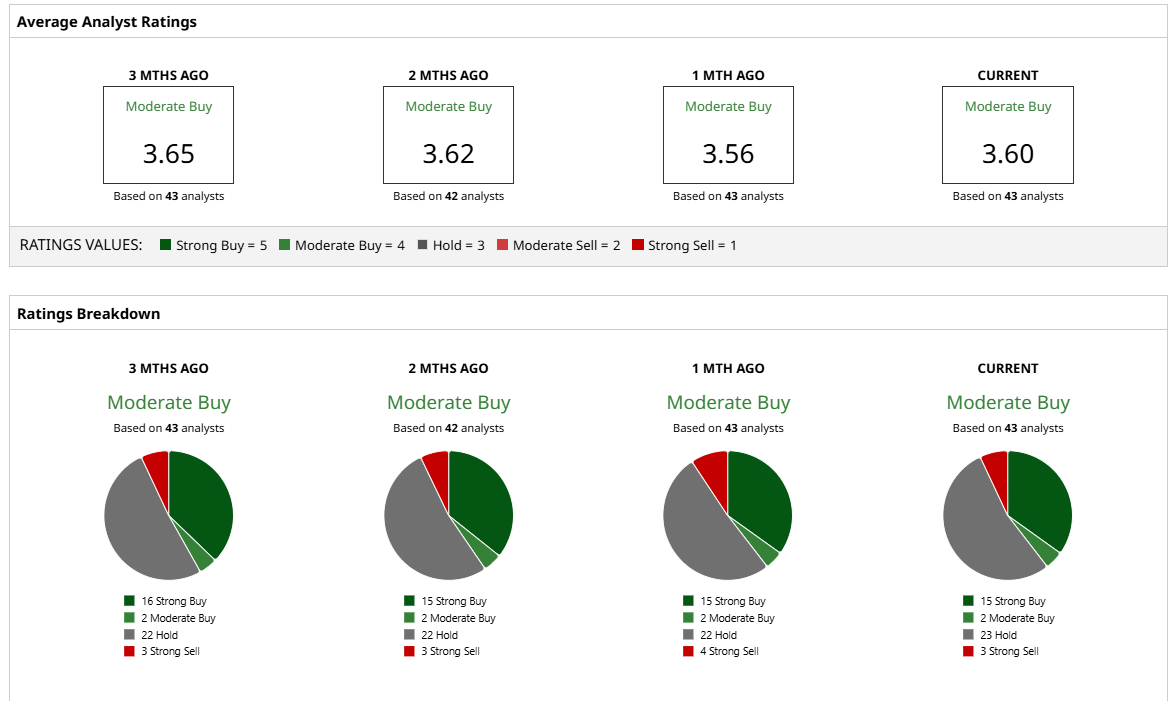

What Is Wall Street Saying About PayPal Stock?

Overall, PayPal stock has earned an overall “Moderate Buy” rating. Of the 43 analysts covering the stock, 15 rate it a “Strong Buy,” two rate it a “Moderate Buy,” 23 rate it a "Hold," and three say it is a “Strong Sell.” The mean target price for the stock is $81.48, which is 17% higher than the current levels. The stock's high target price of $125 implies 79% potential upside over the next 12 months.