/PayPal%20Holdings%20Inc%20sign%20on%20building-%20by%20Sundry%20Photography%20via%20Shutterstock.jpg)

PayPal (PYPL) will release its third-quarter 2025 earnings on Oct. 28. Despite a resilient U.S. labor market and steady consumer spending throughout the year, PayPal’s stock has struggled, falling 17.1% year-to-date. The decline reflects investor concerns over growing competition in the fintech space and broader macroeconomic uncertainty weighing on the sector.

While its stock has underperformed in 2025, PayPal’s financial performance has shown signs of strength. During the first half of 2025, the company reported steady growth in transaction margin dollars, driven by improved performance across its core platforms, including PayPal, Venmo, and its payment service provider (PSP) network. These gains have led to double-digit earnings growth. Moreover, the company is betting big on artificial intelligence (AI), ads, and crypto, which will add new revenue streams and strengthen PayPal’s long-term positioning in digital finance.

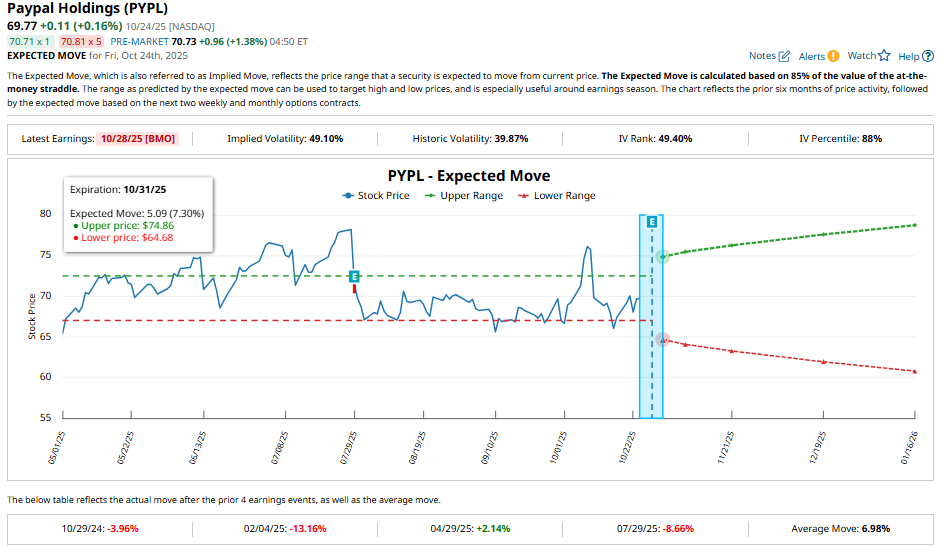

So will Q3 be the continuation of last quarter's momentum, and will the company mark a meaningful improvement in its top and bottom lines? Notably, history suggests caution. PYPL stock has declined after three of the past four quarterly reports, including an 8.7% drop following its second-quarter earnings release.

Options market activity suggests the market expects a post-earnings move of about 7.3% in either direction for contracts expiring Oct. 31. That’s slightly higher than PayPal’s average swing of around 6.98% over the past four quarters.

PayPal Q3 Earnings: What to Expect?

The momentum in PayPal’s business is likely to sustain in Q3. The company’s transaction margin dollars are expected to land between $3.76 billion and $3.82 billion, representing 3% to 5% growth from a year ago. When excluding interest on customer balances, growth could be a healthier 6% to 7%. This reflects ongoing resilience across PayPal’s ecosystem, driven by its core branded checkout business, expanding Venmo usage, and strong performance from its payment services provider (PSP) division.

User growth and engagement also remain bright spots. In the previous quarter, PayPal added nearly 2 million active accounts, pushing its total to 438 million. Monthly active accounts rose 2% year-over-year to 226 million, while transactions per active account (excluding PSP) grew by 4%. This consistent engagement reflects PayPal’s relevance as a leading digital payments platform.

The company has also been working to make its checkout experience faster and more seamless, a move that appears to be paying off. Offerings such as Pay with Venmo and Buy Now, Pay Later (BNPL) options continue to gain traction, while branded debit card features like Tap to Pay are seeing broader adoption both online and in stores. These upgrades enhance the user experience and drive incremental transaction growth.

However, not everything is moving in PayPal’s favor. Management cautioned during its Q2 call that it has seen a modest softening in U.S. retail spending, particularly among Asia-based marketplaces that may be feeling the impact of tariffs and higher import costs. This could act as a short-term headwind for transaction growth.

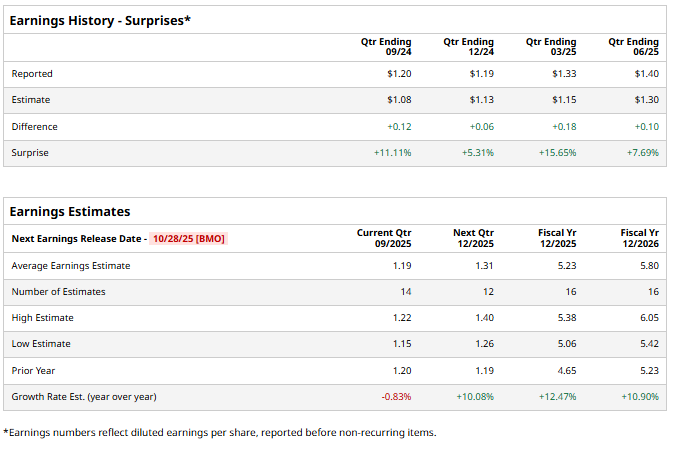

On the profitability side, PayPal’s adjusted earnings per share (EPS) have climbed at a double-digit pace in the first half of 2025, thanks to operational efficiencies and leverage from higher sales. Still, the third quarter is expected to show more muted progress, with management forecasting EPS of $1.18 to $1.22, flat at the midpoint compared with last year. Investments in new product launches and technology, along with a shift in the timing of some marketing spend, could restrict its bottom-line growth.

Wall Street analysts share a similar outlook, projecting earnings of $1.19 per share, slightly below the $1.20 recorded a year ago.

Notably, PayPal has beaten earnings expectations in each of the past four quarters, including a 7.7% positive surprise in Q2.

Is PayPal Stock a Buy, Sell, or Hold?

PayPal’s upcoming Q3 earnings report will likely highlight modest growth in transaction margin dollars and steady user engagement across its core platforms. Moreover, investors will focus on management’s update around AI, ads, and crypto. However, near-term challenges, such as competitive pressure, softer retail spending, and investments in long-term growth initiatives, could lead to muted EPS growth.

Given these mixed dynamics, investors should remain sidelined on PayPal stock ahead of its Q3 report. Analysts currently rate PYPL stock as a “Moderate Buy.”