/PayPal%20Holdings%20Inc%20sign%20on%20building-%20by%20Sundry%20Photography%20via%20Shutterstock.jpg)

PayPal (PYPL) has had a tough run in 2025, with its stock sinking more than 20% year-to-date, underperforming the broader market. The combination of rising competition in the fintech space and macroeconomic uncertainty has pressured its shares. However, recent developments suggest that the company may be setting the stage for a significant recovery.

PayPal’s Blue Owl Deal

A key development is PayPal’s new partnership with Blue Owl Capital, a prominent alternative asset manager, which will help PYPL to lighten its balance sheet. Under a two-year agreement, Blue Owl-managed funds will purchase roughly $7 billion in buy now, pay later (BNPL) receivables originated by PayPal in the U.S. Notably, PayPal retains responsibility for all customer-facing activities, including underwriting and servicing, for its Pay in 4 BNPL product.

Notably, online consumer financing has been a key offering of PayPal since 2008. Meanwhile, in 2020, it launched its Pay in 4 product. Pay in 4 enables consumers to split purchases into four interest-free payments over six weeks, a feature that appeals to cost-conscious shoppers, thereby driving up the average order value.

The BNPL segment has consistently delivered strong growth, with second-quarter volume increasing by more than 20% and monthly active accounts rising by 18%.

The Blue Owl deal signals a more disciplined approach to capital allocation, allowing PayPal to reduce credit risk while maintaining exposure to the growth potential of its BNPL portfolio. By offloading a portion of its receivables, PayPal gains greater flexibility to reinvest in innovation and other strategic initiatives, thereby accelerating its growth.

PayPal closed the second quarter with $6.9 billion in net loan receivables, up 7% sequentially. The quality and diversification of its credit portfolio remain solid, with growth primarily driven by BNPL and international consumer revolving portfolios, where charge-offs have shown improvement.

PayPal Stock Shows Strong Potential for a Comeback

While PayPal's stock has faced challenges, its revenue diversification initiatives, expanding transaction volumes, emphasis on profitability, and partnerships, such as the one with Blue Owl, lay the groundwork for a solid rebound.

So far in 2025, PayPal has delivered impressive results, marking its sixth consecutive quarter of profitable growth despite ongoing macroeconomic uncertainty. In Q2, the company’s transaction margin (TM) dollars rose 8%, excluding interest on customer balances. This growth stemmed from multiple sources, including strong credit performance, higher conversion in branded checkout flows, improved profitability in the payment service provider (PSP) business, and robust performance from Venmo. Moreover, its adjusted earnings per share (EPS) increased by 18%, reflecting leverage from higher sales and a focus on improving efficiency.

Looking ahead, PayPal’s account growth and user engagement remain healthy, which will support its financials. Total active accounts rose by nearly 2 million in Q2, reaching 438 million, while monthly active accounts climbed 2% year-over-year to 226 million. Transactions per account, excluding PSP, also increased by 4%, indicating steady engagement across the platform.

PayPal continues to modernize its checkout experience, which is expected to drive higher payment volumes. Innovations like Pay with Venmo and BNPL solutions are outpacing the market, while branded debit card initiatives, including Tap to Pay, are increasing adoption both online and in-store. By enhancing user experience, PayPal is boosting incremental checkout volumes and driving higher engagement with its services.

Notably, PayPal is evolving into a broader commerce platform. Investments in agentic AI, cryptocurrency offerings, and the launch of PayPal Ads are positioning the company for future growth. Its expanding advertising business, now scaling globally, provides a solid platform for future growth.

Taken together, PayPal’s diversified revenue streams, strong operational performance, and strategic investments suggest a potential recovery in its share price.

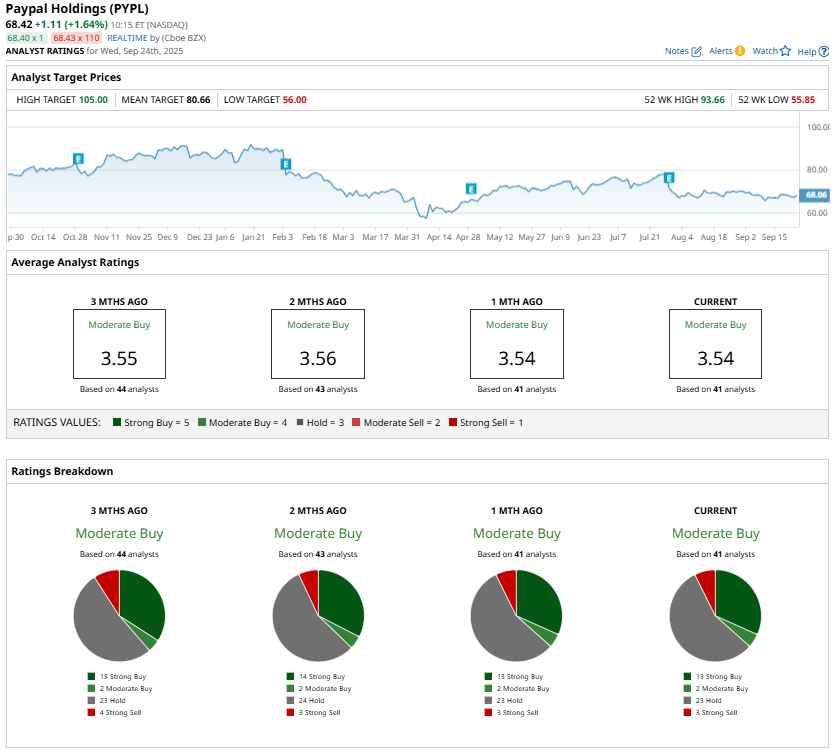

While analysts currently rate PYPL stock as a “Moderate Buy” due to macroeconomic uncertainties, the company’s focus on revenue diversification, improving profitability, and strengthening its balance sheet by lowering credit risk makes it a compelling long-term investment.