/PayPal%20Holdings%20Inc%20HQ%20photo-by%20bennymarty%20via%20iStock.jpg)

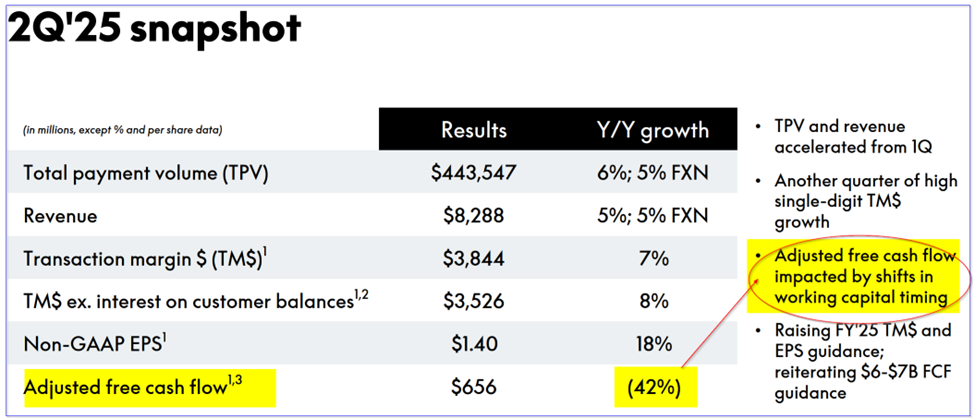

PayPal Holdings (PYPL) reported that its Q2 free cash flow (FCF) fell 42% to just $656 million from $1.14 billion last year. However, it maintained guidance of between $6 and $7 billion FCF in 2025, on par with its 2024 $6.767 billion FCF.

If that actually happens, PYPL stock could be undervalued. It could be worth over 30% more at $88.35 per share. This article will show why.

PYPL is at $67.75 in midday trading on Monday, Aug. 4. That's about $10 below its pre-earnings peak of $77.98 on July 24. Moreover, PYPL is still well below its Jan. 30 peak of $89.57.

Strong Margins Except for Free Cash Flow

PayPal's revenue rose +5.1% YoY to $8.288 billion, which was slightly higher (+2.56%) than analysts' estimates of $8.081 billion. Moreover, most of its margins were flat or slightly higher, except for free cash flow (FCF).

For example, its all-important take-rate (i.e., revenue / total payment volume (TPV) fell just 2 basis points to 1.87% from 1.89% last year. That means that with higher TPV volume, PayPal is still able to “take” its traditional fees from customers.

In addition, its transaction margin (TM) (i.e., TM/revenue) rose just slightly to 46.38% from 45.76% last year. (Note the company talks about TM dollars up 7%, but this does not compare TM against higher revenue.)

However, PayPal's operating cash flow (OCF) fell 41.1% from $1.525 billion last year to just $898 million. The deck said that this was affected by shifts in working capital timing (remember OCF includes addbacks to net income, one of which is changes in net working capital).

After slightly higher capex, this led to a 49% drop in free cash flow (FCF) from $1.368 billion to $692 million. Its adj. FCF was 42.5% lower at $656 million.

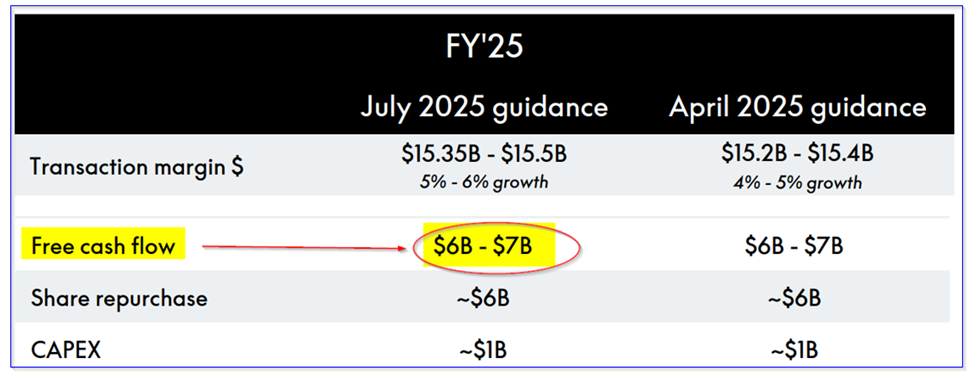

However, PayPal implied in its guidance that this was a one-off dip. In other words, the net working capital movements that led to a dip in Q2 will balance out later in the year. It maintained its outlook on page 14 of its Q2 presentation deck from last year that FCF would range between $6 billion and $7 billion. That would be on par with its 2024 FCF of $6.767 billion.

So, if that happens, could PYPL stock be undervalued here? Let's look at its FCF yield metrics.

Setting a Price Target Using FCF Yield

PayPal does not pay a dividend to shareholders. But, if it did, the payment would be funded by its free cash flow. Let's just assume that it eventually pays out 50% of FCF to shareholders.

What would the stock be worth then?

Here is how we can work that out. Using the company's guidance (see above), we could expect at least $6.5 billion in FCF this year. That represents 19.7% of analysts' estimates of $33.03 billion in revenue this year. Moreover, next year they are projecting $35.05 billion, so FCF could rise to:

$35.05 billion x 0.197 = $6.9 billion FCF 2026

That implies that its FCF yield is 10.68% given its market cap today of $64.59 billion (according to Yahoo! Finance).

If PayPal paid out 50% of that to shareholders, that would equal $3.45 billion, or a dividend yield of over 5%:

$3.45 billion dividends / $64.59 billion mkt cap = 0.0534 = 5.34% div. yield potential

However, this may be too high a yield, and the stock's market cap might rise to lower this yield. For example, Stock Analysis shows PayPal has generated $5.3 billion in trailing 12-month (TTM) FCF. So, its TTM FCF yield is lower than 10.68%:

$5.292b TTM FCF / $64.59b mkt cap today = 0.0819 = 8.19% TTM FCF yield

Therefore, if PayPal paid out 50% of its FCF as a dividend, the equivalent dividend should be 4.095%:

$3.45b 2026 div / 0.04095 = $84.25 billion projected mtk cap

That is 30.4% higher than today's market value of $64.59 billion. In other words, PYPL stock is potentially worth +30.4% more than today's price of $67.75:

$67.75 x 1.304 = $88.35 target price

Analysts Agree PYPL Stock is Undervalued

Yahoo! Finance shows that 43 analysts covering PYPL have an average price target of $83.26. That's +22% higher than today's price. Similarly, Barchart's survey shows an average of $81.14.

Similarly, Stock Analysis shows that 33 analysts have an average price target of $83.00. However, AnaChart.com, which tracks recent analyst recommendations, shows that 35 analysts have an average price target of $89.04. That is closer to my price target of $88.35 above.

As a result, the average survey price target from analysts is $84.11, or +23.6% higher than today's price.

The bottom line here is that either using a FCF analysis or just from analysts' target prices, PYPL stock looks to be too cheap.

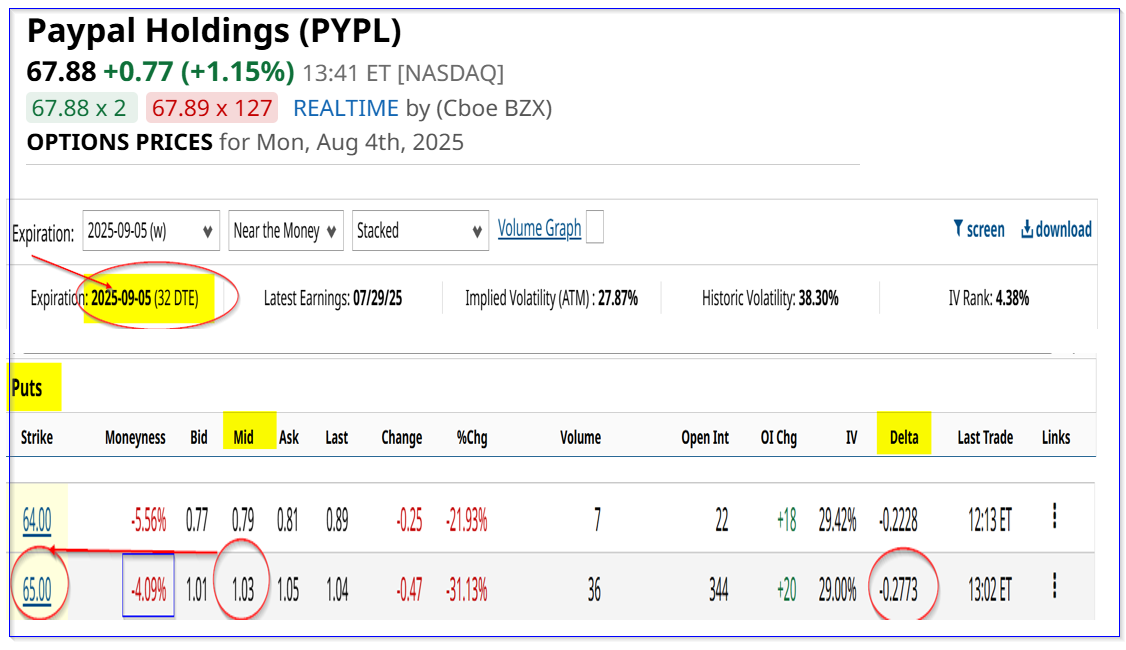

One way to play this is to sell short out-of-the-money (OTM) put options. That way, an investor can get paid while waiting to buy in at a lower price.

Shorting OTM PYPL Put Options

For example, look at the Sept. 5 expiration period, 32 days from now (days to expiry or DTE). The $65 strike price put option contract has a midpoint premium of $1.03. This strike perice is 4% below the trading price (i.e., out-of-the-money or OTM).

That means a short-seller of this put contract makes an immediate yield of 1.585% (i.e., $1.03/$65.00 = 0.015846).

The investor first secures $6,500 in cash or buying power with their brokerage firm. Then they enter an order to “Sell to Open” 1 put contract at $65.00 for expiry on Sept. 5.

The account will then immediately receive $103.00 (i.e., $1.03 x 100 shares since each put contract represents 100 shares). So, the $103.00 income represents 1.585% of the $6,500 secured as collateral.

As long as PYPL stays over $65.00 on or before Sept. 5, the account will not be assigned to buy 100 shares at $65.00. But, even if this happens, the net breakeven buy-in is just $63.97 (i.e., $65.00-$1.03). That is 5.9% or more below today's price, so it provides good downside protection.

More risk-averse investors can sell short the $64.00 strike price put contract and still receive $79 for an investment of $6,400. That represents a 1.234% one-month yield.

Note that there is a slightly lower delta ratio, -22%, or a 22% chance that PYPL will fall to this strike price. That is based on historical volatility.

The bottom line is that investors can set a lower buy-in by shorting OTM puts. Moreover, existing investors in PYPL can earn a pseudo dividend yield here.

For example, if this 1.585% short-put one-month yield play can be repeated over 3 months, the expected return yield is 4.755%. That is higher than our expected 4.1% annual dividend yield if PayPal were to pay out 50% of its FCF next year (see above).

The bottom line is that PYPL stock looks deeply undervalued here. One way to play it is to short OTM puts in nearby expiry periods.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.