/PayPal%20Holdings%20Inc%20HQ%20photo-by%20bennymarty%20via%20iStock.jpg)

PayPal (PYPL) stock rallied more than 10% on Tuesday morning after the fintech giant announced a strategic partnership OpenAI, the artificial intelligence (AI) powerhouse that created ChatGPT.

The deal integrates PayPal’s digital wallet directly into ChatGPT, enabling frictionless AI-enabled shopping experiences.

Users can now complete purchases with one-tap PYPL payments, backed by buyer protections and delivery tracking. Alex Chriss, the firm’s chief executive, dubbed it a “seismic shift” in consumer behavior, positioning PayPal at the forefront of intelligent agent commerce.

Following today’s rally, PayPal stock is up nearly 40% versus its year-to-date low in early April.

How OpenAI Deal Could Prove a Boon for PayPal Stock

The OpenAI partnership gives PYPL stock a front-row seat in the emerging world of AI-powered commerce.

By embedding its wallet into ChatGPT, the financial technology firm becomes the default payment layer for conversational shopping, an area McKinsey forecasts could capture 20% of global e-commerce by 2030.

This integration allows PayPal to monetize AI transactions at scale, leveraging its 14% transaction fee model. Early beta testers have praised the seamless checkout experience, hinting at volume spikes ahead.

OpenAI has already partnered with Shopify (SHOP) and Walmart (WMT) as well, but PYPL’s wallet-first approach sets it apart, potentially driving new merchant adoption and expanding its total addressable market.

Why Else Are PYPL Shares Pushing Higher on Tuesday?

PayPal shares are worth owning heading into 2026 also because the payments giant reported better-than-expected financials for its third quarter and raised its earnings guidance on Tuesday morning.

The company’s management now expects per-share earnings to fall between $5.35 and $5.39 this year, reinforcing investor confidence in its turnaround strategy.

Additionally, the San Jose-headquartered firm declared its first-ever quarterly dividend of $0.14 today, effectively becoming much more attractive for income-focused investors as well.

These updates bode well for PYPL shares as they signal PayPal is executing well on its core platforms while pivoting toward higher-margin growth.

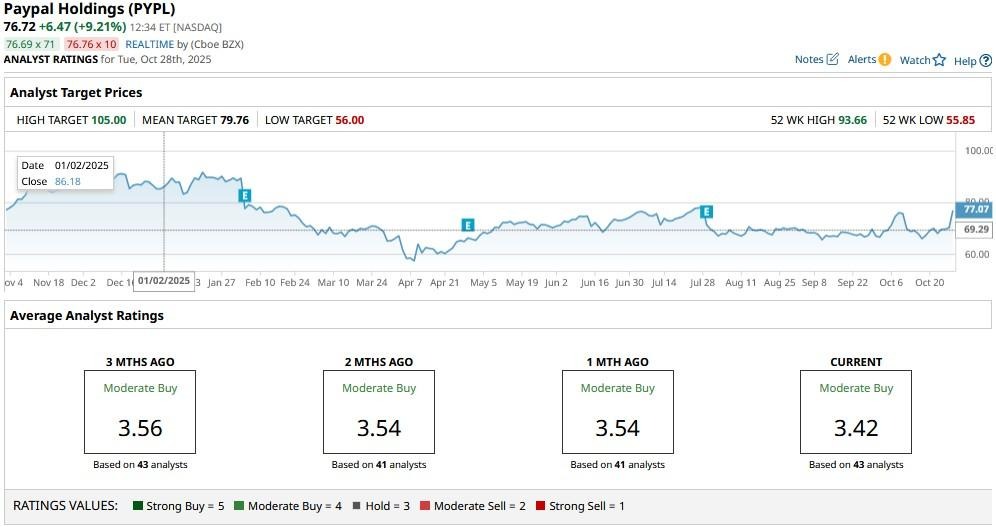

PayPal Remains a ‘Buy’ Among Wall Street Firms

Wall Street continues to see PayPal stock as an attractive long-term holding as well.

The consensus rating on PYPL shares remains at “Moderate Buy” with price targets going as high as $105, indicating potential upside of another 35% from here.