/PayPal%20Holdings%20Inc%20sign%20on%20building-%20by%20Sundry%20Photography%20via%20Shutterstock.jpg)

PayPal Holdings (PYPL) stock could be worth 20% more, based on management's free cash flow (FCF) guidance and an average FCF yield metric. Investors can short out-of-the-money puts and calls, as well as buy long-dated in-the-money calls to play PYPL.

PYPL closed at $67.30 on Friday, Sept. 26, but it's well off a recent peak of $78.22 on July 28. However, it could be worth $81.00 per share. This is based on PayPal's own free cash flow guidance in its Q2 earnings release on July 29.

I discussed this in an Aug. 4 Barchart article ("PayPal Maintains its Huge FCF Guidance Despite a Q2 Drop - Is PYPL Stock Too Cheap?). I suggested that it was worth $88.35. This article will update that price target.

At the time, PYPL was at $67.75, so it has remained flat. But, I also recommended shorting out-of-the-money (OTM) puts for income. That worked out well, and I will update that play.

Price Target for PYPL Based on Free Cash Flow

FCF Margin. Management forecasted on page 14 of its Q2 earnings deck that its 2025 free cash flow will be between $6 and $7 billion. Based on analysts' revenue estimates for 2025 of $33.09 billion, its FCF margin will be about 20%:

$6.5 billion (midpoint FCF est.) / $33.09 billion revenue est. = 0.1964 = 19.64% FCF margin

That compares with 2024's 21.3% FCF margin: (i.e., $6.767 billion FCF / $31.797 billion revenue).

Moreover, analysts now project that 2026 revenue could reach $35.06 billion. So, using a 20% FCF margin, FCF could rise by 7.9%:

$35.06 x 0.20 = $7.012 billion FCF 2026

$7.012b / $6.5b = 1.0788-1 = +7.88%

In other words, PayPal's value could rise. Let's see by how much.

FCF Yield. Based on PayPal's trailing 12-month (TTM) FCF of $5.3 billion (Stock Analysis), and its present market cap of $64.3 billion, its FCF yield is 8.24%:

$5.3b FCF / $64.3b mtk cap = 0.0824 = 8.24% FCF yield

That is equal to a FCF multiple of 12x (i.e., 1/0.0824 =12.13).

But, using management's $6.5 billion FCF midpoint guidance, the FCF yield is 10% (i.e., $6.5b/$64.3b = 0.101). That is equal to a 10x multiple (i.e, 1/0.10 = 10).

So, let's use an average 11x multiple to value PayPal's 2026 estimated FCF:

$7.012b x 11x = $77.13 billion market cap estimate

That is 20% higher than today's market cap of $64.3 billion (i.e., $77.13b/$64.3b = 1.20). In other words, PYPL stock is worth 20% more than its price today:

$67.30 x 1.20 = $80.76 per share target price

Analysts Agree. Yahoo! Finance reports that the average price target of 42 analysts on Wall Street is $82.56. That is close to my $80.76 target. In addition, AnaChart.com's survey shows an average of $87.58 from 35 analysts.

Using Options to Play PYPL

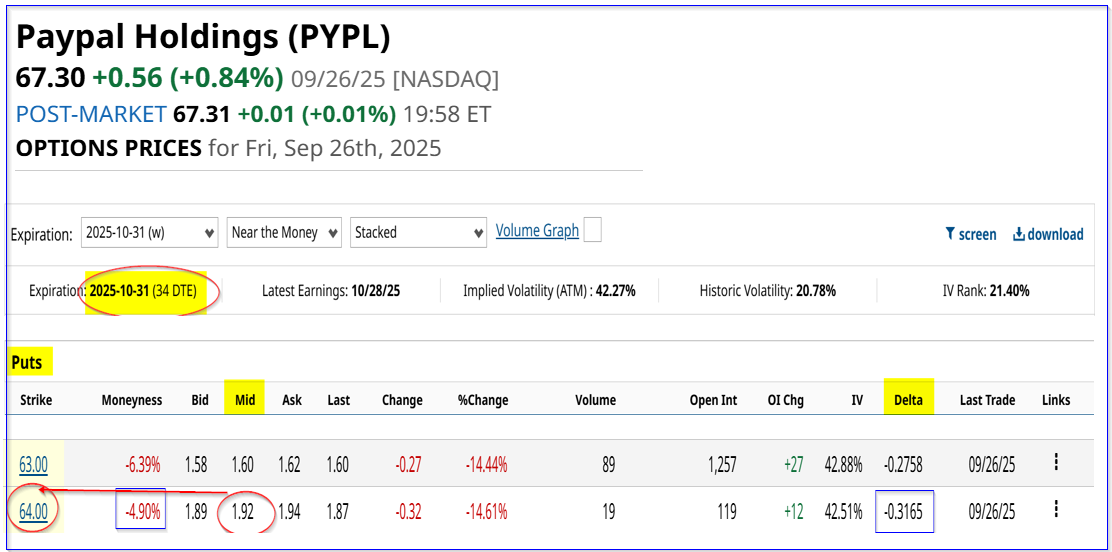

Short OTM Puts. The key here is to short near-term puts that are out-of-the-money (OTM) with a relatively low delta ratio (i.e., chance of getting exercised).

For example, the Oct. 31, 2025, expiry period, just over a month away, $64.00 strike price put option contract, 5% below Friday's close, has a $1.92 midpoint premium.

That means the short-seller can make an immediate yield of 3.0% for one month:

$1.92/$64.00 = 0.03 = 3.0% short-put yield

Note that the delta ratio is 31%, which implies a 31% chance PYPL could fall to $64.00 in the next 34 days, based on past trading volatility.

Some investors may want to have less risk. Note that the $63.00 put option is 6.39% out-of-the-money (OTM) and has a lower yield (i.e., $1.60/$63.00 = 0.02539 = 2.539%). However, the delta ratio is lower at 27.58%, implying a lower assignment risk.

Either way, these two puts offer attractive one-month yields, and on average, an investor could make a 2.7695% 1-month yield with a 50/50 mix shorting both put contracts. (Note that the average moneyness is -5.645% out-of-the-money, and the average delta ratio is about -30% (i.e., -0.2965%).

Assuming this play can be repeated for 3 months, the expected return (ER) is over 8.30% (i.e., 2.77% x 3), and for 6 months, it's +16.62%.

That is almost equal to just buying and holding PYPL based on my +20% upside price target.

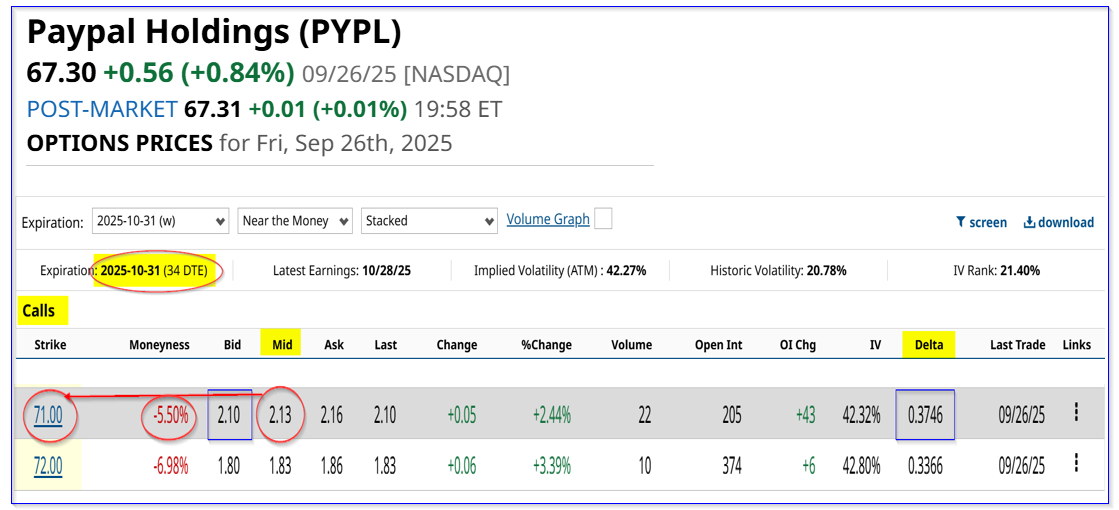

Short OTM Calls. This play is similar to the short put play, but the yield is slightly higher. For example, the Oct. 31, 2025, $71.00 call option contract has a midpoint premium of $2.13.

That strike price is 5.50% over Friday's close (similar to the 5.65% OTM 50/50 mix short-put mix above). But the yield is higher, assuming a covered call play is used:

$2.13 premium received / $67.30 trading price = 0.03165 = 3.165% one-month yield

However, note that the delta ratio is much higher as well - i.e., 37.46%. As a result, to take on less risk, the $72.00 short-call play yields 2.72% (i.e., $1.83/$67.30), but its delta ratio is only 34%.

This yield will be even higher if, instead of buying 100 shares as collateral for this covered call play, the investor buys an in-the-money call (ITM) option. (This is known as a “poor man's covered call.”)

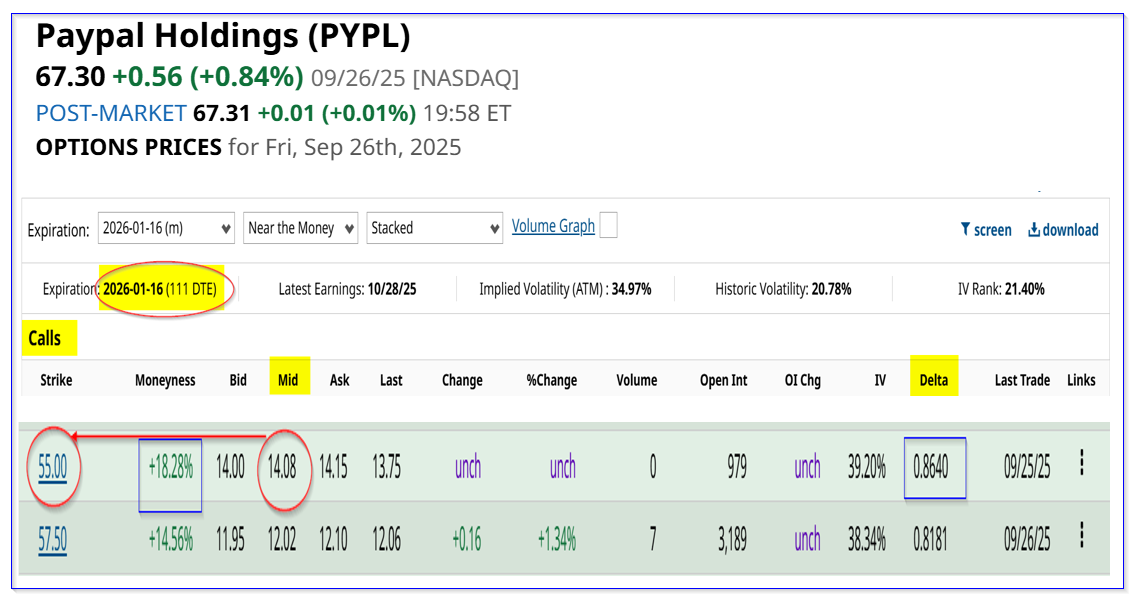

Buy ITM Calls. The trick here is to buy an ITM call for a longer date out in expiration. That way, it mimics the value of owning the equity, except for a much lower price and less cash outlay. That also enhances the yield for this poor man's covered call.

For example, the January 16, 2026, call option period shows that the $55.00 call option has a midpoint premium of $14.08. That is significantly cheaper to implement, hence it fits a “poor man's” budget.

In other words, instead of having to pay $6,730 to buy 100 shares as collateral for the covered call play, an investor only has to shell out $1,408 (representing 100 shares from 1 call contract).

That means that the yield is now very high. For example, the investor doing a $72.00 1-month short-call makes the following:

$183/$1,408 = 13.0% 1-month yield

This assumes that PYPL does not rise over $72.00 in one month, i.e., up 7% from Friday's price of $67.30. (If it does, the investor will need to roll this short-call over to a later period and/or higher strike price to avoid getting assigned).

And if the investor can repeat this strategy for 3 months, the expected return is 39% (i.e., 13% x 3).

Investors can study Barchart's Options Education webinars to study how this works and the downside risks with options.

The bottom line is that PYPL stock is around 20% undervalued here. Investors can take advantage of this by shorting out-of-the-money puts and calls in 1-month expiry periods, as well as buying in-the-money long-dated calls.