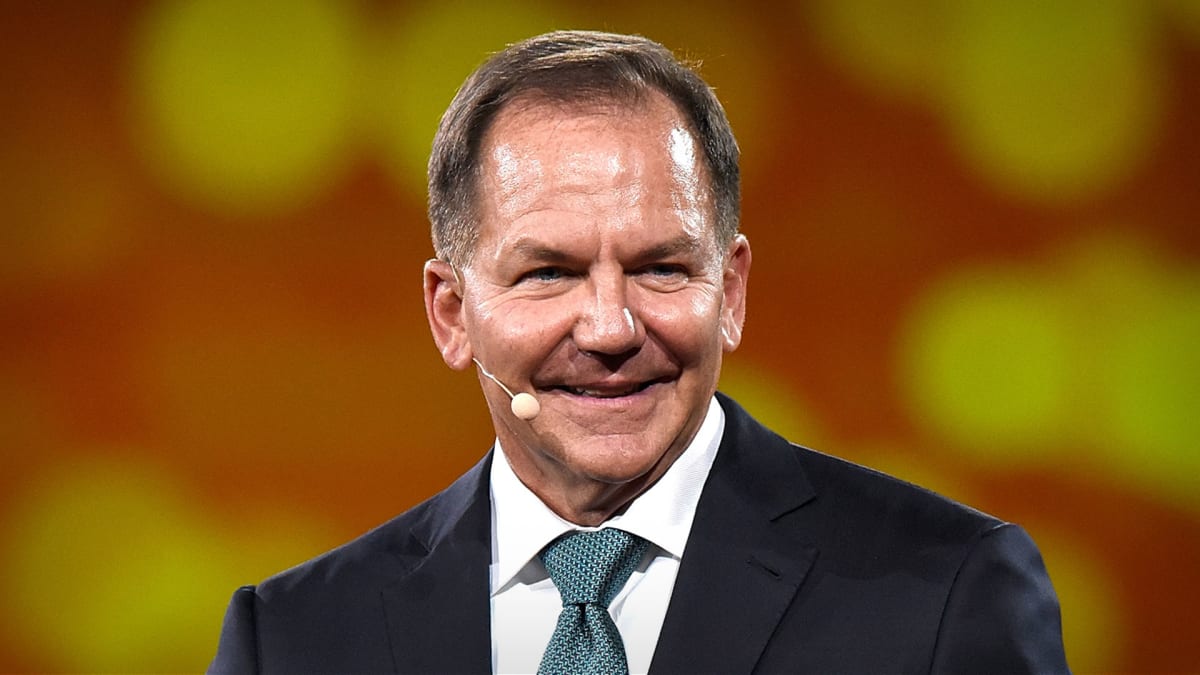

Hedge fund manager Paul Tudor Jones believes the Federal Reserve will not raise interest rates again and has reached its goal in combating inflation.

The Fed has been raising interest rates to curb inflation rates and increased them again at its meeting earlier this month.

DON'T MISS: Consumer Sentiment Falls As Spending Levels Tumble

Inflation declined to the slowest pace in two years last month. The headline consumer price index for April fell to 4.9% after reaching a high of 9% in June 2022. The dip below 5% was the first one in at least two years, according to the Bureau of Labor Statistics.

Getty

Fed Might Be Done Raising Rates

The billionaire investor told CNBC on Monday he believes that the central bank has finished raising interest rates.

“I definitely think they are done,” Jones said. “They could probably declare victory now because if you look at CPI, it’s been declining 12 straight months... That’s never happened before in history.”

The Fed began raising rates in March 2022 as inflation rates started to skyrocket. The central bankers increased rates 10 times, boosting the fed funds rate to a target range of 5%-5.25%, which has been advantageous for savers and retirees.

In 2006, stocks rose for over a year after the Fed finished raising rates. Between 2004 and 2006, the Fed increased rates by 17 times and raised the fed fund target rate by 4%.

The stock market is likely to move in a similar fashion this year, but at a slow pace, Jones said on CNBC’s “Squawk Box.”

“Equity prices ... I think they’re going to continue to go up this year,” he said. “I’m not rampantly bullish because I think it’ll be a slow grind.”

Investors should expect some volatility caused by the ongoing debate on increasing the debt ceiling and take advantage of any declines in the market.

The lack of IPOs and a lower number of deals so far this year means that there is more capital waiting to be invested, Jones said.

“We have no IPOs, no calendar, no secondaries, valuations are at 19 but nobody’s rushing to offer so clearly, something is going on internally in the stock market,” he said. “From a flow standpoint, that’s constructive.”

Stocks' Tight Trading Range

U.S. stocks remain in one of the tightest trading ranges in nearly two years, market experts said.

Despite a modestly better-than-expected first-quarter earnings season and the isolation of regional-bank-balance-sheet risks limited to a small number of stocks, the S&P 500 has been unable to reclaim the year-to-date highs it achieved in early February.

"It’s fair to ask whether this low volatility suggests the market is too complacent about the possibility of debt-ceiling turmoil," said Chris Larkin, managing director for trading and investing at E-Trade From Morgan Stanley.

"A debt default may not be the most likely scenario, but any prolonged debate or unexpected development has the potential to trigger higher volatility."

The broader post-earnings performance for the S&P 500 has been muted, despite the stronger-than-expected results.

The wind down of the first quarter earnings season means the focus will be on this week's big retail earnings since Walmart, Home Depot and Target will all report over the next three days.