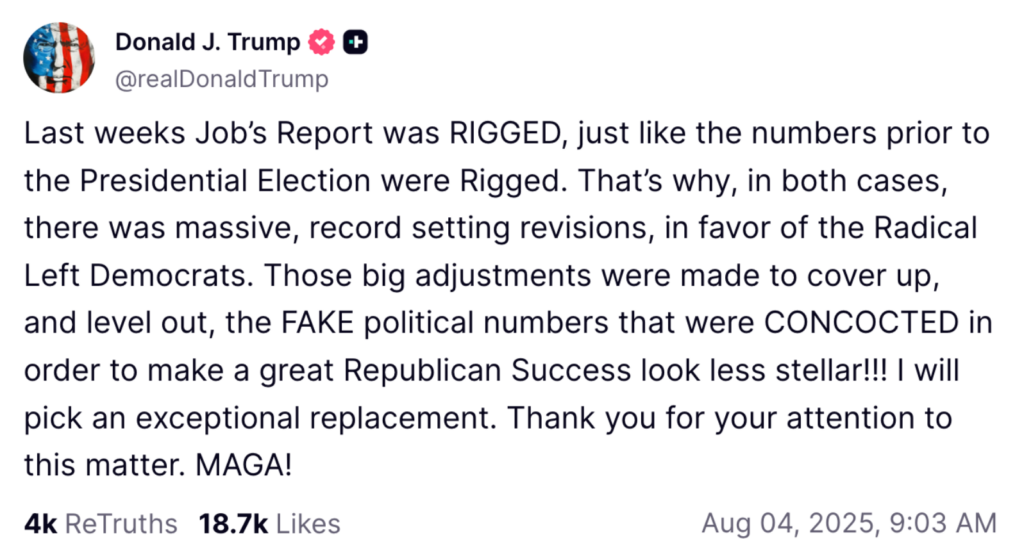

President Donald Trump's reaction to the latest jobs report, which showed a significant slowdown in hiring, has been met with sharp criticism from Nobel Prize-winning economist Paul Krugman.

In a recent Substack post titled “The Paranoid Style in American Economics,” Krugman deconstructed the president’s claim that the report was “rigged,” arguing that “every accusation is a confession.”

What Happened: The July jobs report, released by the Bureau of Labor Statistics (BLS), revealed a weaker-than-expected gain of just 73,000 jobs. More critically, the report included major downward revisions for May and June, reducing the previously reported job gains by a staggering 258,000. These revisions paint a picture of a rapidly cooling labor market.

Krugman argues that Trump’s immediate dismissal of the data and subsequent firing of the BLS commissioner is a predictable pattern of a “paranoid style.”

He highlighted a history of right-wing critics rejecting unfavorable economic data, such as “inflation truthers” during the Obama administration.

For Krugman, this behavior is a form of projection, and he had long predicted that an administration of this style would “begin manipulating economic data” as soon as it faced a negative report.

Other economists agree that the data, though weak, is credible. Jeffrey Roach, chief economist at LPL Financial, noted that “downward revisions are common during periods of economic slowdowns.”

Jamie Cox, managing partner at Harris Financial Group, was more blunt, stating, “Powell is going to regret holding rates steady this week. September is a lock for a rate cut.”

Why It Matters: The consensus among economists is that the jobs report is a clear signal of an economic shift, one that will pressure the Federal Reserve to reconsider its monetary policy.

Krugman’s warning, however, extends beyond the data. He cautions that by refusing to acknowledge a slowdown, the administration risks creating a “Potemkin economy”—a facade of prosperity that prevents real problems from being addressed.

Price Action: The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose on Wednesday. The SPY was up 0.77% at $632.78, while the QQQ advanced 1.26% to $567.32, according to Benzinga Pro data.

On Thursday, the futures of the S&P 500, Nasdaq 100, and Dow Jones indices were trading higher.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

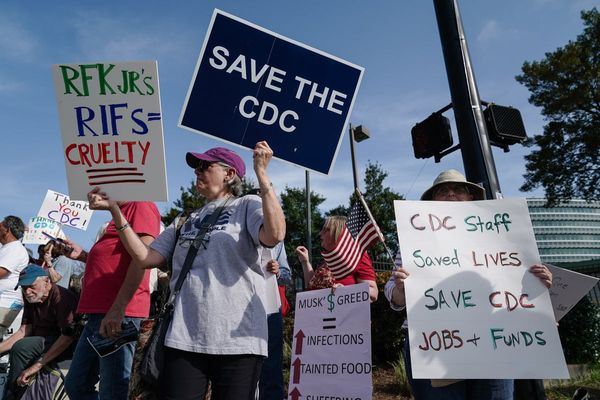

Photo courtesy: Shutterstock