Family drama is hard to navigate. However, when that drama stems from finances being skewed in a way that makes someone’s life harder, it can create situations where resolution is impossible. That seems to be the case for one person who discovered her family had been using her Social Security Number to secure loans since she was 12.

She chose to remain anonymous when she posted about her issue on Reddit. Although her financial journey began when she was just 12 — or as she described it, “Cable in 2014, a furniture store card in 2016, a cell family plan when I was 18” — she explained that she only realized the depth of the financial hole she’d been shoved into once she started college

In her long post asking for both financial and family advice, she explained that she first realized her parents’ financial maneuvering during her childhood now meant she couldn’t access a credit card. Wistfully, she wrote that the bank told her, even though she had personally never owned a credit card, her utilization rate was already at 89%.

We’ve seen families — more so parents — do much worse to each other, but these parents have been jeopardizing her financial future for as long as she can remember. As she recalls, the first time she ever signed off on anything was in middle school, when her mother handed her an internet bill to sign while she was doing her homework, claiming it would “build” her credit.

For the next few years, they used her SSN for everything they needed, to the point that she’s now even considering reporting her own parents to the police for credit card fraud. When she checked her credit reports, she discovered seven accounts tied to her SSN. Two were paid off, another two were in collections, and three others were still active. She’s now looking for creative ways to clean up her credit as quickly as possible.

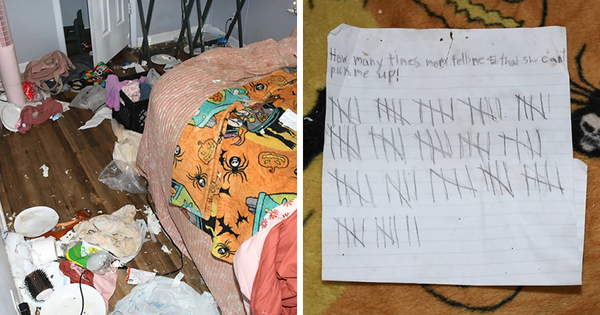

Okay, but could you quickly sign this one little thing too?

In the interest of keeping peace, she had resisted confronting her parents until now. The proverbial straw that broke the camel’s back came when her parents approached her to co-sign on their mortgage refinance — claiming that the house was their “family legacy.” This time, she put her foot down and sent them her credit report, declaring that they had put her $9,780 in the hole.

Her parents apparently caused quite a stir, arguing that they had spent $12,000 over the years to raise her. Her younger brother, who still lives with them, even chimed in and suggested she just sign off and “look into it later.” According to People, she advised him to check his own credit report too.

As things stand, she has reportedly filed for fraud alerts and is seeing a therapist to help her set boundaries. But in the interest of keeping her family together, she is also considering mediation with her parents. She did, however, say from this point on she’s keeping records in case this ends up going legal.