New York-based Paramount Global (PARA) is a leading media, streaming, and entertainment company offering television, film production, and digital content across various global platforms. With a market cap of $8.8 billion, the company owns a diverse portfolio of entertainment brands and provides streaming services, including Paramount+, Pluto TV, BET+, and Noggin. The entertainment giant is expected to announce its fiscal second-quarter earnings for 2025 on Thursday, Aug. 14.

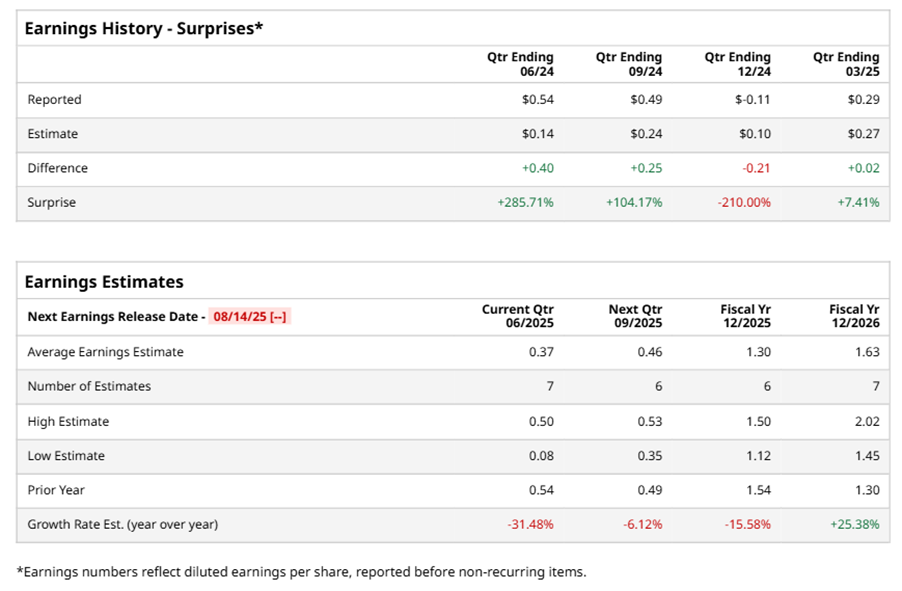

Ahead of the event, analysts expect PARA to report a profit of $0.37 per share on a diluted basis, down 31.5% from $0.54 per share in the same quarter last year. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the full year, analysts expect PARA to report EPS of $1.30, down 15.6% from $1.54 in fiscal 2024. However, its EPS is expected to rise 25.4% year over year to $1.63 in fiscal 2026.

PARA stock has slightly outperformed the S&P 500 Index’s ($SPX) 13.4% gains over the past 52 weeks, with shares up 13.6% during this period. However, it underperformed the Communication Services Select Sector SPDR ETF’s (XLC) 26.2% uptick over the same time frame.

PARA’s strong performance can be attributed to positive expectations for the upcoming release of Mission Impossible – The Final Reckoning and the confirmation of the $8 billion Skydance merger closing in the first half of 2025, which boosted investor morale.

On May 8, PARA shares closed up by 1% after reporting its Q1 results. Its revenue stood at $7.2 billion, down 6.4% year over year. The company’s adjusted EPS declined 53.2% year over year to $0.29.

Analysts’ consensus opinion on PARA stock is reasonably bearish, with an overall “Moderate Sell” rating. Out of 23 analysts covering the stock, two advise a “Strong Buy” rating, 12 give a “Hold,” and nine recommend a “Strong Sell.” While PARA currently trades above its mean price target of $11.67, the Street-high price target of $16 suggests an upside potential of 22%.