/Palo%20Alto%20Networks%20Inc%20HQ%20sign-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

With a market cap of $115.3 billion, Palo Alto Networks, Inc. (PANW) is a leading global cybersecurity company headquartered in Santa Clara, California. It offers advanced firewalls, cloud-based security, AI-driven threat intelligence, and network protection solutions for enterprises, governments, and service providers.

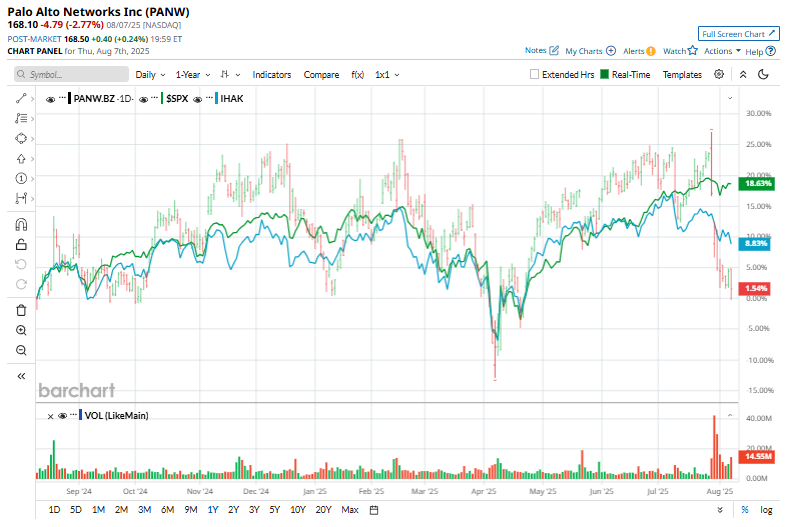

Over the past year, PANW stock has climbed 10.5%, compared to the S&P 500 Index’s ($SPX) 21.9% gains. In 2025, PANW has dipped 7.6%, trailing SPX’s 7.8% rise on a YTD basis.

Zooming in, PANW has also lagged behind the iShares Cybersecurity And Tech ETF (IHAK), which has gained 12.6% over the past year and 2.9% in 2025.

On June 30, Palo Alto Networks shares fell over 5% after the company announced a $25 billion cash-and-stock deal to acquire CyberArk, a leading provider of identity security solutions. This move marks one of the largest deals in the cybersecurity sector, aimed at strengthening Palo Alto Networks’ portfolio in identity and access management. However, the sizable purchase price and potential integration challenges appeared to spark investor concerns, contributing to the sharp drop in share value.

For the current fiscal 2025, ending in July, analysts expect PANW’s earnings to grow 17.3% annually to $1.76 per share. The company has matched or surpassed the Street’s bottom-line estimates in each of the past four quarters, which is impressive.

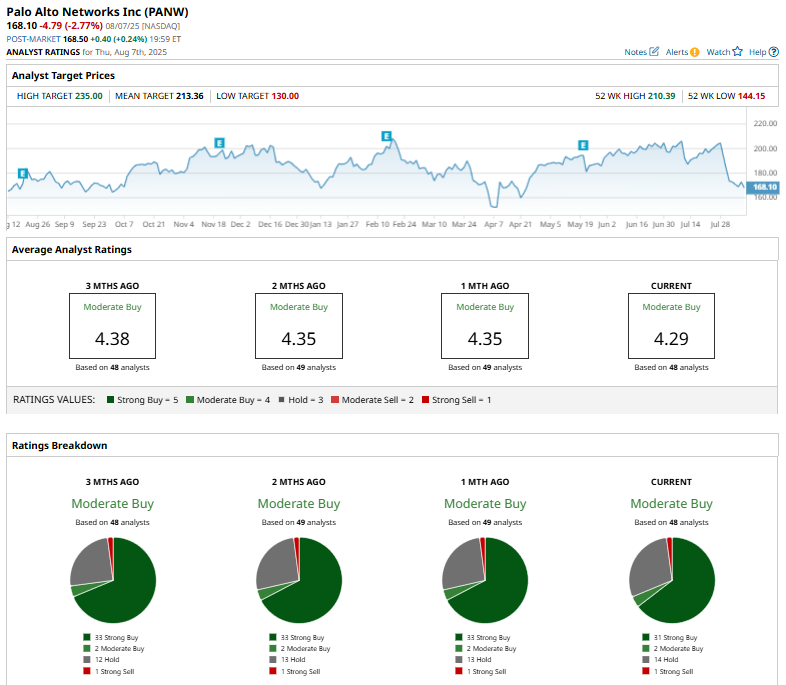

Among the 48 analysts covering the PANW stock, the consensus rating is a “Moderate Buy.” That’s based on 31 “Strong Buy,” 2 “Moderate Buy,” 14 “Hold,” and one “Strong Sell” rating.

This configuration is more bearish than a month ago, when 33 analysts had rated a “Strong Buy” recommendation for the stock.

On July 31, DA Davidson’s Rudy Kessinger lowered Palo Alto Networks’ (PANW) price target to $215 from $225 but maintained a “Buy” rating, calling its $25 billion CyberArk acquisition “transformative” for filling a key gap with the most comprehensive Identity Security platform in the market.

PANW’s mean price target of $213.36 suggests a 26.9% upside potential. Its Street-high target of $235 represents a 39.8% premium to current price levels.