/Palo%20Alto%20Networks%20Inc%20HQ%20sign-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

Palo Alto Networks, Inc. (PANW) generated strong free cash flow (FCF) and FCF margins for its fiscal year ending July 31. Moreover, in yesterday's earnings release, management projected strong FCF margins in the next fiscal year. That makes PANW stock a favorite of value investors.

PANW stock is up 4.7% today to $184.58. But it could be worth at least 15% more to $213.00 based on its strong FCF margins and analysts' revenue forecasts.

Strong FCF and FCF Margins

Palo Alto Networks has a relatively stable and strong network security subscription-based revenue model. That makes projecting its revenue and free cash flow fairly easy. This is what attracts value investors to the stock.

In fact, Palo Alto Networks is one of the very few companies that discuss their FCF and FCF margins.

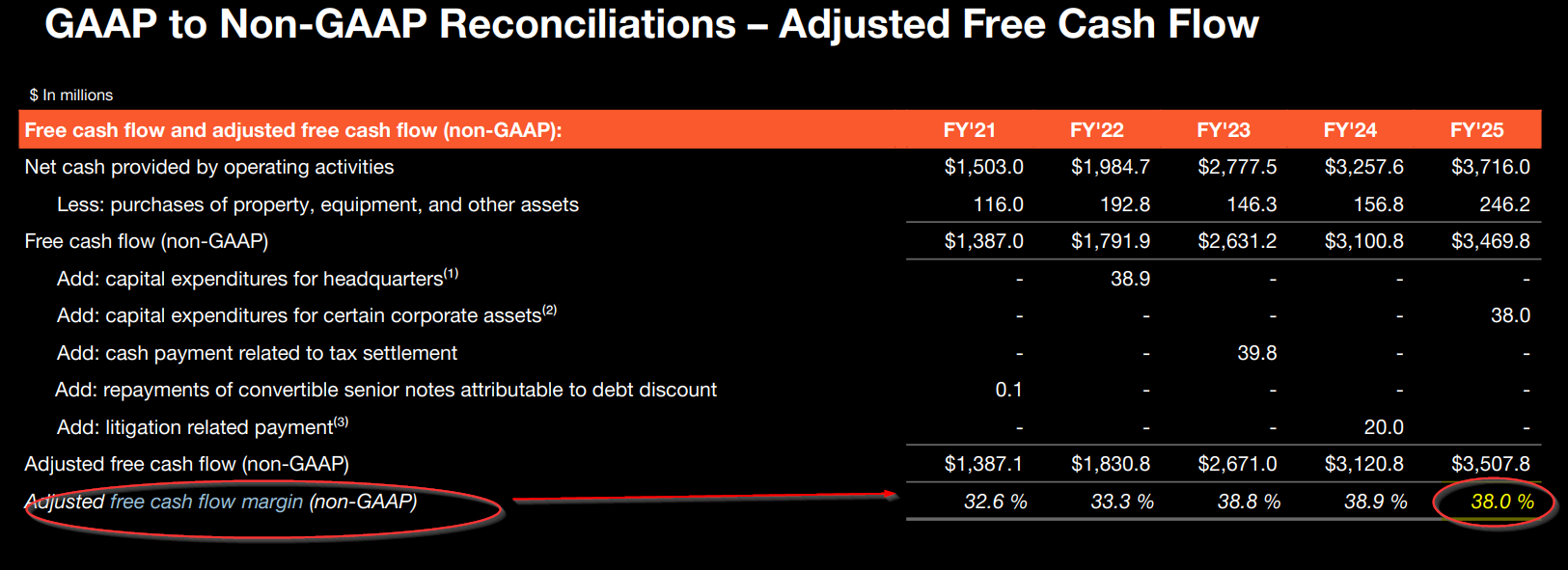

For example, in its Aug. 18 earnings release, the company reported that along with FY 2025 revenue rising 14.87% Y/Y to $9.22 billion, adjusted FCF hit a new high of $3.508 billion, up +12.4% Y/Y.

That means its FCF margin hit the projected 37% of revenue figure it had been guiding, although slightly lower than last year's 38.9%. However, the table on page 31 of its deck shows that in the last five years, this FCF margin has been rising.

Moreover, management forecasted that it expects this strong performance to continue next year and over the next several years. The guidance it provided in the earnings release indicated that revenue should rise about 14% this year, and FCF margins will be between 38% to 39%.

That implies that revenue could be about $10.5 billion in the midpoint of its estimate range, and FCF will be over $4 billion (up from $3.5 billion this year):

$10.5 billion FY 26 x 38.5% = $4.0425 billion target FCF

As a result, PANW stock could have good upside.

Target Prices for PANW Stock

For example, right now Palo Alto Networks' stock has a market value of $123.06 billion, according to Yahoo! Finance. That means its FCF yield is 2.85%:

$3.5 billion adj. FCF / $123 = 0.02845

So, using management's implied guidance of $4.04 billion in FCF next year, it could end up with a $142 billion market cap over the next 12 months:

$4.04b adj. FCF / 0.02845 = $142 billion mkt cap

That implies an upside of +15.4% from today's price:

$142b / $123b = 1.154 -1 = +15.4% upside

That puts the price target at $213.00 per share:

$1.154 x $184.58 price today = $213.00 price target

Analysts agree that PANW stock is undervalued. For example, Yahoo! Finance reports that 53 analysts have an average price target of $213.49 per share. Similarly, Barchart's survey has a mean price of $213.22.

The bottom line is that value investors love this stock given its predictable FCF and potential upside.

As a result, one simple way to play this is to buy in-the-money (ITM) calls.

Buying In-the-Money (ITM) Calls

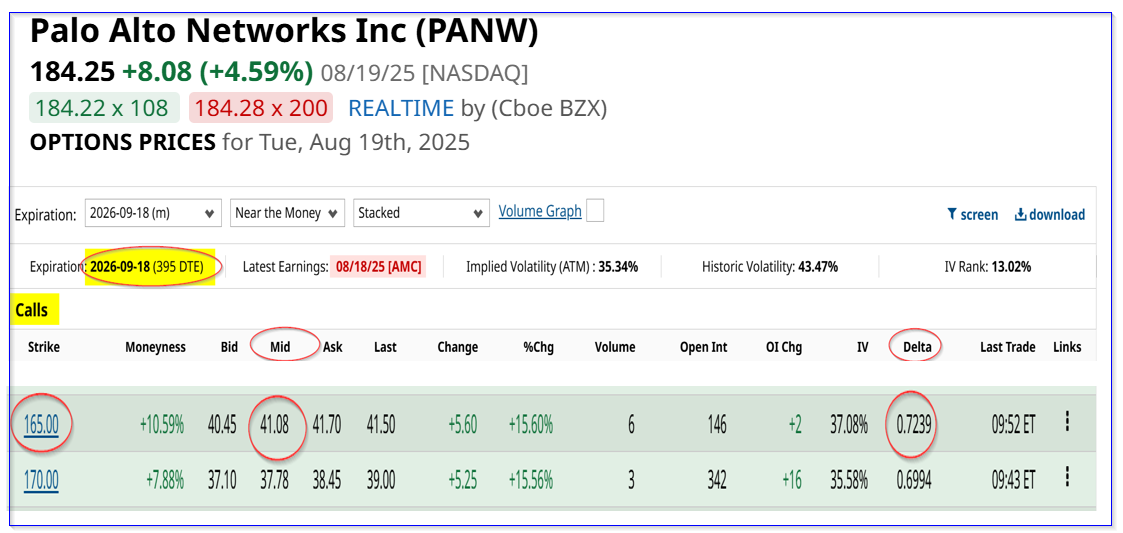

This is a potentially easier way to play PANW stock. For example, look at the Sept. 18, 2026, expiration period, over 1 year from now (i.e., 395 days to expiry or DTE).

If an investor buys the $170.00 call option contract at the midpoint of $41.08, they can benefit from any upside in owning 100 shares at less than 23% of the cost of buying 100 shares.

Moreover, the breakeven point (i.e., $165+$41.08, or $206.08), is only 11.65% over today's stock price (i.e., $206.08/$184.58 = 1.11648).

That means that any increase in the stock (or vice versa) will have a greater effect on the call options. For example, the delta ratio is over 72%, meaning that any increase in the stock price will lead to a 72-cent increase in the call option.

The bottom line is that if PANW rises to $213.00, as we expect, over the next year, and possibly well before that, the upside in the calls will be better than the stock:

Intrinsic value of calls at $213.00 = $213-$165.00 (strike price) = $48.00

$48.00 / $41.08 = 1.16845 = +16.85% vs. 15.4% for the stock

However, if PANW rises to $220, the intrinsic value of the calls will be $55.00, or an upside of 33.9% for the call option owner. That compares with +19% for the stock owner. (Of course, this leverage works on the downside as well, so investors should study the risks here).

The bottom line is that Palo Alto Networks' free cash flow is fairly predictable, and PANW stock looks deeply undervalued. That makes it a favorite of value investors.