Palo Alto Networks, Inc. (NASDAQ:PANW) will release financial results for the fourth quarter after the closing bell on Monday, Aug. 18.

Analysts expect the Santa Clara, California-based company to report quarterly earnings at 89 cents per share, up from 75 cents per share in the year-ago period. Palo Alto Networks projects to report quarterly revenue at $2.5 billion, compared to $2.19 billion a year earlier, according to data from Benzinga Pro.

On July 30, Palo Alto entered into a definitive agreement with CyberArk to acquire the identity security company. Shareholders of CyberArk will receive $45 in cash and 2.2005 shares of Palo Alto common stock for each CyberArk share held for an approximate equity value of $25 billion.

Palo Alto Networks shares fell 1.9% to close at $173.55 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

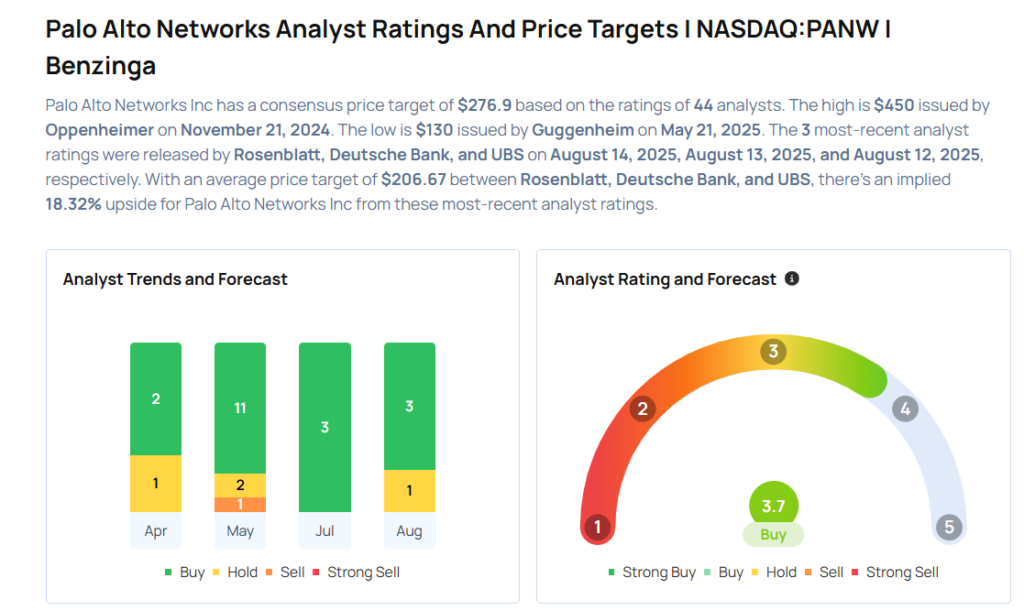

- Rosenblatt analyst Catherine Trebnick maintained a Buy rating and cut the price target from $235 to $215 on Aug. 14, 2025. This analyst has an accuracy rate of 63%.

- Deutsche Bank analyst Brad Zelnick upgraded the stock from Hold to Buy and boosted the price target from $200 to $220 on Aug. 13, 2025. This analyst has an accuracy rate of 68%.

- UBS analyst Roger Boyd maintained a Neutral rating and cut the price target from $200 to $185 on Aug. 12, 2025. This analyst has an accuracy rate of 62%.

- Piper Sandler analyst Rob Owens upgraded the stock from Neutral to Overweight and increased the price target from $200 to $225 on Aug. 12, 2025. This analyst has an accuracy rate of 79%.

- DA Davidson analyst Rudy Kessinger maintained a Buy rating and cut the price target from $225 to $215 on July 31, 2025. This analyst has an accuracy rate of 60%.

Considering buying PANW stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock