I examined why palladium was struggling at the $1,000 per ounce level in a March 6 Barchart article when I concluded:

Palladium remains inexpensive compared to gold and silver at below the $1,000 per ounce level. Accumulating palladium at the current price and lower could be optimal, as the odds favor higher prices over the coming months and years.

On March 5, 2025, nearby NYMEX palladium futures were at the $949.50 per ounce level, with the Aberdeen Physical Palladium ETF product (PALL) at $86.28 per share. In late June 2025, the futures and ETF were higher, and the recent price action suggests that higher highs could be on the horizon.

Palladium has been in a bullish trend since the April 7 low

NYMEX palladium for September delivery reached a $883.50 per ounce low on April 7 as U.S. tariffs gripped markets across all asset classes.

The daily chart highlights palladium’s 25.5% ascent to a high of $1,109 on June 9. Palladium futures for delivery in September 2025 remained above the $1,000 pivot point and closer to the June 9 high than the April 7 low in late June at nearly $1,090 per ounce.

Critical technical resistance is at the October 2024 high

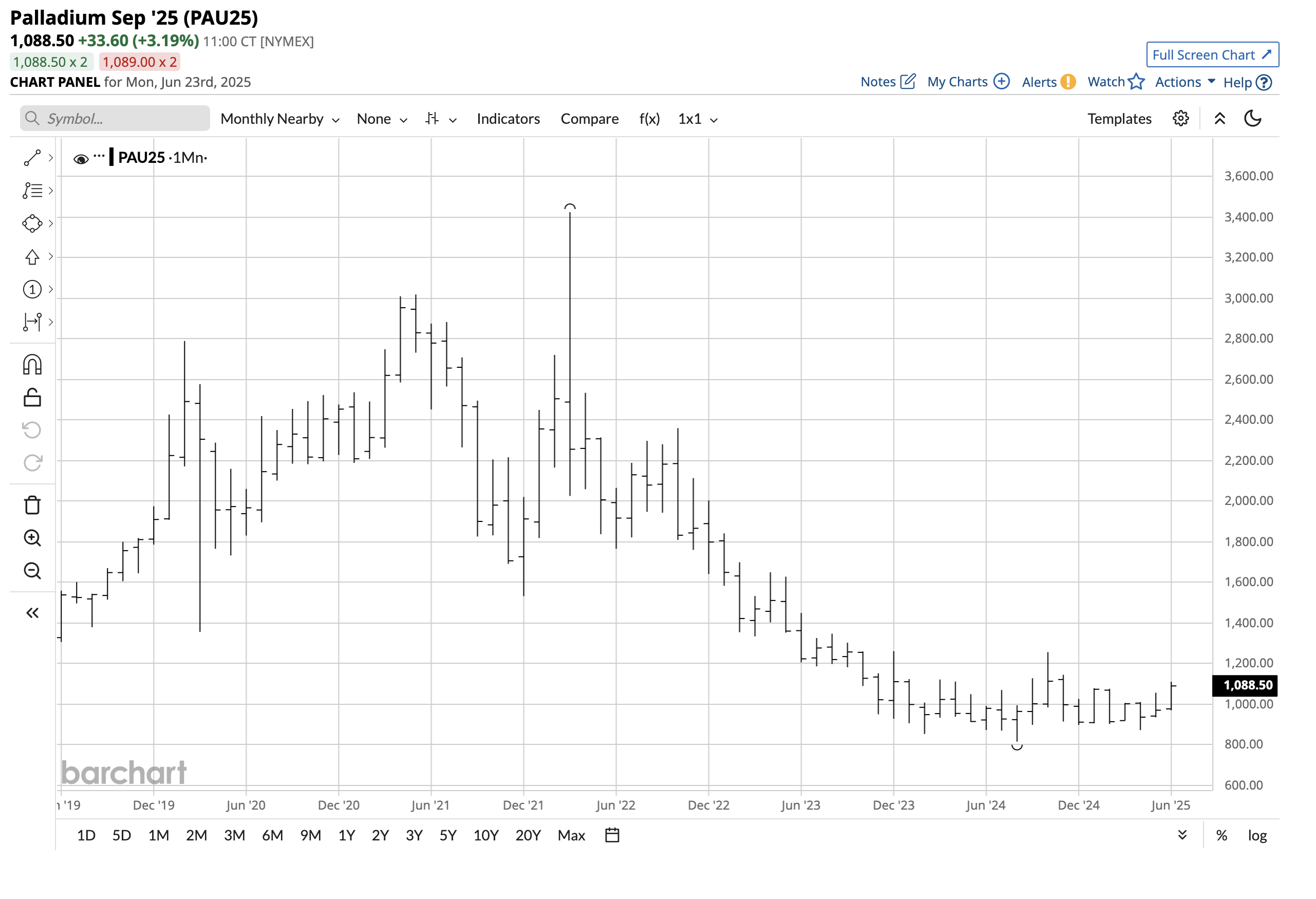

The longer-term palladium futures chart indicates the precious metal’s current upside target.

The monthly continuous contract chart suggests that the October 2024 high of $1,255 serves as the technical resistance level. A move above resistance could signal the end of the long-term consolidation that has gripped palladium futures since they plummeted 76.25% from the March 2022 high of $3,425 to the August 2024 low of $813.50 per ounce.

Palladium’s sister metal is close to a technical upside break

Platinum and palladium are industrial precious metals with many applications. Their high melting and boiling points make them critical ingredients in the automobile, oil, and petrochemical refining industries, as well as in medical and other fields. As precious metals, they also have jewelry and ornamental applications, serving as long-term stores of value. While gold and silver are highly liquid precious metals and in significant bullish trends, platinum and palladium suffer from less liquidity in the futures and physical markets. Annual platinum and palladium production is significantly lower than that of gold and silver. Moreover, most of the platinum and palladium production comes from South Africa as primary production and Russia as a byproduct of nickel mining.

While the price action in palladium has turned bullish, the critical technical resistance level of $1,255 remains $146 above the most recent high of $1,109 per ounce.

The monthly continuous NYMEX platinum futures chart shows that, after trading around the $1,000 pivot point (like palladium) for years, platinum futures have surged, rising 53% from $878.30 in April 2025 to their most recent high of $1,343.40 in June 2025. Platinum futures were not far below the critical long-term technical resistance level, at the February 2021 high of $1,348.20. At above $1,290 per ounce in late June 2025, platinum futures remain closer to the June high than the April low and are in a bullish trend. A break above the 2021 peak could lead to platinum prices rising toward a challenge of the all-time high of $2,308.80 set in March 2008.

Platinum’s bullish price action could lead to buying in palladium over the coming weeks and months, as the two platinum group metals share similar supply and demand fundamentals.

Levels to watch in palladium futures- The bullish case

The weekly chart of NYMEX palladium futures zones in on the technical levels that will either cause them to continue to make upside progress or return below the $1,000 pivot point.

The weekly continuous contract chart shows the first support level at $1,015.50, the high of May 26. Resistance is at the most recent June high of $1,109 per ounce. The bullish case for palladium includes the following:

- Gold and silver have been on a bullish tear in 2025. As prices reach new record highs in gold and new multi-year peaks in silver, investors and traders seeking value could be turning to platinum and palladium.

- Russia and South Africa are the leading producers of palladium. Geopolitical turmoil, tariffs, and trade barriers could lead to sudden disruptions in the supply chain.

- Palladium and platinum are rarer metals than gold and silver, with less annual output and limited above-ground inventories.

- Palladium’s open interest, the total number of open long and short positions in the NYMEX futures market, is the lowest of the four metals in contracts and total market value. Less liquid markets tend to experience higher price volatility as herds of buyers or sellers can cause substantial price moves. We witnessed palladium’s 2022 rally, which took the price to $3,425, driven by supply concerns following Russia's invasion of Ukraine.

- U.S. energy policy, which favors fossil fuels, is likely to increase palladium demand for automobile catalytic converters and oil refining catalysts.

- Palladium’s trend has turned higher. If the futures continue to make higher lows and higher highs, the bullish trend is likely to continue, attracting investment capital to the metal as it remains at under one-third the price as the 2022 high.

The bottom line is that, compared to gold and silver, and most recently platinum, palladium offers value at the current price level.

PALL tracks palladium prices

The most direct route for investing in or taking a risk position in palladium is the physical market for bars and coins. The NYMEX futures market provides an alternative, as it features a physical delivery mechanism; however, the low liquidity compared to the other precious metals makes palladium futures challenging. Moreover, without a liquid forward market, the exchange does not offer palladium option contracts.

The fund summary for the Aberdeen Physical Palladium ETF product (PALL) states:

At $98.39 per share, PALL had over $474.9 million in assets under management and trades an average of over 276,000 shares daily. PALL charges a 0.60% management fee. The palladium ETF is more liquid than the NYMEX futures market, making it an excellent option for investors. Moreover, PALL does an excellent job tracking palladium futures prices. During the most recent rally, nearby palladium futures rose 25.5% from the April 7 to the June 9 high.

As the daily chart shows, PALL rose 20.1% from the April 7 low of $82.39 to the June 11 high of $98.96 per share. One drawback of the ETF is that palladium futures trade around the clock; PALL is only available during U.S. stock market hours and may miss highs or lows that occur outside of these hours.

Given the price action in gold, silver, and platinum, palladium could be in the early days of a rally that could take prices substantially higher. PALL could be a bargain at a price below the $100 per share in late June 2025.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.