In a January 29, 2023, Barchart article, I wrote:

The palladium futures arena could be in for a significant price recovery when it finds its bottom. However, the trend remains bearish in early 2024, and bear markets in illiquid markets can take prices to irrational, illogical, and unreasonable levels that defy fundamental and technical analysis.

On January 29, nearby NYMEX palladium futures were trading at $971 per ounce, and the Aberdeen Physical Palladium ETF product (PALL) was at $90.85 per share. Prices made lower lows since late January but were not significantly different in early March 2024.

Palladium futures reached lows in mid-February

NYMEX palladium futures prices plunged after reaching the 2022 all-time high.

The chart dating back to the 1970s shows palladium prices were in a bullish trend, making higher lows and higher highs since late 2008 $160 low when they experienced a parabolic rally in 2022.

Source: Statista

Russia leads the world in production. Russia’s February 2022 invasion of Ukraine and sanctions on Moscow led to significant price and supply fears that lifted palladium futures to an all-time high of $3,380.50 per ounce, where they ran out of upside steam.

In late 2023, palladium futures fell below the $1,000 per ounce level for the first time since September 2018. Over the first two months of 2024, prices had traded primarily below the $1,000 level, probing under $900 in February to a $856 low.

PALL has followed the futures

At the $1,059.50 level, June palladium futures were 68.7% below the 2022 high and 23.8% above the February 2024 low.

The long-term chart of the Physical Palladium ETF product (PALL) illustrates the 73.7% decline from the 2022 high and the 23.5% recovery from the February 2024 low. PALL does an excellent job tracking volatile palladium futures prices.

At $96.94 per share, PALL had $209.55 million in assets under management. PALL trades an average of just below 60,000 shares daily and charges a 0.60% management fee. After reaching the low in February 2024, palladium prices could be consolidating and searching for direction.

Palladium is rare and has increasing industrial applications

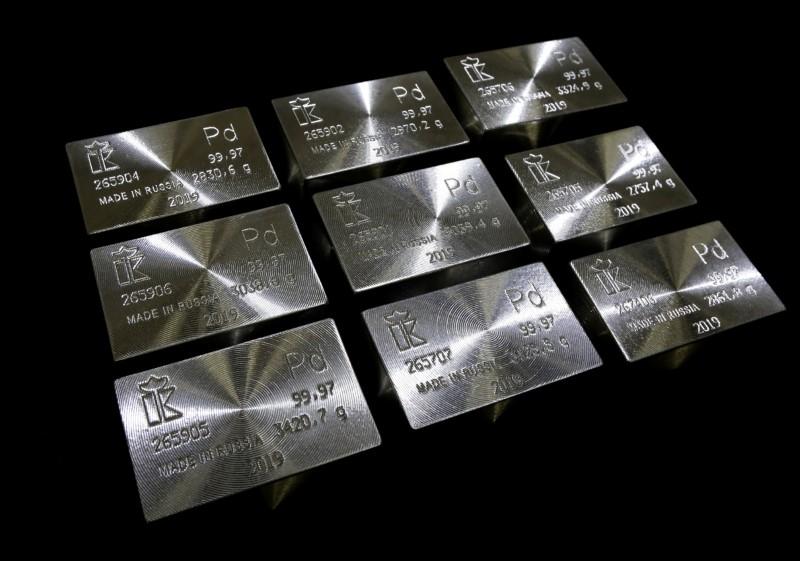

Palladium is a rare platinum group metal with only 210 metric tons of global output in 2022. Palladium is a precious metal with growing industrial applications.

Catalytic reactions in industry require palladium because of its density and heat resistance. Dental fillings, crowns, and jewelry manufacturing also require palladium. Other products, such as high-end concert flutes, contain palladium. Over the past years, palladium’s primary application has been in automobile catalytic converters that reduce toxic emissions.

An emerging application is in the hydrogen economy, where palladium has many uses. According to a recent article in Mining Review Africa, “The increasing demand for the purification of hydrogen during blue hydrogen production is one possible example of a palladium-based application. Further examples include the cracking of hydrogen carriers and the semiconductor industry, where high-purity hydrogen is needed as a process gas.”

Russian strategic stockpiles may have weighed on the price

Russia is the leading palladium-producing country. In Russia, strategic stockpiles are state secrets. In the early 1990s, when the Berlin Wall fell, Russia’s need for revenues caused a tidal wave of strategic commodity sales, pushing palladium prices well below the $100 per ounce level. While there is no data, Russia’s increasing cash needs to fund the ongoing Ukraine war could have led to significant palladium destocking when the price reached the 2022 high. Russian selling has likely caused the decline in palladium prices, which is a mixed blessing for the metal’s future path of least resistance. If Russia has sold its strategic stockpiles, limited production and illiquidity in the futures market could lead to a significant price recovery over the coming months and years.

A scale-down buying approach

I favor a scale-down buying approach to the palladium market, leaving plenty of room to add on further declines. Illiquid markets can fall to illogical, unreasonable, and irrational prices that defy fundamental analysis during bearish trends. Therefore, leaving room on the downside and adding when downside spikes occur could be the optimal approach to palladium investing.

While physical bars and coins are the most direct investing route, the PALL ETF is a liquid alternative for market participants seeking palladium exposure.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

.png?w=600)