/Palantir%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock.jpg)

With a market cap of around $426.4 billion, Palantir Technologies Inc. (PLTR) is a Colorado-based software company that specializes in big data analytics and artificial intelligence solutions. Founded in 2003, the company develops platforms that help organizations integrate, manage, and analyze large and complex datasets for decision-making and operational insights.

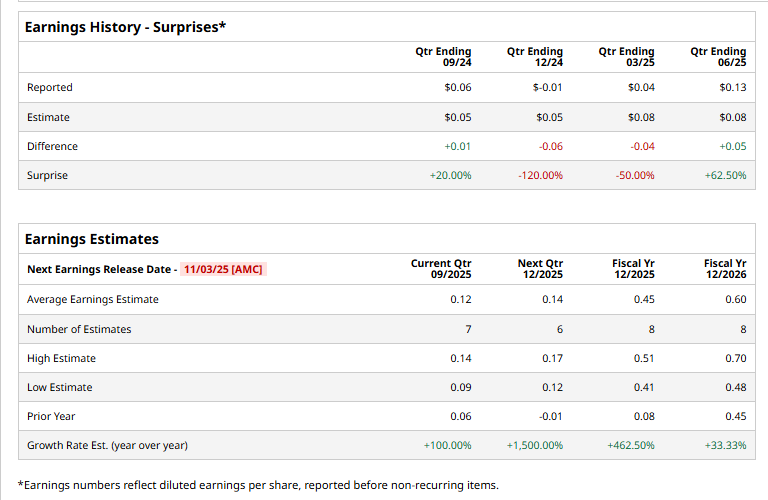

The tech company is slated to announce its fiscal Q3 2025 earnings results after the market closes on Monday, Nov. 3. Ahead of this event, analysts expect PLTR to report an EPS of $0.12, a 100% increase from $0.06 in the year-ago quarter. It has exceeded Wall Street's earnings expectations in two of the past four quarters while missing on two other occasions.

For fiscal 2025, analysts expect Palantir Technologies to report EPS of $0.45, a significant growth of 462.5% from $0.08 in fiscal 2024.

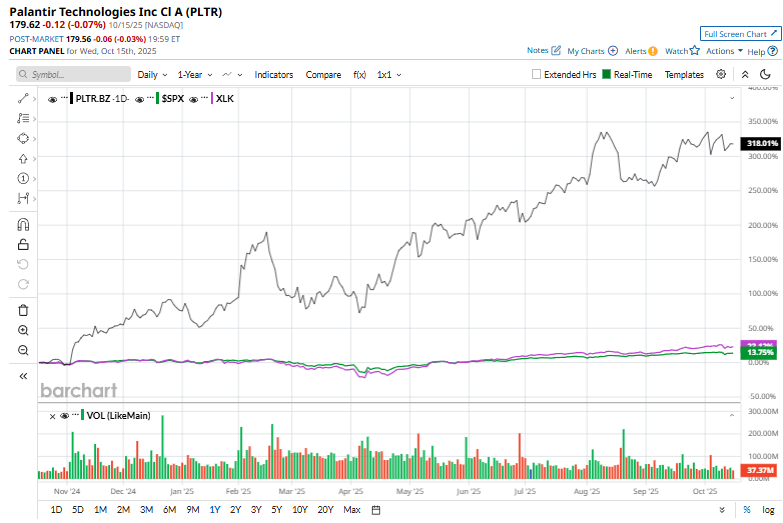

Shares of Palantir Technologies have jumped 418.3% over the past 52 weeks, surpassing the broader S&P 500 Index's ($SPX) 11.6% return and the Technology Select Sector SPDR Fund's (XLK) 10.2% rise over the same period.

Oct. 6, Palantir Technologies shares rose over 3%, following a broad rally in AI and semiconductor stocks after Advanced Micro Devices, Inc. (AMD) surged more than 23% on news of its multi-year GPU deal with OpenAI.

Analysts' consensus view on Palantir Technologies stock remains cautious, with a "Hold" rating overall. Out of 21 analysts covering the stock, four recommend a "Strong Buy," 14 "Holds," one "Moderate Sell," and two have a "Strong Sell" rating. The stock currently trades above the mean price target of $156.29.